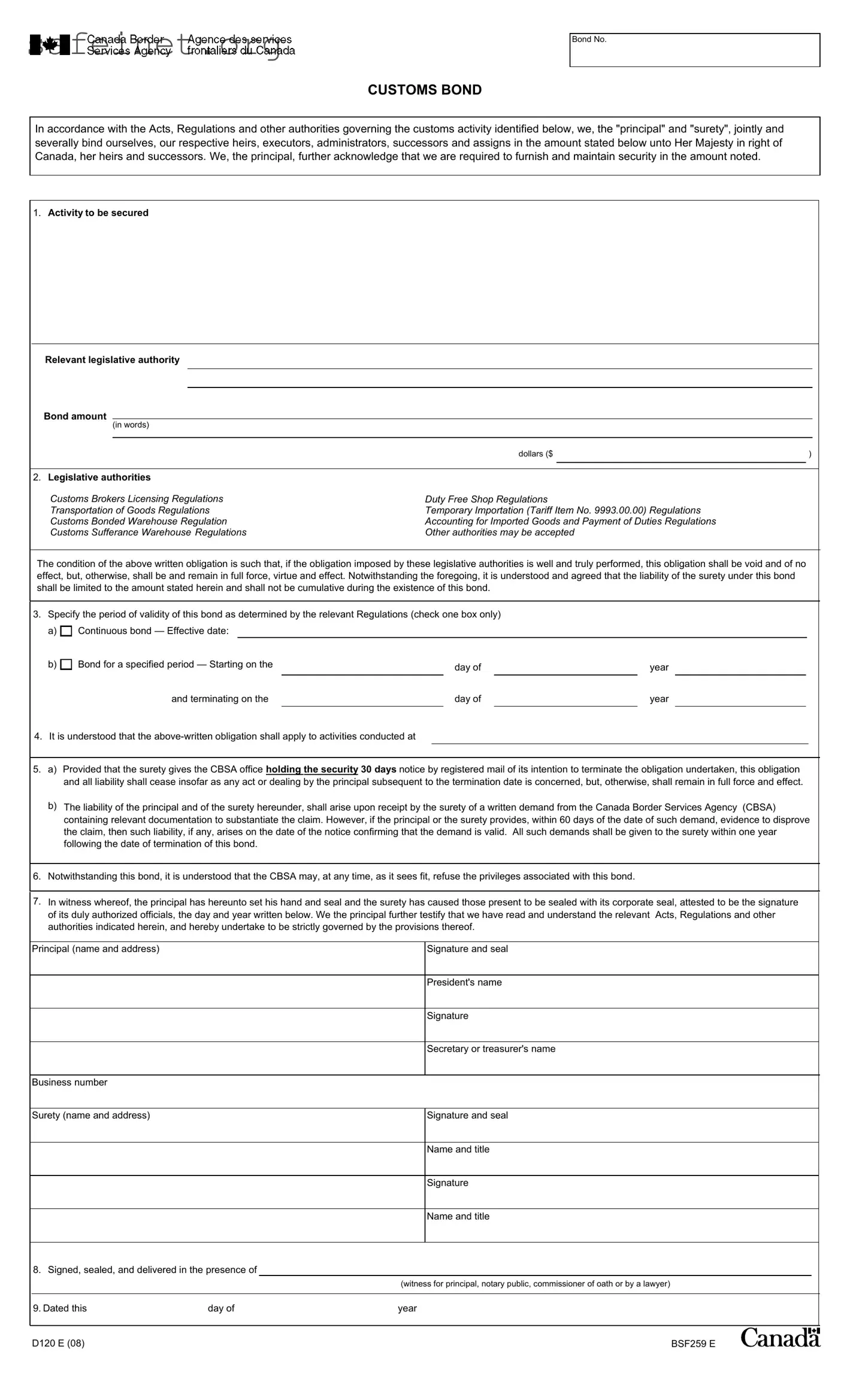

What is the D120 E form?

The D120 E form is a customs bond document used in Canada. It serves as a guarantee that the principal and the surety will fulfill their obligations under customs regulations. The bond ensures that the specified amount will be available if there are any claims related to customs activities. This form is crucial for businesses engaged in international trade and helps facilitate smooth customs operations.

Who are the parties involved in the D120 E form?

There are two main parties involved in the D120 E form: the principal and the surety. The principal is typically the business or individual responsible for customs activities, while the surety is usually a bonding company or financial institution that guarantees the principal’s obligations. Both parties sign the bond, making them jointly liable for any claims made under it.

What is the purpose of the customs bond?

The purpose of the customs bond is to ensure compliance with various customs regulations. It acts as a financial safety net for the Canada Border Services Agency (CBSA) in case the principal fails to meet their tax or regulatory obligations. By providing this bond, businesses can participate in activities like importing goods, operating a bonded warehouse, or managing temporary imports.

What is the bond amount and how is it determined?

The bond amount is specified in the D120 E form and can vary depending on the nature of the customs activities being secured. Businesses should assess the financial risks involved and set an appropriate bond amount that reflects their obligations under relevant customs regulations. This ensures adequate coverage in case any claims arise.

How long is the D120 E bond valid?

The D120 E bond can be issued for a specified period or as a continuous bond. If it is a continuous bond, it remains effective until terminated by the surety, provided they notify the CBSA. For a bond for a specified period, the starting and ending dates must be clearly indicated on the form. Understanding the validity period is essential for compliance and ensuring that customs obligations are continually met.

What happens if the bond needs to be terminated?

If the surety wishes to terminate the bond, they must provide the CBSA with 30 days' notice via registered mail. This notice must include relevant documentation. Termination will not affect any obligations that were incurred before the termination date, so businesses must remain vigilant until the process is complete.

Can the CBSA refuse privileges related to the bond?

Yes, the CBSA reserves the right to refuse the privileges associated with the D120 E bond at any time. This could occur for various reasons, including non-compliance with customs regulations or failure to maintain the required bond amount. It's essential for the principal to remain compliant to prevent such refusals.

What should be included in the D120 E form?

The D120 E form requires specific information such as the activities to be secured, the bond amount, the validity period, and the signatures of both the principal and surety. It also requires witness signatures and the principal's acknowledgment of understanding customs regulations. Providing complete and accurate information is critical to avoid issues later.

How is liability determined under the D120 E bond?

Liability under the D120 E bond arises from a written demand by the CBSA, accompanied by relevant documentation supporting the claim. If the principal or surety can disprove the claim within 60 days, liability is reconsidered based on new evidence. All demands must be made within one year following the bond’s termination to be valid.

Where can I find the D120 E form?

The D120 E form can typically be found on government websites related to customs and trade, such as the Canada Border Services Agency's official site. Additionally, businesses can obtain copies through customs brokers or legal professionals who specialize in international trade and customs law.

Continuous bond — Effective date:

Continuous bond — Effective date: