owner/occupant/lienholder may contact to respond to this notice. The statement must indicate the intent to enforce a mechanic’s lien pursuant to Chapter 770 ILCS 95/1 et seq. unless payment has been received within a minimum of 14 days and shall further provide the date and location of sale. After 14 days minimum has lapsed without service payment, the owner of a self-service storage facility also must place an ad in a newspaper of general publication in the location of the facility once each week for two consecutive weeks listing the last owner’s, storage facility occupant’s and lienholder’s name(s); the year, make and vehicle identification number (VIN) of the vehicle; name and address of the facility; and time, place and manner of the sale.

Public Sale

If charges are not paid before the 15th day after the first newspaper publication, the owner of the self-service storage facility may dispose of the vehicle at public sale in accordance with Chapter 770 ILCS 95/1 et seq.

Mechanic’s Lien

A mechanic’s lien may be established against a vehicle by an individual or company after the vehicle’s owner or person consenting to such service fails to pay and leaves the vehicle in the custody of the individual or company for an extended period of time.

If an individual or company has repaired, provided service, supplies and materials, towed and/or stored a vehicle with the consent of the vehicle owner and has not been paid for the services rendered, a mechanic’s lien may be enforced on a vehicle currently in their possession by obtaining a Certificate of Title for the vehicle on which the labor, service, materials or storage were expended pursuant to the following statutes: ILCS Chapter 770, Sections 50/1 through 50/6 and 770 Sections 45/1 et seq and 90/1 et seq. Each statute identifies the specific requirements set forth with which to obtain title based on the total amount of the lien. Liens imposed due to the Self-Service Storage Facility Act are enforced pursuant to Chapter 770, Sections 95/1 et seq. After taking the required actions to establish a mechanic’s lien, the individual or company may sell the vehicle at public auction in order to recoup the monies owed by the vehicle owner.

Important Facts to Remember

•If the mechanic lienholder asserts a fee that is not reasonably related to the work performed, those charges may not be considered as part of the overall bill for services rendered. An example is administrative costs or title searches related to disposal of the vehicle. The mechanic lienholder must set forth with specificity the items of labor and material and their corresponding values that comprise the lien. Inflated costs and/or inappropriate calculations/monetary values may be subject to further investigation.

•To enforce a mechanic’s lien, the vehicle owner’s consent is required. Documentation provided to the Secretary of State must indicate consent, whether express or implied. If a person signs a document stating that he or she agrees to the written statement of charges for completed work or services, express consent is given. Without this signature, consent is very difficult to prove.

•A vehicle owner parking inappropriately consents to removal by towing of his or her vehicle where notice that unauthorized vehicles will be towed from such property is provided pursuant to state law, local ordinances or regulation by any state or local agency. Implied consent is inferred by the vehicle owner’s actions and the vehicle may be relocated by a licensed agent. Proof of tow authorization by the property owner or law enforcement agency is required.

•Towing agencies may enforce a mechanic’s lien for service, supplies and materials, towing and/or storage for vehicles towed pursuant to the order of a law enforcement official or agency. Proof of tow authorization by the law enforcement agency is required.

•A property owner may not use the mechanic’s lien process to dispose of a vehicle, even though the requirement of the sign does not apply to residential property clearly reserved or intended exclusively for the use or occupation of residents or their vehicles, without proving consent to service by the vehicle owner. Illinois law provides for the disposal of abandoned or unclaimed vehicles by a law enforcement agency authorizing a towing agency to remove the vehicle from said property.

•The mechanic lien process is intended for intact vehicles with no significant damage. Vehicles sustaining major damage may not qualify for a clear, regular certificate of title.

•The mechanic’s lien process MAY NOT begin until 60 days has lapsed without service payment for liens of $2,000 or less, or until 30 days has lapsed without service payment for liens of more than $2,000. A mechanic’s lien transaction in violation of these provisions of the Illinois Compiled Statutes will be returned.

Documents Required to Transfer Ownership

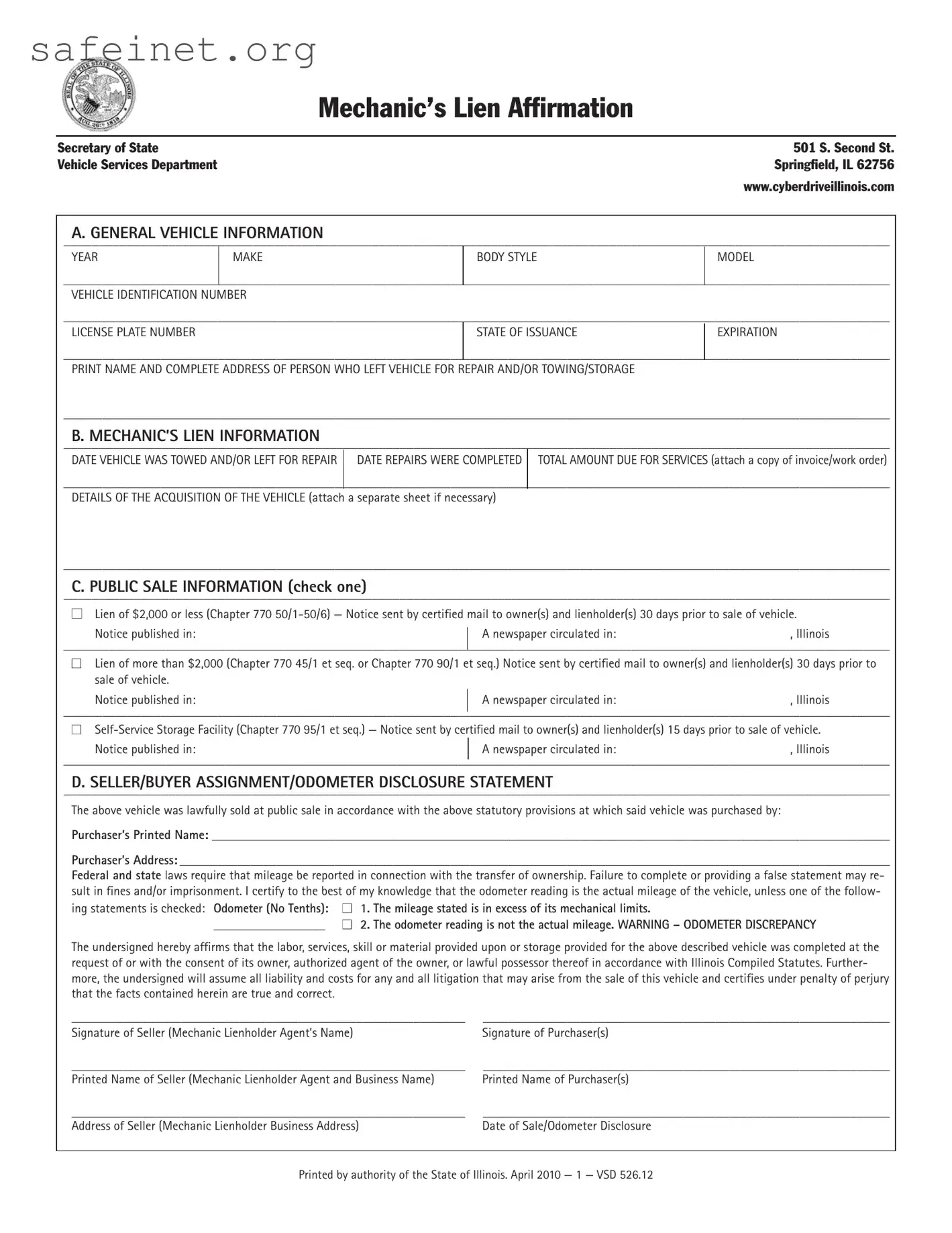

1.Mechanic’s Lien Affirmation (VSD-526) completed in full by the seller (mechanic lienholder) and purchaser of the vehicle.

2.Application for Vehicle Transaction(s) (VSD-190) completed in full in the name of the individual/business acquiring the vehicle pursuant to the mechanic lien sale.

3.Verification of Ownership — Title Search conducted by the Secretary of State, Motor Vehicle Records Division, and, if applicable, an out-of-state motor vehicle de- partment or agency.

4.Proof of Notifications:

•Notices by Certified Mail — Original or copy of the actual letters mailed certified, the U.S. Post Office date stamped receipts for certified mail (PS form 3800) and signed, return receipt (PS Form 3811), together with any unopened certified letter(s) returned by the post office as undeliverable, unclaimed, etc. mailed to the owner(s) and lienholder(s).

•Notice of Service (if Applicable) — Affidavit of Service filed with the Clerk of the Circuit Court with liens in excess of $2,000 for unknown owners/lienholders and/or undeliverable mailings.

•Notices by Newspaper Publication — Original or copy of the actual newspaper publication(s) published and the Certificate of Publication identifying the name of the publication and publication dates.

5.Copy of the invoice/work order reflecting the vehicle information; services rendered; date the vehicle was brought in for service; complete name, address, contact information and signature of the owner; name of authorized agent of the owner or lawful possessor thereof who brought the vehicle in consenting to service; and total amount due.

6.Appropriate title fee — $95 for Certificate of Title, $4 for Salvage Certificate or No-fee for Junking Certificate.

7.Appropriate sales tax form and sales tax payment payable to Illinois Department of Revenue.