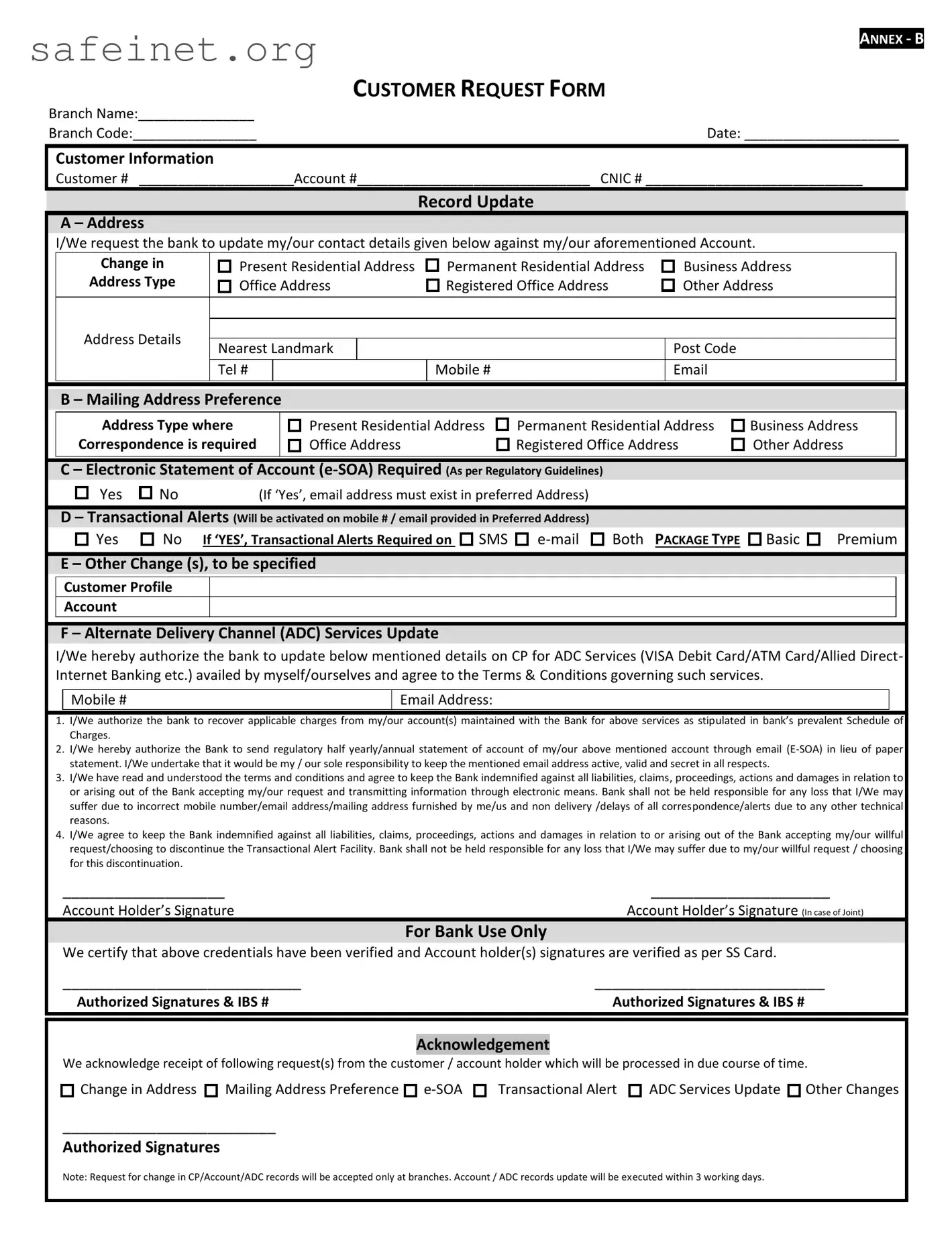

What is the purpose of the Customer Request form?

The Customer Request form serves as a means for bank customers to formally request updates and changes to their account information. This includes alterations to contact details, mailing preferences, and account services such as electronic statements and transactional alerts. By submitting this form, customers ensure that their records are accurate and current, facilitating efficient communication and service delivery by the bank.

How do I fill out the Customer Request form correctly?

To fill out the Customer Request form, start by entering the branch name and branch code. Next, provide your customer number, account number, and CNIC number. Carefully complete all relevant sections, indicating any changes in address, mailing preferences, and electronic statement requests. Ensure that the mobile number and email address provided for transactional alerts are accurate. Lastly, remember to sign where indicated, including a joint account holder’s signature if applicable.

What should I do if I need to update my contact information?

If you need to update your contact information, you should specify your new residential, permanent, or business address in the appropriate section of the form. Additionally, you can indicate preferences for your mailing address and request to receive electronic statements at the new email address. It is important to ensure that all details are current and correct to avoid any disruptions in service or communication.

What if I change my mind after submitting the request?

If you change your mind after submitting your request, it may be challenging to retract it immediately. However, you should contact your bank branch as soon as possible to inquire about the status of your request. Depending on the circumstances, the bank might allow you to modify your request before it is fully processed. Always keep a record of your submitted forms and any correspondence for reference.

Are there any charges associated with using the services requested in the form?

Yes, there may be applicable charges associated with the services you request in the Customer Request form. The bank's schedule of charges outlines these fees, and by submitting the form, you authorize the bank to recover any such charges from your account. It’s wise to review the schedule carefully to understand any financial implications connected to the services you are opting for.

How long will it take for changes to be processed?

Changes submitted through the Customer Request form will typically be processed within three working days. However, this timeline can vary based on specific bank policies or the volume of requests being handled. It is recommended to keep the bank’s acknowledgment of your request for future reference and to follow up if there are any delays beyond the expected processing time.

Yes

Yes

Change in Address

Change in Address

Mailing Address Preference

Mailing Address Preference

ADC Services Update

ADC Services Update

Other Changes

Other Changes