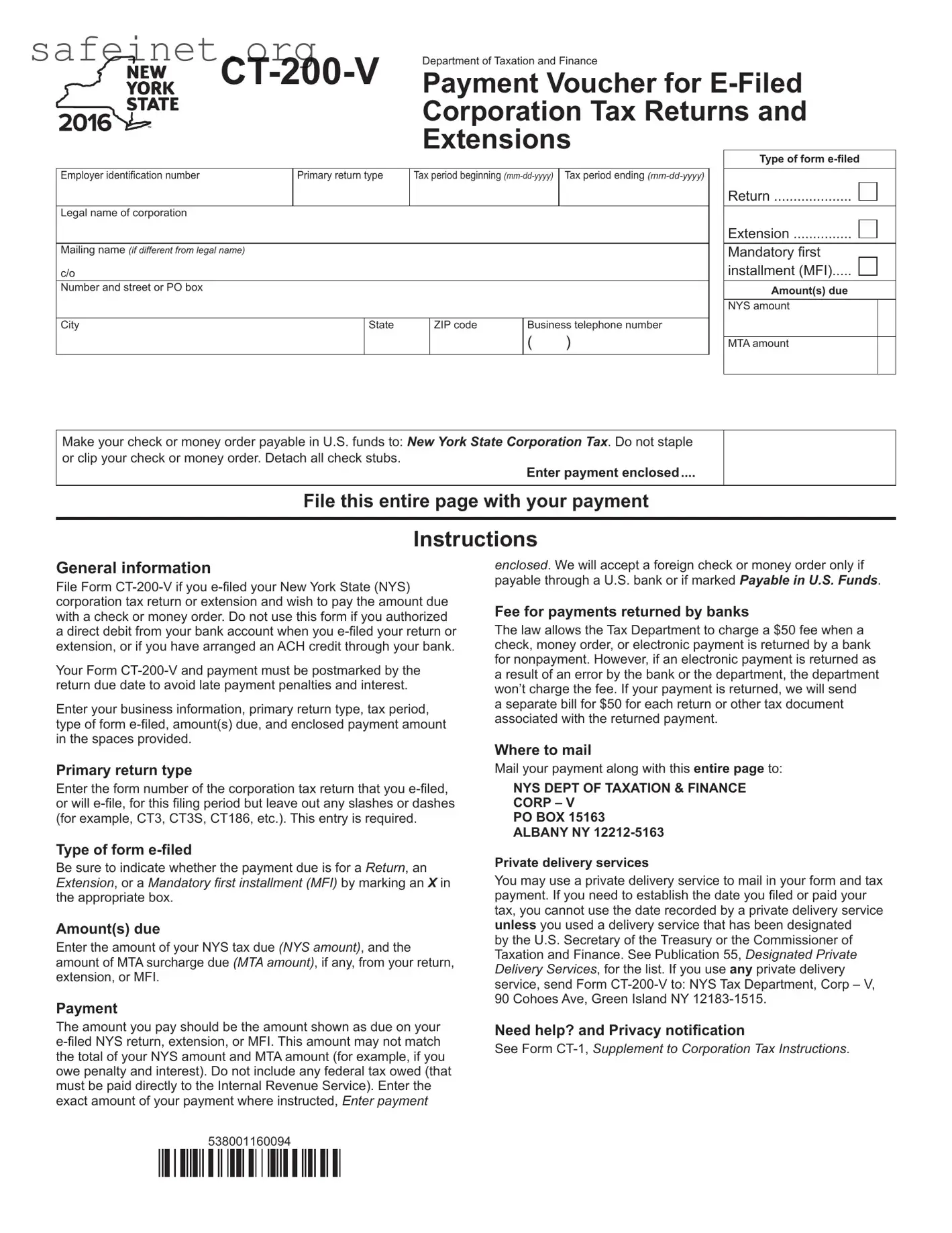

What is the purpose of the CT-200-V form?

The CT-200-V form serves as a payment voucher for corporation tax returns and extensions filed electronically in New York State. If a corporation has e-filed their return or extension and wishes to submit payment via check or money order, this form must be completed and submitted along with the payment. It is important to remember that this form should not be used if direct debit or ACH credit arrangements were made when e-filing.

What information is required on the CT-200-V form?

When filling out the CT-200-V form, several key details must be provided. This includes the employer identification number, primary return type, the tax period start and end dates, legal name of the corporation, mailing address, business telephone number, and the type of form being filed. Additionally, the form requires the amounts due for New York State tax and MTA surcharge, if applicable. Accuracy in these entries is crucial to ensure proper processing of the payment and avoid potential penalties.

What payment methods are accepted with the CT-200-V form?

Payments should be made via check or money order made out to New York State Corporation Tax. The payment must be in U.S. funds. It is essential not to staple or clip the check or money order, and all check stubs should be detached. When submitting payment, please ensure that the amount entered on the form matches the total amount due, as shown on your e-filed return or extension.

What happens if the payment method is returned?

If a submitted check, money order, or electronic payment is returned for nonpayment, the Tax Department is authorized to impose a $50 fee. This fee will apply to each tax document associated with the returned payment. However, if the return was due to an error by the bank or the department, the fee will not be charged. It is advisable to ensure sufficient funds are available to avoid additional charges.

Where should the CT-200-V form and payment be mailed?

The completed CT-200-V form should be mailed to the New York State Department of Taxation and Finance at the following address: NYS DEPT OF TAXATION & FINANCE, CORP – V, PO BOX 15163, ALBANY NY 12212-5163. For those using private delivery services, the form should be sent to: NYS Tax Department, Corp – V, 90 Cohoes Ave, Green Island NY 12183-1515. Using a designated private delivery service ensures proper tracking and timely submission of the payment.