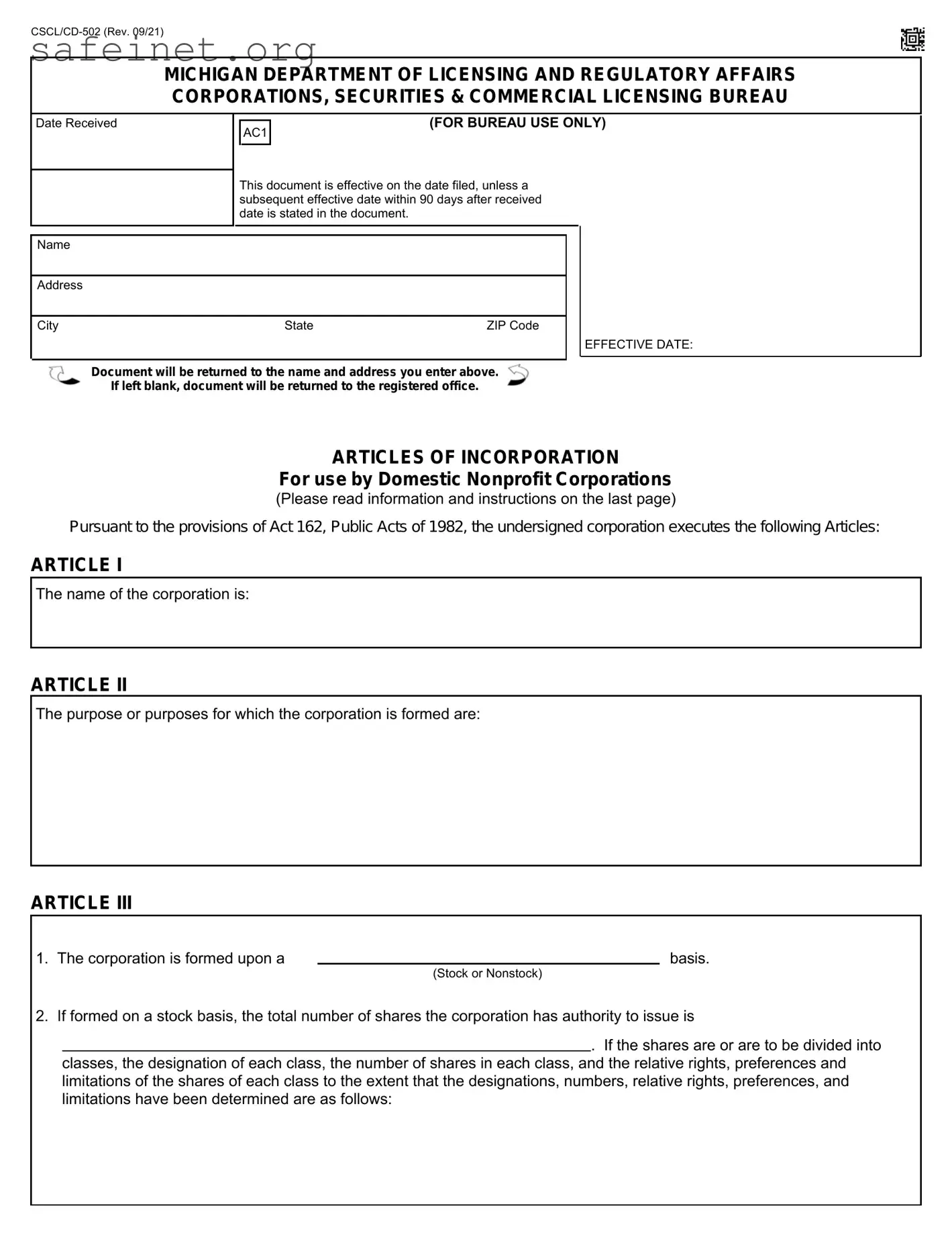

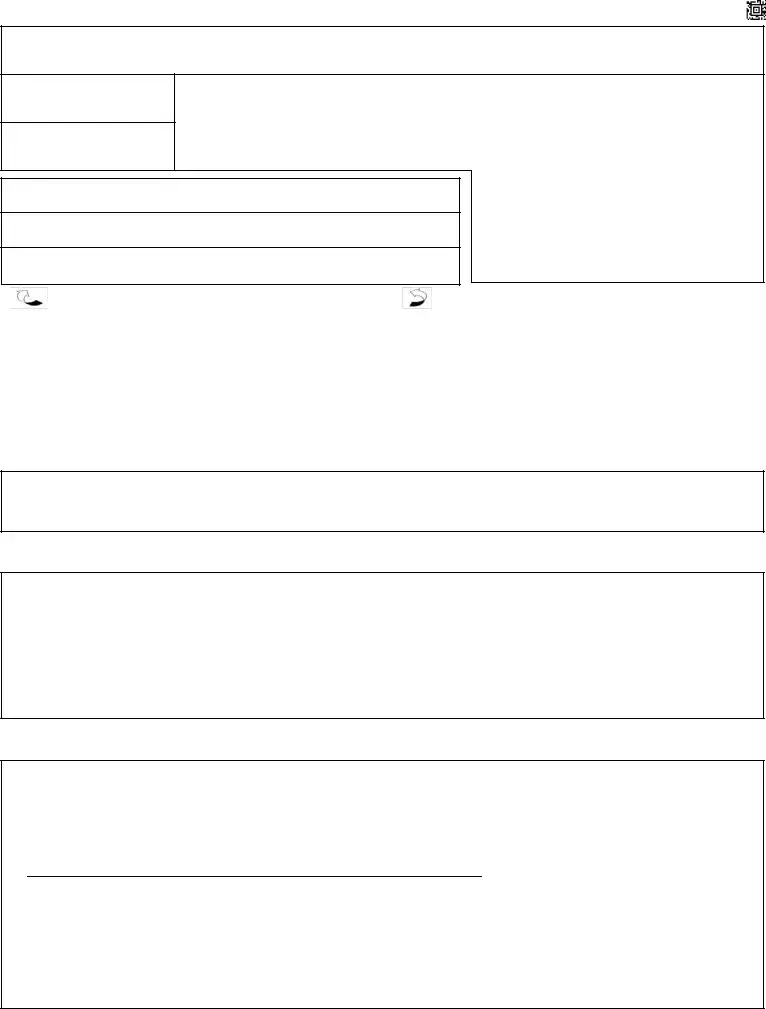

Preparer's Name

Business Telephone Number ( |

) |

|

|

|

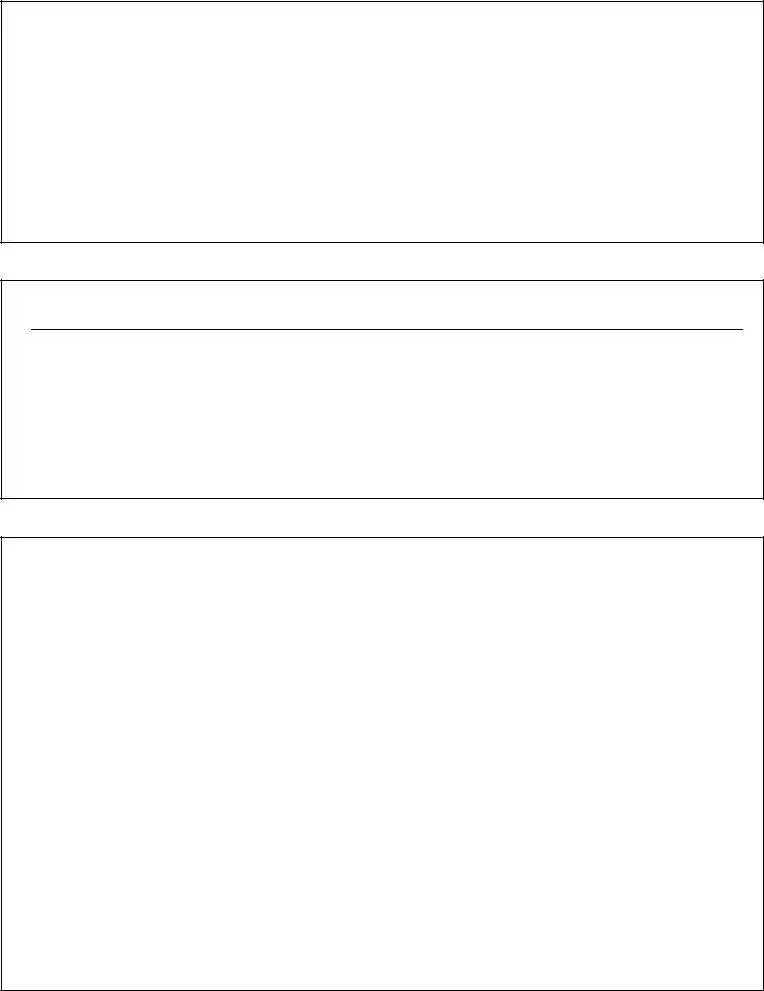

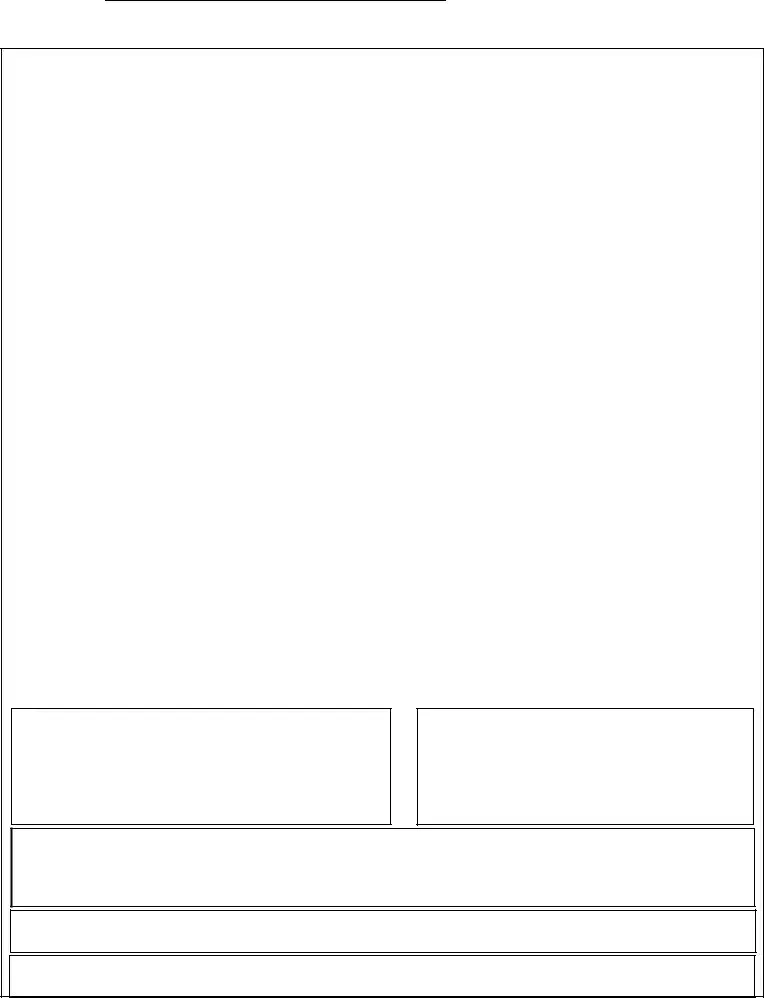

INFORMATION AND INSTRUCTIONS

1.This form may be used to draft your Articles of Incorporation. A document required or permitted to be filed under the act cannot be filed unless it contains the minimum information required by the act. The format provided contains only the minimal information required to make the document fileable and may not meet your needs. This is a legal document and agency staff cannot provide legal advice.

2.Submit one original of this document. Upon filing, the document will be added to the records of the Corporations, Securities & Commercial Licensing Bureau. The original will be returned to your registered office address, unless you enter a different address in the box on the front of this document.

Since this document will be maintained on electronic format, it is important that the filing be legible. Documents with poor black and white contrast, or otherwise illegible, will be rejected.

3.This document is to be used pursuant to the provisions of Act 162, P.A. of 1982, by one or more persons for the purpose of

forming a domestic nonprofit corporation.

4 . Article II - The purpose for which the corporation is formed must be included. It is not sufficient to state that the corporation may engage in any activity within the purpose for which corporations may be formed under the Act.

5.Article III - The corporation must be formed on a stock or nonstock basis. Complete Article III(2) or III(3) as appropriate, but not both. Real property assets are items such as land and buildings. Personal property assets are items such as cash, equipment, fixtures, etc. The dollar value and description must be included. If there is no real and/or personal property, write in "none".

6.A domestic nonprofit corporation may be formed on either a membership or directorship basis. A membership corporation entitles the members to vote in determining corporate action. If formed on a directorship basis, the corporation may have members but they may not vote and corporate action is determined by the Board of Directors.

7.Article IV - A post office box may not be designated as the address of the registered office.

8.Article V - The Act requires one or more incorporators. Educational corporations are required to have at least three (3) incorporators. The address(es) should include a street number and name (or other designation), city and state.

9.This document is effective on the date endorsed "filed" by the Bureau. A later effective date, no more than 90 days after

the date of delivery, may be stated as an additional article.

10.The Articles must be signed in ink by each incorporator listed in Article V. However, if there are 3 or more incorporators,

they may, by resolution adopted at the organizational meeting by a written instrument, designate one of them to sign the Articles of Incorporation on behalf of all of them. In such event, these Articles of Incorporation must be accompanied by a copy of the resolution duly certified by the acting secretary at the organizational meeting and a statement must be placed in the articles incorporating that resolution into them.

11.FEES: Make remittance payable to the State of Michigan. Include corporation name on check or money order.

FILING AND FRANCHISE FEE |

$20.00 |

Veterans: Pursuant to MCL 450.3060(5), if a majority of the initial members of a membership corporation, initial directors of a directorship corporation, or initial shareholders of a stock corporation, as applicable, are, or if applicable the initial members, initial directors, or initial shareholders will be, individuals who served in the armed forces and were separated from that service with an honorable character of service or under honorable conditions (general) character of service, you may contact the Corporations Division regarding a fee waiver.