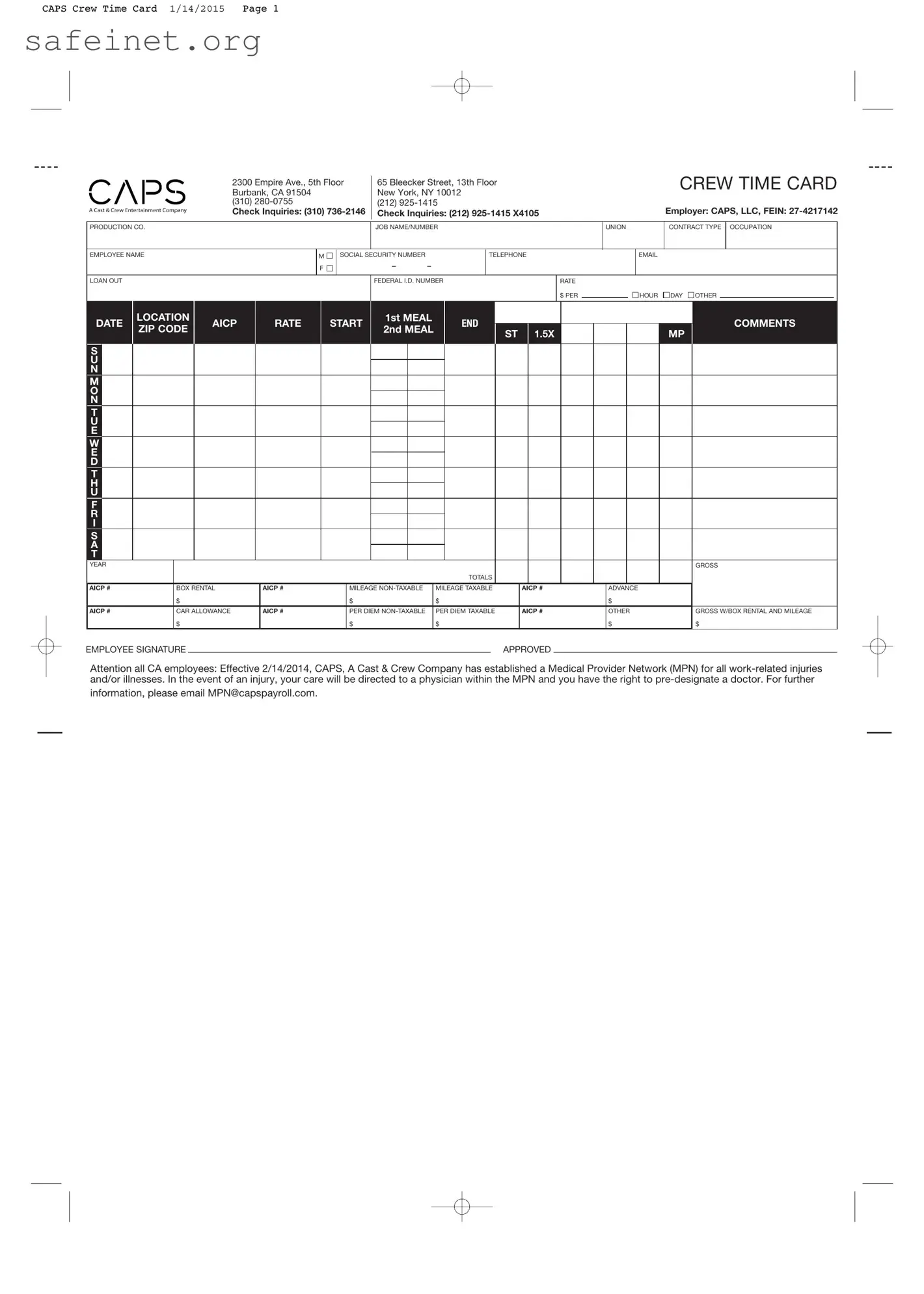

The Crew Time Card form is an essential document used by employees and employers in the entertainment industry to accurately track hours worked and associated payments. This form is structured to capture key information, including basic employee details such as name, social security number, and contact information. Additionally, it requests specifics about the production company, job name, contract type, and occupation, ensuring clarity and accountability in payroll processing. The form includes sections for recording dates, locations, and different rates of pay, such as regular hourly rates and meal allowances. For accuracy, the Crew Time Card also tallies gross totals and breaks down taxable and non-taxable reimbursements like mileage and per diem. Employees must sign the form to validate the information, while an approval section is designated for supervisory confirmation. Notably, it informs employees about the established Medical Provider Network for work-related injuries, emphasizing the importance of industry regulations and health coverage. As completion of this form is vital for proper payroll management, understanding its components and implications is crucial for both employees and employers.

HOUR

HOUR  DAY

DAY  OTHER

OTHER