What is the purpose of the Credit Reference Request form?

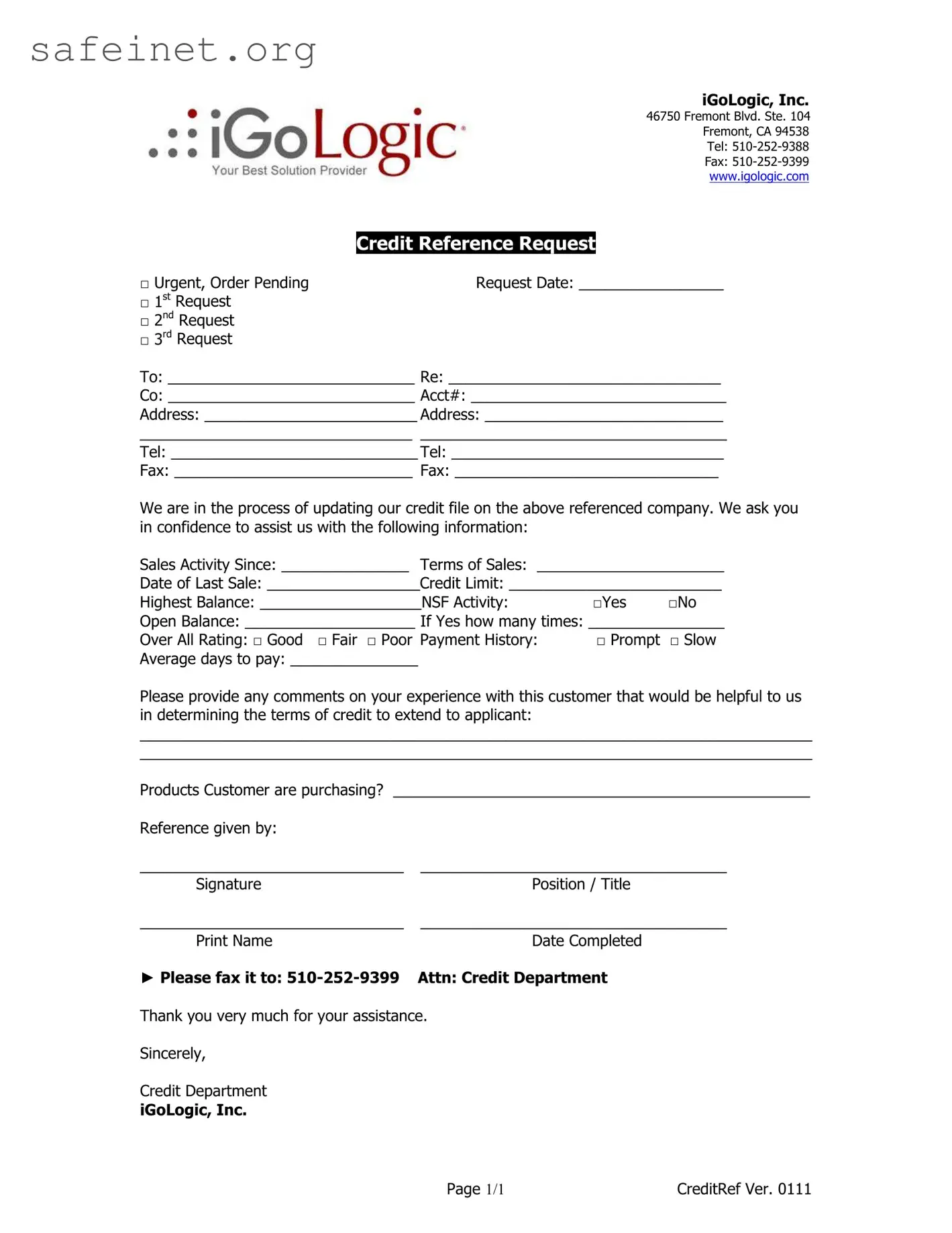

The Credit Reference Request form is designed to collect important information about a potential customer’s creditworthiness. Businesses use this form to request insight from a company that has previously engaged in business with the applicant. By filling out this form, organizations aim to gather data regarding payment history, sales activity, and overall financial reliability. This information is instrumental in making informed decisions about extending credit terms to the applicant.

Who should fill out the Credit Reference Request form?

Typically, the form should be filled out by suppliers or businesses that have an existing relationship with the applicant seeking credit. The responsible party—often someone from the accounting or credit department—should provide accurate information about past dealings, payment patterns, and any relevant insights that could impact the credit evaluation process.

How is the information submitted through the form used?

The information provided on the Credit Reference Request form is used to assess the applicant's financial behavior. It allows the requesting company to gauge the risk involved in extending credit to the applicant. Details about payment history, sales activity, and any negative incidents, such as insufficient funds (NSF) occurrences, will inform the organization’s credit decision-making process.

What happens if I need to make an urgent request?

If your request is urgent, you should check the appropriate box labeled “Urgent, Order Pending” on the form. This designation alerts the recipient that your inquiry requires prompt attention. Additionally, contacting the company via telephone after submitting the form may help expedite the process. You should provide your request date clearly and indicate that this is the first, second, or third request, as needed, to ensure clarity.

What details are necessary to complete the form?

Essential details include the applicant’s name, address, and contact information, along with your own contact details. You will also need to indicate sales activity, payment terms, the date of the last sale, credit limits, and the highest balance. Notably, the sections regarding NSF activity and overall rating provide critical insights, so be thorough when providing this information. Comments regarding your experience with the customer can also significantly add context to the evaluation process.

How should I submit the completed form?

Once you have completed the Credit Reference Request form, it should be faxed to 510-252-9399, attention to the Credit Department at iGoLogic, Inc. Ensuring that all required fields are filled out clearly will facilitate more efficient processing. Keeping a copy of your submission for your records may also prove beneficial should you need to follow up.