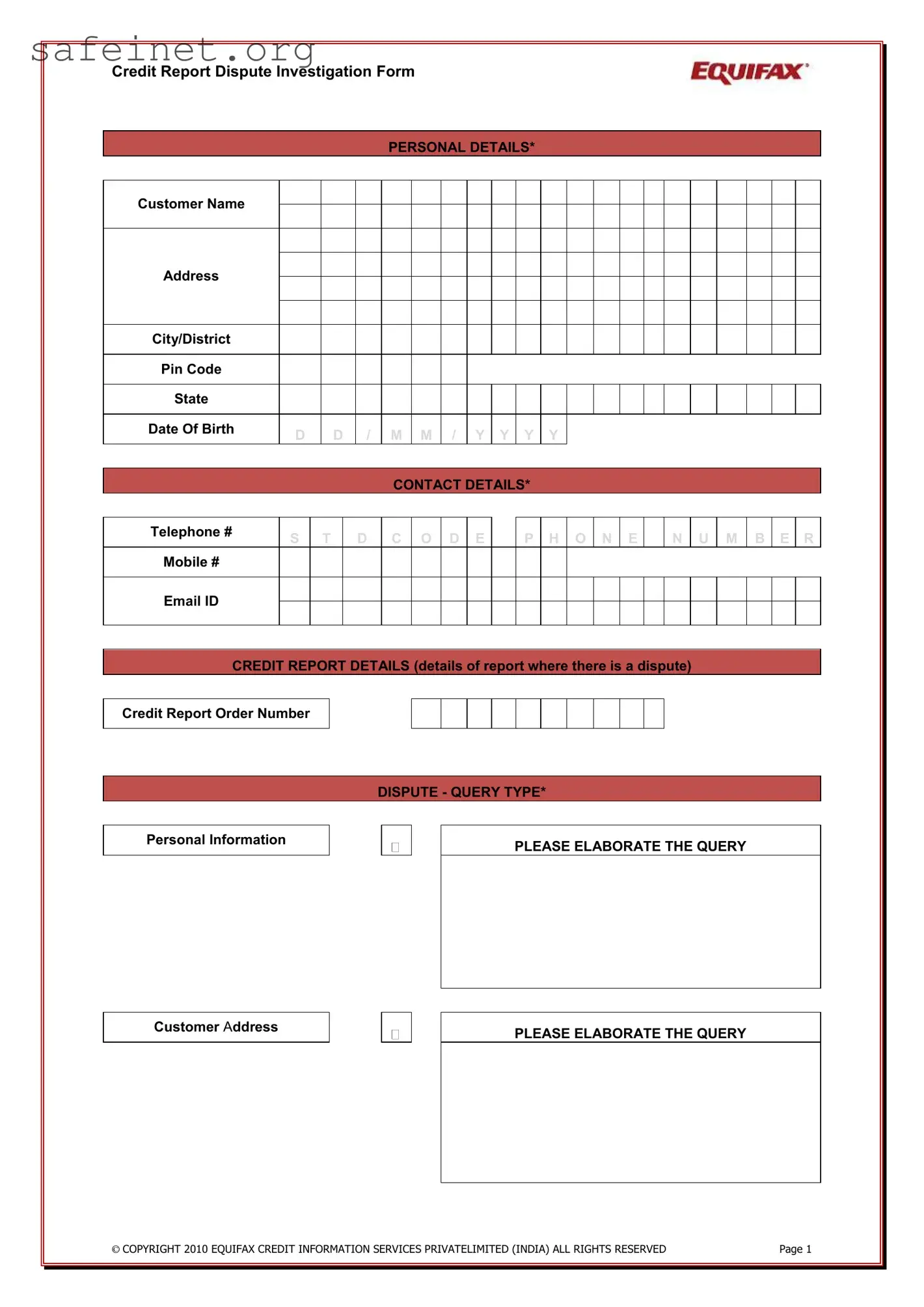

What is the purpose of the Credit Investigation form?

The Credit Investigation form is designed to help you dispute inaccuracies in your credit report. If you notice any errors regarding your personal or account information, this form allows you to formally raise those concerns with the credit reporting agency.

What information do I need to provide in the form?

You must provide your personal details, including your full name, address, date of birth, and contact information. Additionally, you will need to include your credit report order number and details about the specific dispute, including the type of query and an elaboration on your concerns.

What happens if I don’t complete all required fields?

Your submission may be delayed or rejected. Mandatory fields, marked with an asterisk, are necessary to process your dispute efficiently. Make sure to fill in all required sections to avoid complications.

How can I elaborate on my query if there is not enough space on the form?

If you require more space to explain your dispute, you can use an additional piece of paper. Please attach it to the form and reference it in your response. Clarity is vital to ensure your issue is properly addressed.

Can I submit the form electronically?

The submission method can vary by agency. Check with the credit reporting agency regarding their specific submission guidelines, as some may allow electronic submissions while others might require a physical copy.

What if I find more than one error in my credit report?

You can report multiple errors in a single Credit Investigation form. For each separate dispute, provide detailed information in the designated sections. Ensure you clearly identify each issue to facilitate proper investigation.

How long will it take to resolve my dispute?

The investigation process generally takes about 30 days. The credit reporting agency will review your claim and contact the relevant creditors to verify the information. You should receive an update or resolution within that timeframe.

Will my credit score be affected during the dispute process?

Initiating a dispute generally does not directly affect your credit score. However, if the investigation leads to a correction that improves your report, your score may improve. It's important to follow up and confirm any changes once your dispute is resolved.

What should I do if my dispute is denied?

If your dispute is denied, you can request a copy of the investigation results. Review the response and gather any additional evidence that supports your claim. You may resubmit your dispute with new information or clarify your concerns further.

Is there a fee associated with submitting the Credit Investigation form?