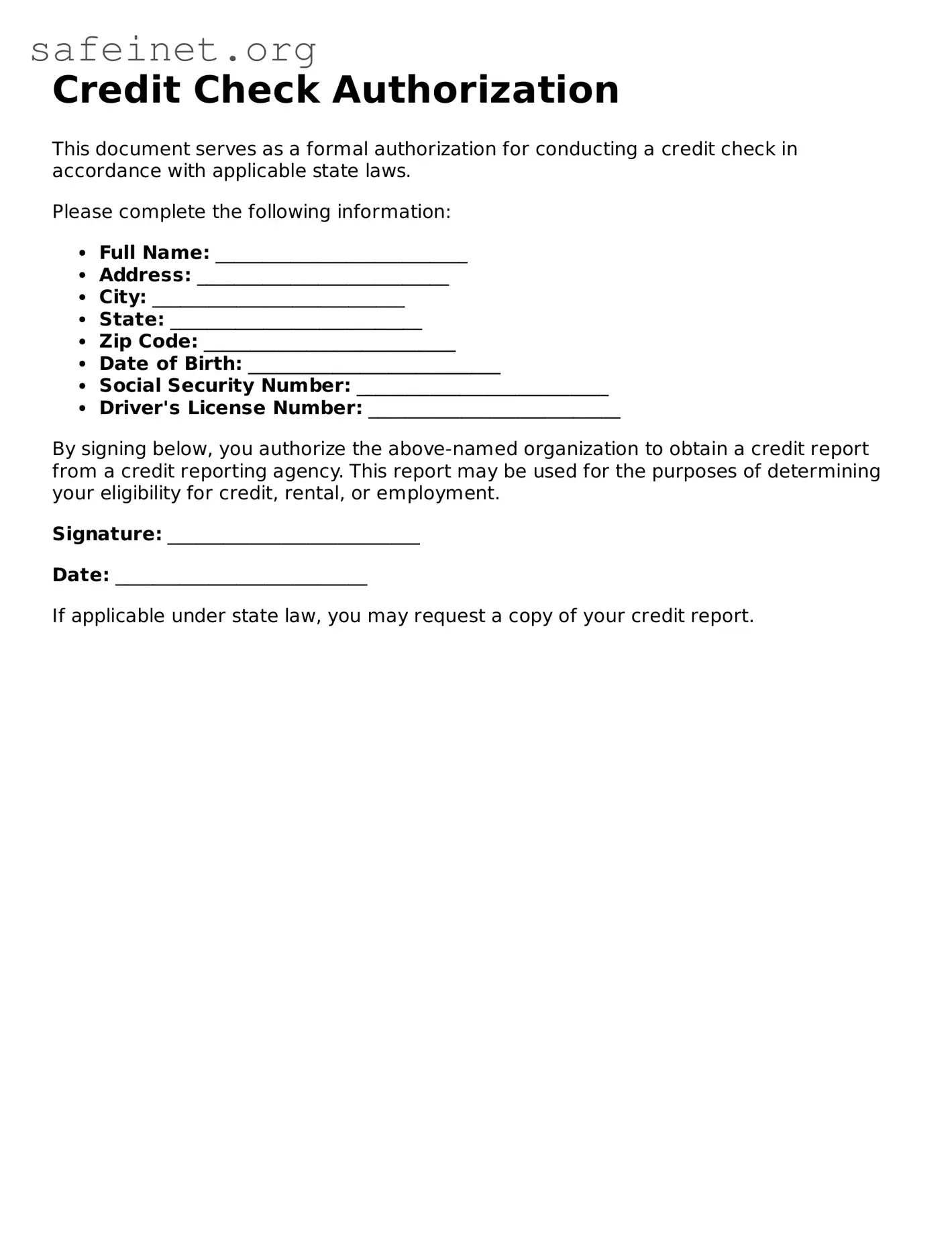

Credit Check Authorization

This document serves as a formal authorization for conducting a credit check in accordance with applicable state laws.

Please complete the following information:

- Full Name: ___________________________

- Address: ___________________________

- City: ___________________________

- State: ___________________________

- Zip Code: ___________________________

- Date of Birth: ___________________________

- Social Security Number: ___________________________

- Driver's License Number: ___________________________

By signing below, you authorize the above-named organization to obtain a credit report from a credit reporting agency. This report may be used for the purposes of determining your eligibility for credit, rental, or employment.

Signature: ___________________________

Date: ___________________________

If applicable under state law, you may request a copy of your credit report.