What is a Credit Card Payment Authorization form?

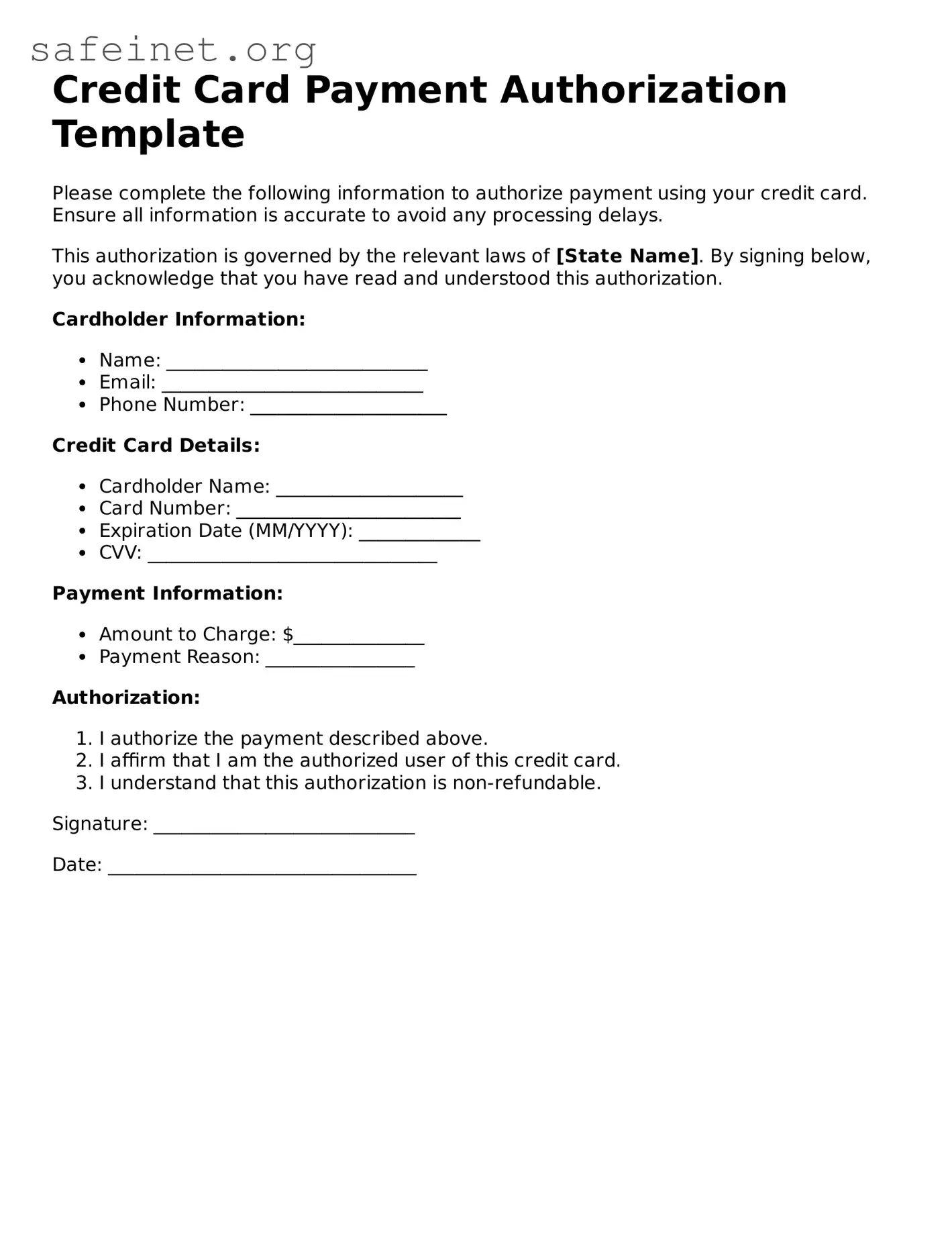

A Credit Card Payment Authorization form is a document that allows a business or organization to charge a customer's credit card for specific services or products. This form typically requires the customer’s name, credit card details, and the amount to be charged. It ensures that the payment is authorized by the cardholder, helping to protect against unauthorized charges.

Why do I need to fill out this form?

Completing this form is important for businesses when they need to process a credit card transaction. It provides a clear record of your consent, ensuring compliance with payment processing standards. By signing it, you authorize the business to charge your credit card, making the transaction smooth and efficient.

Is my personal information secure when completing this form?

Your personal information should be handled with the utmost care. Reputable businesses use secure methods to process and store your credit card information, safeguarding it against unauthorized access. Always ensure that the entity requesting the authorization has a strong privacy policy and uses secure transmission methods like HTTPS.

Can I cancel the authorization after I’ve submitted the form?

Cancellations depend on the specific terms outlined in the agreement. Generally, if you wish to revoke authorization, it is crucial to notify the business as soon as possible. They may require confirmation or additional steps to cancel the future charges. Review the terms carefully to understand your options.

What happens if there are insufficient funds on my credit card?

If there are insufficient funds or the credit limit is exceeded, the transaction will likely be declined. It is important to monitor your available balance prior to submitting the authorization form. The business may also attempt to reach you for payment arrangements if a payment fails.

Can I update my credit card information after submitting the form?

Yes, you can usually update your credit card information after submitting the original form. Contact the business directly to inform them of any changes. They may ask you to complete a new authorization form to ensure they have accurate payment details on file.

What if I suspect fraudulent activity on my account?

If you suspect any fraudulent activity on your account, it is crucial to act quickly. Contact your credit card issuer immediately to report the issue. You may also want to reach out to the business that holds your authorization to inform them of the situation, as they may have further steps they can recommend.

How long is the authorization valid?

The validity period of an authorization can vary based on the specifics of the transaction and the business’s policies. Some transactions may only require a one-time charge, while others might involve recurring charges. Always clarify with the business how long your authorization will remain active and under what conditions it may expire.