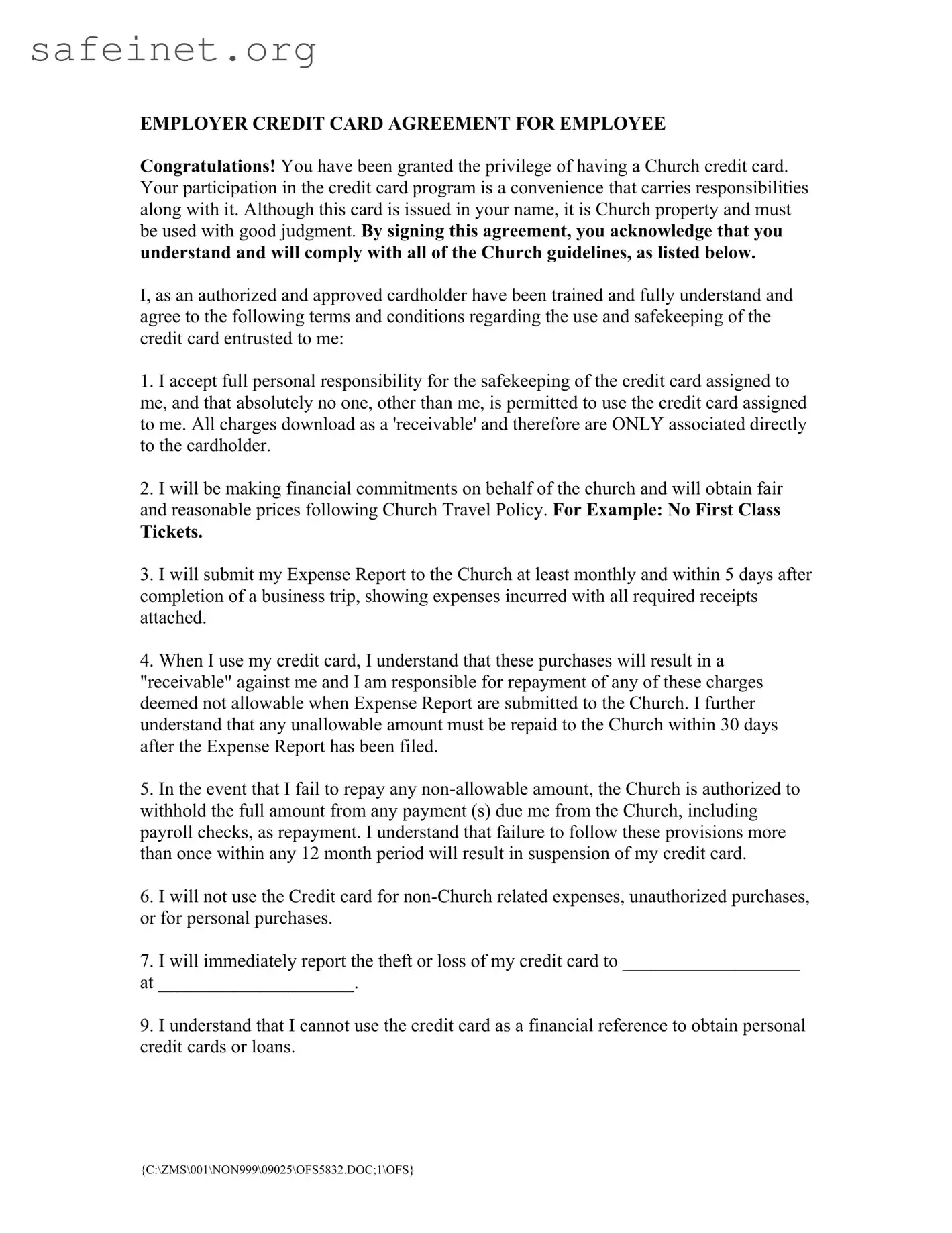

EMPLOYER CREDIT CARD AGREEMENT FOR EMPLOYEE

Congratulations! You have been granted the privilege of having a Church credit card. Your participation in the credit card program is a convenience that carries responsibilities along with it. Although this card is issued in your name, it is Church property and must be used with good judgment. By signing this agreement, you acknowledge that you understand and will comply with all of the Church guidelines, as listed below.

I, as an authorized and approved cardholder have been trained and fully understand and agree to the following terms and conditions regarding the use and safekeeping of the credit card entrusted to me:

1.I accept full personal responsibility for the safekeeping of the credit card assigned to me, and that absolutely no one, other than me, is permitted to use the credit card assigned to me. All charges download as a 'receivable' and therefore are ONLY associated directly to the cardholder.

2.I will be making financial commitments on behalf of the church and will obtain fair and reasonable prices following Church Travel Policy. For Example: No First Class

Tickets.

3.I will submit my Expense Report to the Church at least monthly and within 5 days after completion of a business trip, showing expenses incurred with all required receipts attached.

4.When I use my credit card, I understand that these purchases will result in a "receivable" against me and I am responsible for repayment of any of these charges deemed not allowable when Expense Report are submitted to the Church. I further understand that any unallowable amount must be repaid to the Church within 30 days after the Expense Report has been filed.

5.In the event that I fail to repay any non-allowable amount, the Church is authorized to withhold the full amount from any payment (s) due me from the Church, including payroll checks, as repayment. I understand that failure to follow these provisions more than once within any 12 month period will result in suspension of my credit card.

6.I will not use the Credit card for non-Church related expenses, unauthorized purchases, or for personal purchases.

7.I will immediately report the theft or loss of my credit card to ___________________

at _____________________.

9.I understand that I cannot use the credit card as a financial reference to obtain personal credit cards or loans.