The Form CR-A, used for the Annual Commercial Rent Tax Return in New York City, bears similarities to the IRS Form 1040, which is the standard individual income tax return. Both forms require the taxpayer to provide personal information, such as names, addresses, and social security numbers, to ensure proper identification. They also mandate a detailed reporting of income—CR-A focuses on commercial rent, while Form 1040 includes all sources of personal income. This structured approach ensures that the correct tax amount is calculated based on the reported figures.

Another document comparable to the Form CR-A is the IRS Form 1065, which is utilized by partnerships to report income and deductions. Similar to the CR-A, this form necessitates a thorough accounting of revenues and expenses. Partnerships must disclose the individual income of each partner, much like CR-A requires businesses to report rents received from subtenants. Both forms emphasize transparency in financial reporting to ensure compliance with tax regulations.

The New York State Form IT-201, the Resident Income Tax Return, shares an overarching objective with the CR-A: both facilitate the collection of necessary tax information from taxpayers. IT-201 asks for comprehensive personal and financial data, including income sources and exemptions. This emphasis on detailed disclosures parallels the CR-A's need for meticulous reporting of commercial rents and deductions, ensuring an accurate assessment of tax obligations.

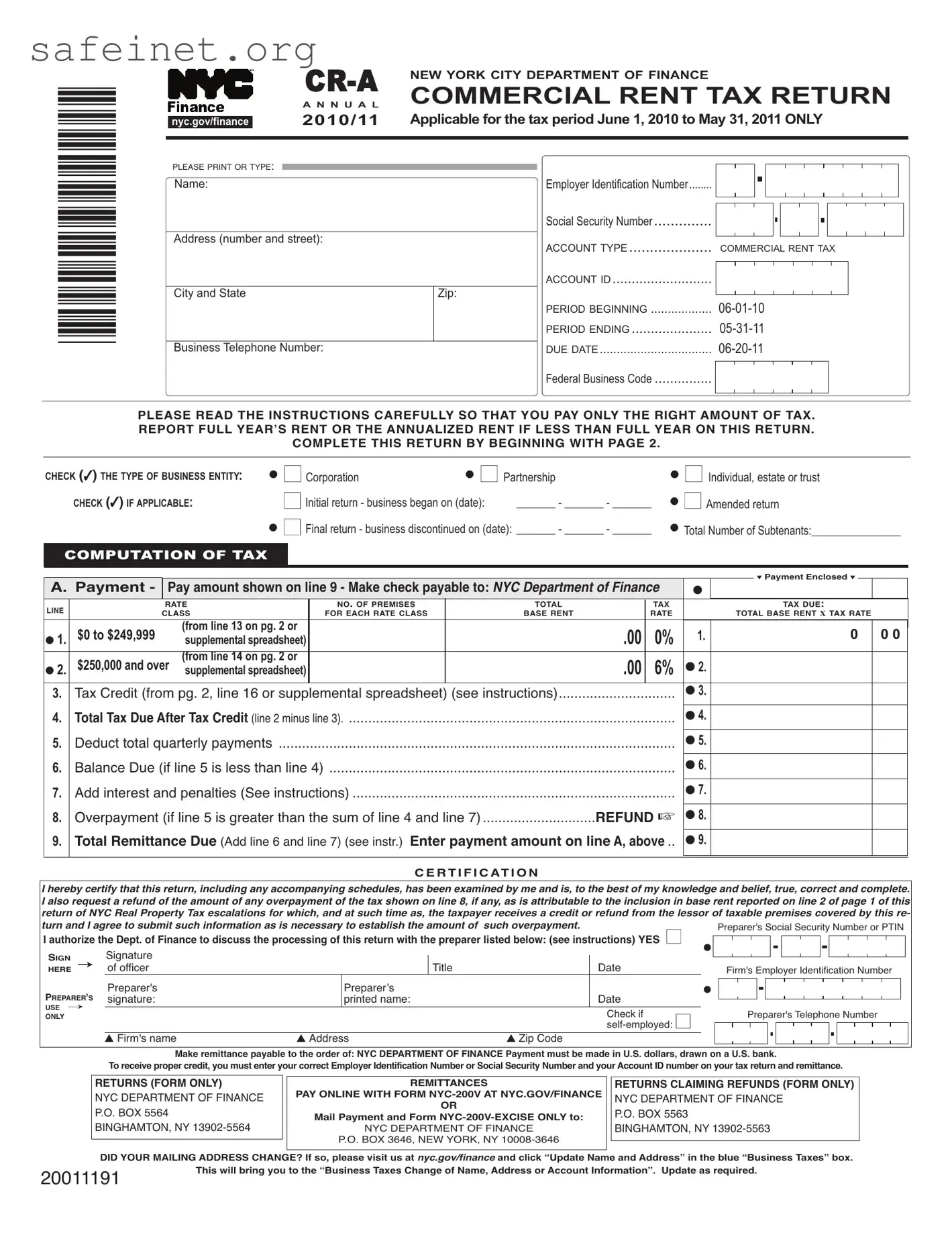

Form NYC-200V, used for filing certain business taxes in New York City, aligns closely with the CR-A in terms of administrative procedure. Both forms involve computations related to tax liabilities and require adherence to specific deadlines. The experience of preparing these forms aims to minimize errors and encourage timely submissions, enhancing overall compliance with tax deadlines.

The IRS Schedule C, Profit or Loss from Business, is another document similar to the CR-A. Schedule C requires business owners to report their income and expenses, offering an overview of profitability. Both documents require a detailed breakdown of financial activities to evaluate tax responsibilities accurately. Crucially, they each serve to document business performance for tax purposes, highlighting the interconnectedness of business reporting across different jurisdictions.

The Sales and Use Tax Return, often required by states, resembles the CR-A as both forms collect substantial financial information from businesses. Just like the CR-A assesses the commercial rent tax due based on reported receipts, the Sales and Use Tax Return calculates taxes based on sales made. Both require careful compilation of financial data to prevent penalties or overpayment, fostering accuracy in tax reporting.

The Form 941, the Employer’s Quarterly Federal Tax Return, provides another parallel to the CR-A. While Form 941 focuses on employment taxes, both require meticulous record-keeping and submission of relevant account information on a recurring basis. The attention to detail necessary for both submissions speaks to the importance of accountability in financial reporting for tax obligations.

The New York City Business Corporation Tax Return (Form NYC-1127) also shares a structural similarity with the CR-A. Both forms require entities conducting business in New York City to provide detailed tax information, including financial summaries and deductions. This consistency in required information emphasizes compliance with local tax laws to ensure accurate tax calculations and to limit the risk of audits.

Lastly, the IRS Form 990, used by tax-exempt organizations to report financial information, has commonalities with the CR-A regarding transparency and public accountability. While Form 990 aims to inform the public about the financial health of nonprofits, it similarly requires detailed disclosures of financial activities. Both forms function to uphold the principles of financial integrity in their respective contexts, ensuring that stakeholders can access essential financial information.