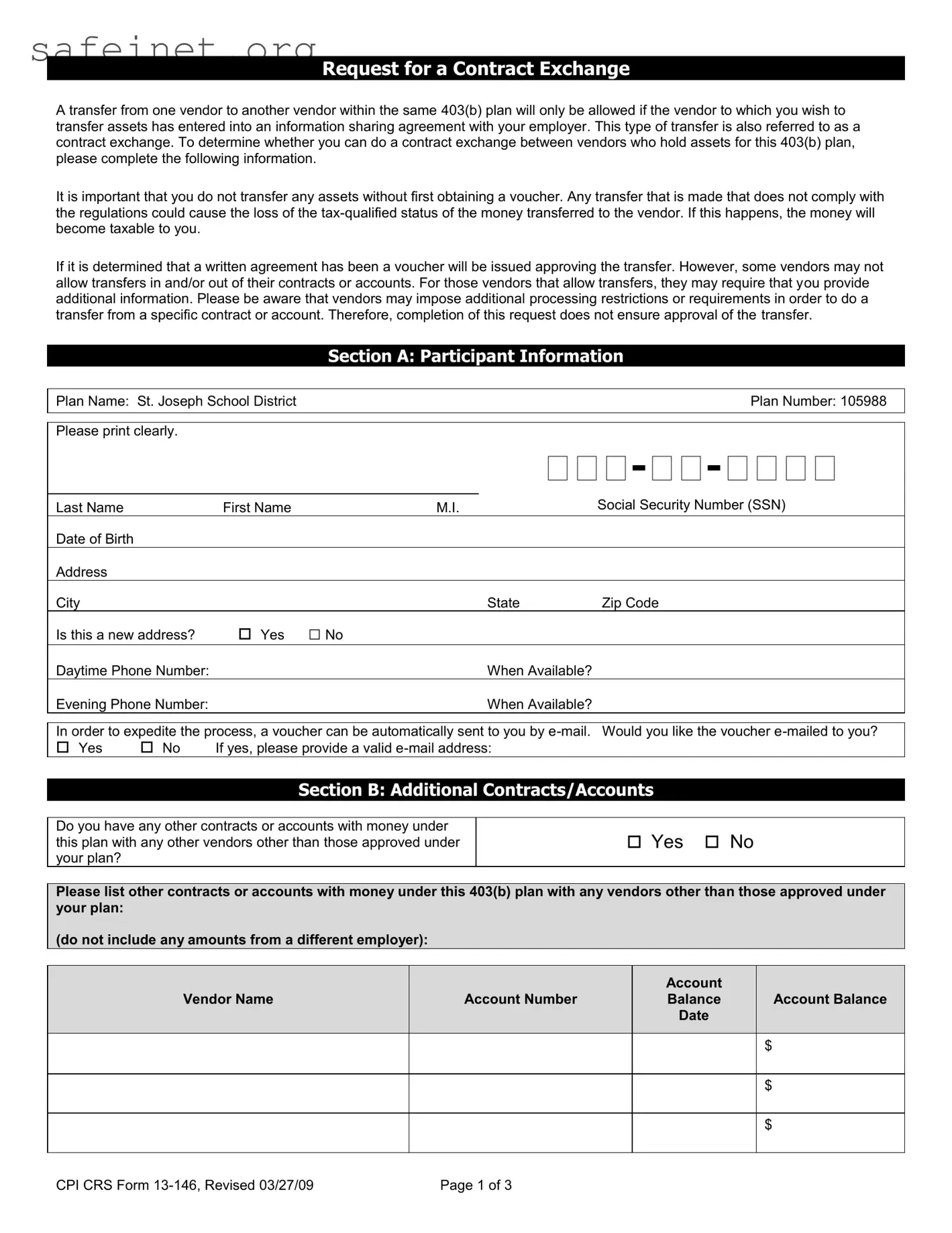

What is the purpose of the Cpi Crs 13 146 form?

The Cpi Crs 13 146 form is used to request a contract exchange within a 403(b) plan. This allows participants to transfer assets from one vendor to another, provided the receiving vendor has an information sharing agreement with the employer. Proper use of this form is crucial to avoid potential tax implications.

What are the requirements for submitting this form?

Before submitting the form, participants must ensure the vendor receiving the transfer has an information sharing agreement with their employer. Additionally, completing the form does not guarantee approval of the transfer. Participants must also obtain a voucher prior to moving assets to avoid losing the tax-qualified status of their money.

What happens if I transfer assets without obtaining a voucher?

If a participant transfers assets without a voucher, they risk losing the tax-qualified status of those funds. If this occurs, the transferred amount may become taxable, which can lead to unexpected financial consequences.

Can I submit multiple transfer requests using the Cpi Crs 13 146 form?

No, each transfer must be submitted through a separate request. The form allows for only a single transfer request to be processed at a time. Participants must complete additional forms for each transfer they wish to make.

What information do I need to provide on the form?

The form requires participants to provide personal information, including their name, social security number, date of birth, and contact information. Additionally, participants must specify the vendors involved and the amounts to be transferred, along with details about any other existing accounts or contracts under the same plan.

How long is the voucher valid?

The voucher issued upon approval is valid for 30 days. If the participant does not complete the transfer by using the voucher within this timeframe, the voucher will expire, necessitating a new request for approval.

Where should I send the completed Cpi Crs 13 146 form?

The completed form should be sent to Common Remitter Services at their mailing address: 4903 10th Street, P.O. Box 110, Great Bend, KS 67530. Participants can also fax the request to (620) 792-5622 if they prefer that method.