What is the purpose of the CPE Reporting Florida form?

This form is used to report Continuing Professional Education (CPE) hours for licensed accountants in Florida. It allows licensed professionals to document their completed CPE courses within a two-year reestablishment period. Proper completion ensures compliance with Florida Board of Accountancy regulations.

What are the minimum CPE requirements for license renewal?

Each licensee must complete at least 80 hours of continuing education during the two-year reestablishment period. This includes a minimum of 20 hours in accounting and auditing subjects, 4 hours in ethics, and no more than 20 hours in behavioral subjects.

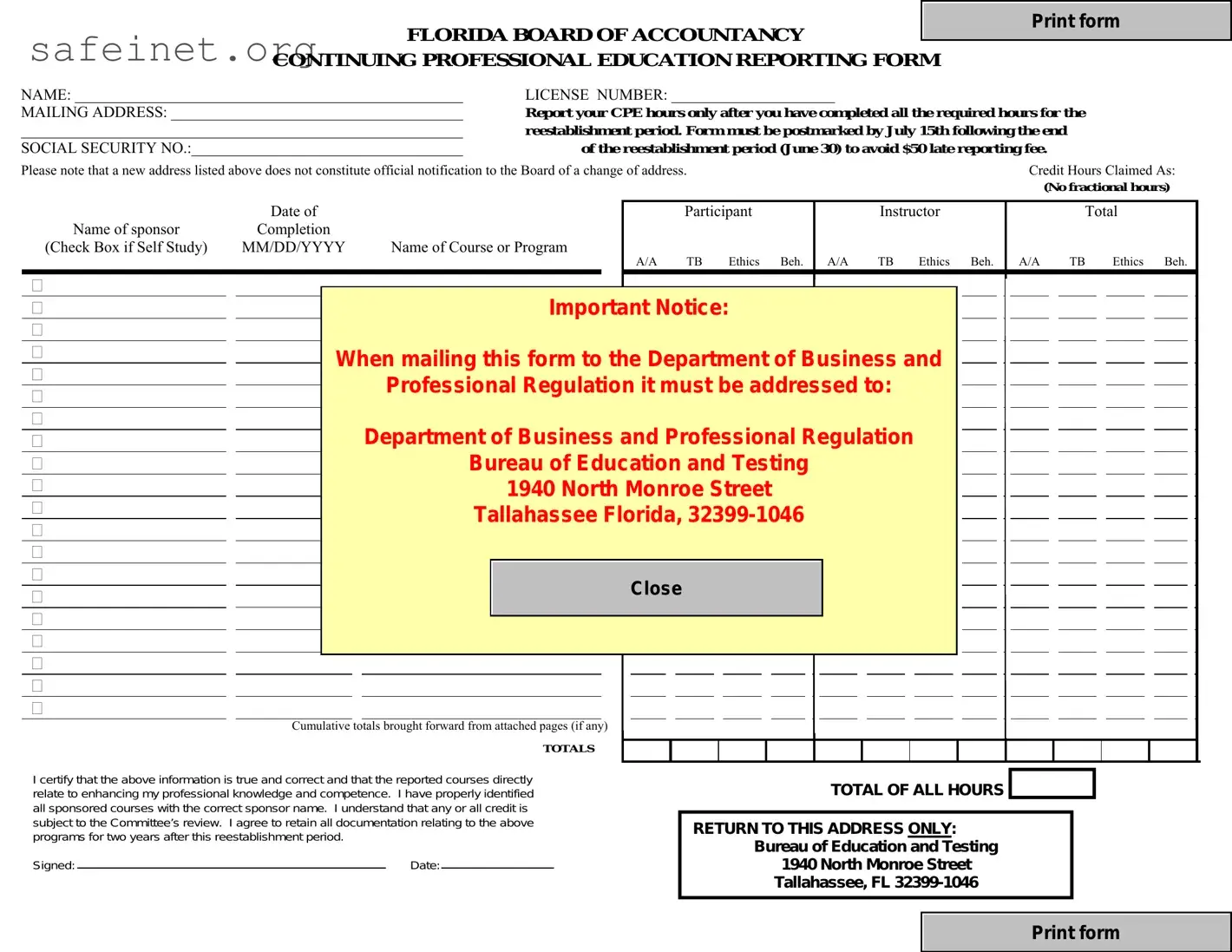

How do I submit the completed CPE Reporting form?

The completed form must be mailed to the Department of Business and Professional Regulation, Bureau of Education and Testing at 1940 North Monroe Street, Tallahassee, Florida, 32399-1046. Ensure it is postmarked by July 15 following the end of the reestablishment period to avoid a late fee.

Can I report fractional hours of CPE?

No, you cannot report fractional hours. All claimed hours must be whole numbers. If you have any fractional hours, they will be rounded down to the nearest whole hour, and any fractional hour reported will be removed.

What do I need to do if my address changes?

If your address changes, you must notify the Board office in writing. A change of address listed on the CPE Reporting form will not count as official notification and won't update your records with the Board.

What if I have questions about filling out the form?

If you have questions regarding the CPE Reporting form or need assistance, you can contact the Bureau of Education & Testing at 850.487.1395 or write to the address mentioned above. They can provide guidance on completing the form correctly.