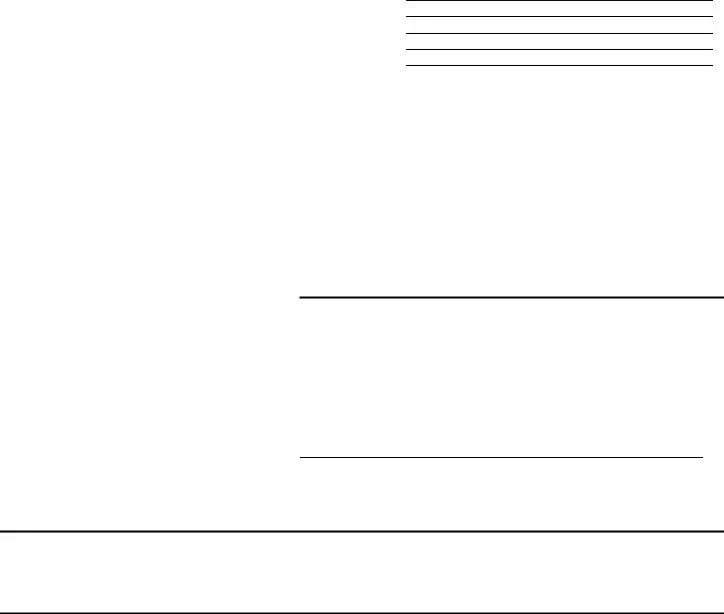

What is the CP75A form?

The CP75A form is a notice from the Internal Revenue Service (IRS) that informs taxpayers about an audit of their tax return. Specifically, it is used when the IRS needs more information regarding claimed tax credits or deductions on a taxpayer's Form 1040 for a specific tax year, in this case, the 2016 tax year.

Why did I receive the CP75A notice?

You received the CP75A notice because the IRS is reviewing the information you provided on your 2016 tax return. They require additional documentation to verify certain claims you made, such as the Earned Income Credit. The IRS typically sends this notice when they have questions about your tax return or see discrepancies that require further investigation.

What should I do after receiving the CP75A form?

First, carefully read the notice to understand what documents you need to provide. You have 30 days from the notice date to gather the required documentation and send it back to the IRS. Additionally, complete the Response form that came with the notice, and use it to indicate which items you’re addressing. If you can’t provide the documents in time, you should contact the IRS at the number listed on the notice.

What happens if I don’t respond to the CP75A?

If you do not send the required documentation within the 30-day timeframe, the IRS will disallow the claims under audit. This could lead to adjustments on your tax return, which may result in additional taxes owed, along with possible penalties and interest. It’s important to respond to ensure your claims are upheld.

What documentation do I need to provide?

The notice specifies what types of supporting information are necessary. For instance, if you claimed the Earned Income Credit based on a qualifying child, you must send proof that establishes the relationship, age, and residency of that child. Review the details in the notice carefully and provide copies of any relevant documents.

How can I contact the IRS for assistance?

You can reach the IRS by calling the phone number provided in the notice, which is 800-829-1040. This number should help you with questions about the auditing process or any specific concerns regarding your notice. If you need additional assistance and your tax circumstances are causing a hardship, consider contacting the Taxpayer Advocate Service.

What if I'm having trouble gathering my documents?

If you’re unable to collect the necessary documentation within the allowed timeframe, it’s essential to reach out to the IRS as soon as possible. The notice includes a contact number that you can call for help. They may offer an extension or provide guidance on how to proceed.

What happens after I send my documentation?

Once you send the required documents to the IRS, they will review the information you provided. You should allow at least 30 days for this review process. If the IRS finds that your documentation supports your tax return, they will issue any applicable refund and notify you that the audit is closed. Conversely, if they find discrepancies, they will send you another notice explaining the proposed changes and any additional taxes owed.

Are there resources available for further assistance?

Yes, the IRS provides various resources, including the Taxpayer Advocate Service for those facing hardships or issues that haven’t been resolved. Moreover, you can find organizations and individuals available to help taxpayers, especially those with lower incomes. A complete directory of Low Income Taxpayer Clinics is available online for public access.

Is it important to keep a copy of the CP75A notice?

Absolutely. Keeping a copy of the CP75A notice is vital for your records. This documentation serves as proof of correspondence with the IRS and may be necessary in the future for any related tax matters or inquiries. Always retain important tax documents for your records.