What is the purpose of the Court Inventory form?

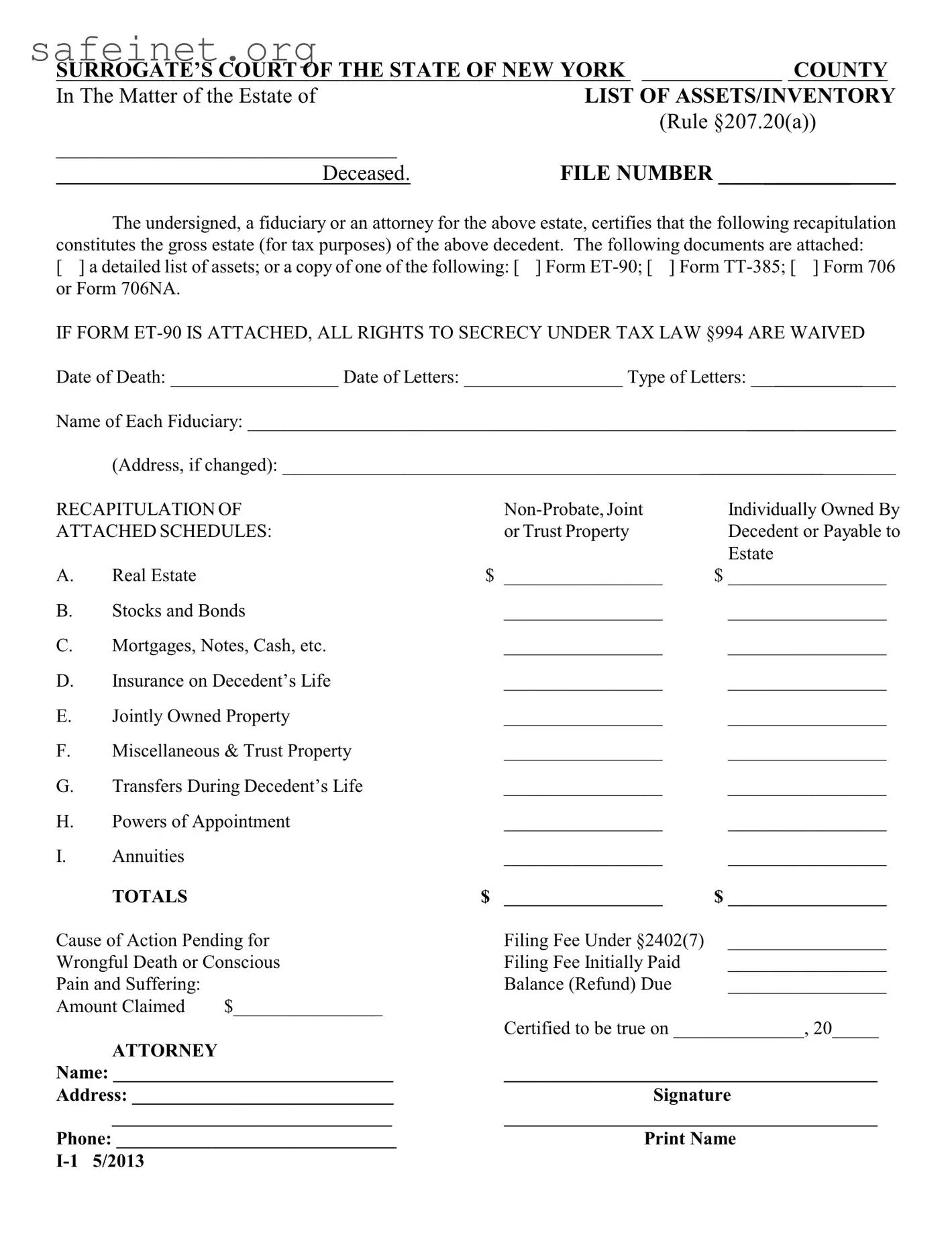

The Court Inventory form is designed to provide a clear and organized summary of the assets of a deceased individual's estate. It serves as a vital record for tax purposes and helps the court identify the total value of the estate. This form must be accurately completed by a fiduciary or an attorney representing the estate.

Who is required to complete the Court Inventory form?

Typically, a fiduciary or an appointed attorney for the estate must complete this form. A fiduciary could be an executor or administrator tasked with managing the estate. It’s their job to accurately account for all assets and liabilities of the deceased person.

What information is needed to fill out the Court Inventory form?

To complete the form, you will require detailed information about the deceased's assets, including but not limited to real estate, stocks, bonds, bank accounts, insurance policies, and any jointly owned properties. Information regarding outstanding debts and transfers made during the decedent's life is also necessary.

Are there any documents required to accompany the Court Inventory form?

Yes, you need to attach specific documents such as a detailed list of assets or, alternatively, copies of certain forms like Form ET-90, Form TT-385, or Form 706/706NA. The completion of the form ensures transparency and accuracy in the accounting of the estate.

What should I do if there are changes to the beneficiary's address?

If there are changes to the address of a fiduciary or beneficiary, it’s crucial to include the updated address on the form. Maintaining accurate contact information helps streamline communication with the court and ensures that all parties are notified of any important developments.

What happens if I fail to complete the Court Inventory form accurately?

Inaccurate or incomplete forms can lead to delays in the proceedings. The court may request revisions or additional documentation, which can prolong the process of estate settlement. In some cases, it may even lead to legal complications, so it’s critical to fill out the form with care and precision.

Where should the completed Court Inventory form be submitted?

The completed Court Inventory form should be submitted to the Surrogate’s Court in the appropriate county where the estate is being administered. It’s important to ensure it’s filed by any deadlines set by the court to avoid potential complications.