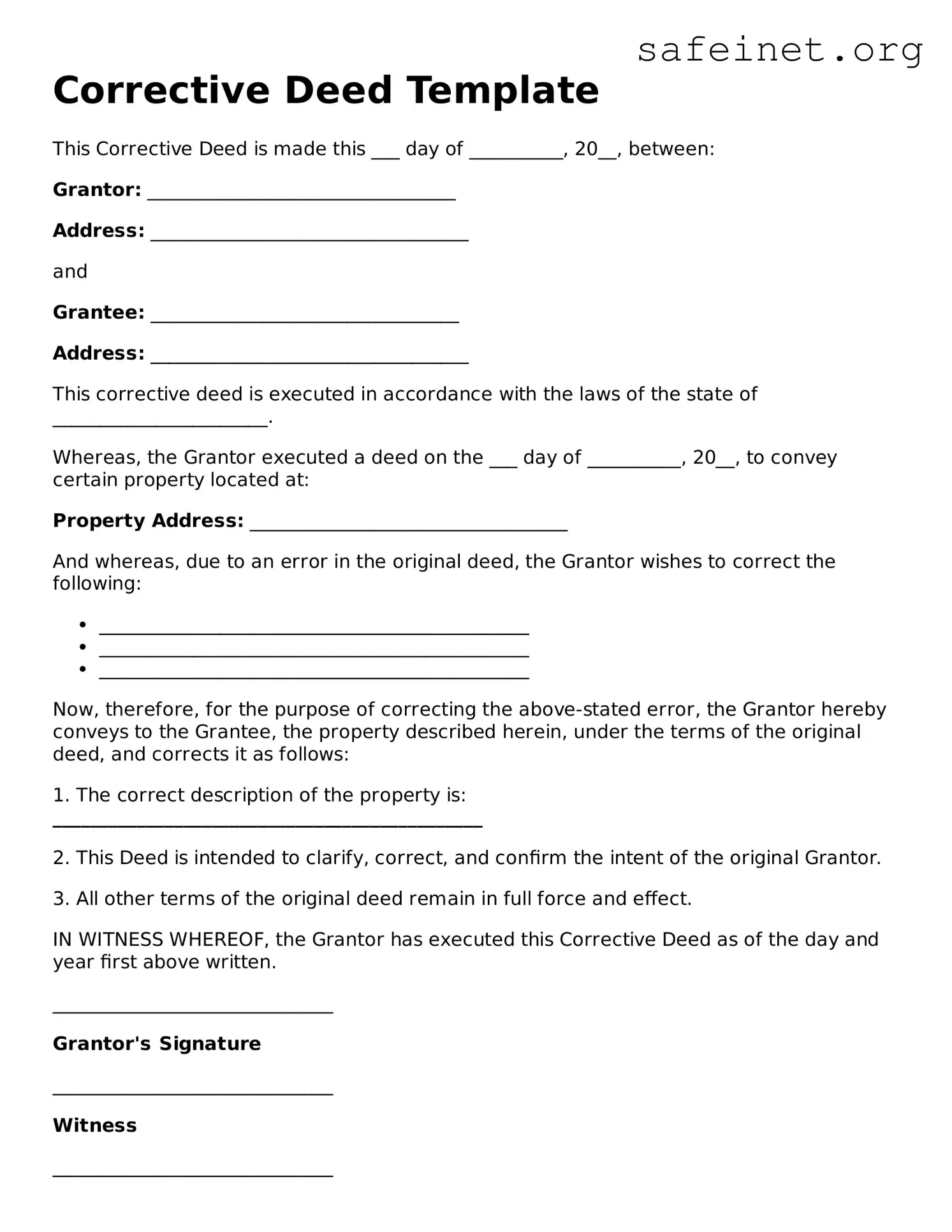

Corrective Deed Template

This Corrective Deed is made this ___ day of __________, 20__, between:

Grantor: _________________________________

Address: __________________________________

and

Grantee: _________________________________

Address: __________________________________

This corrective deed is executed in accordance with the laws of the state of _______________________.

Whereas, the Grantor executed a deed on the ___ day of __________, 20__, to convey certain property located at:

Property Address: __________________________________

And whereas, due to an error in the original deed, the Grantor wishes to correct the following:

- ______________________________________________

- ______________________________________________

- ______________________________________________

Now, therefore, for the purpose of correcting the above-stated error, the Grantor hereby conveys to the Grantee, the property described herein, under the terms of the original deed, and corrects it as follows:

1. The correct description of the property is:

______________________________________________

2. This Deed is intended to clarify, correct, and confirm the intent of the original Grantor.

3. All other terms of the original deed remain in full force and effect.

IN WITNESS WHEREOF, the Grantor has executed this Corrective Deed as of the day and year first above written.

______________________________

Grantor's Signature

______________________________

Witness

______________________________

Notary Public

My commission expires: _____________