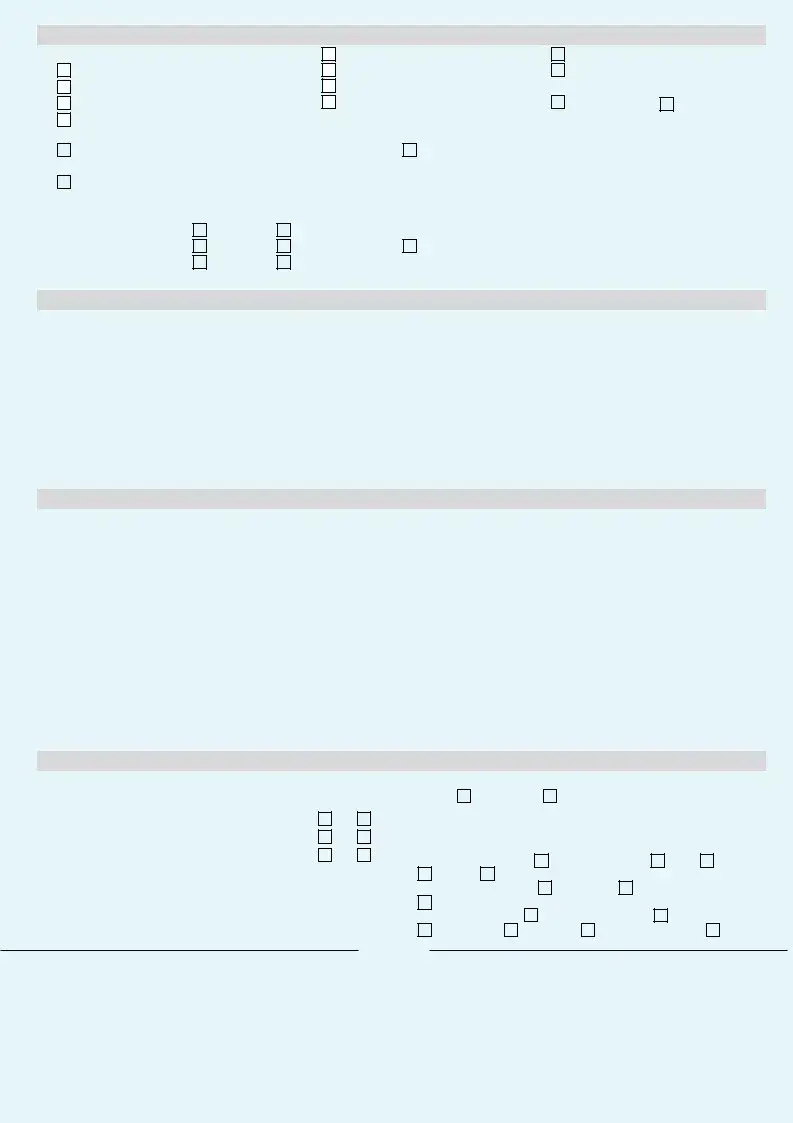

What is the purpose of the Corporation Bank Account Opening form?

The Corporation Bank Account Opening form is designed for individuals and entities to request the opening of a savings or current account with the bank. By filling out this form, applicants provide necessary details such as personal information, account preferences, and compliance documentation needed to open and maintain an account. It ensures all necessary information is gathered to process the account opening efficiently.

Who can apply for an account using this form?

This form can be filled out by individuals (such as sole proprietors), companies, firms, associations, trusts, and other legal entities. Each applicant needs to provide specific details about themselves or their organization, including full names, occupations, and relationship details if necessary.

What information is required on the account opening form?

The form requires a variety of information. This includes the account type the applicant wishes to open, initial deposit amount, full names and designations of those applying, address details, occupation codes, and identification numbers like PAN or GIR. Additionally, applicants must provide their contact information and address for correspondence.

Are there any specific requirements for joint accounts?

Yes, if the account is a joint account, all account holders will need to provide their details on the form. It’s important to specify how the account will be operated, whether jointly or by any one of the account holders. Each individual must sign the form, acknowledging their agreement to the terms and conditions.

What is the minimum balance requirement for different account types?

Different account types have varied minimum balance requirements. The form allows applicants to choose the account based on their needs and financial capability. Applicants need to ensure they are aware of the prescribed minimum balance under each scheme to avoid penalties.

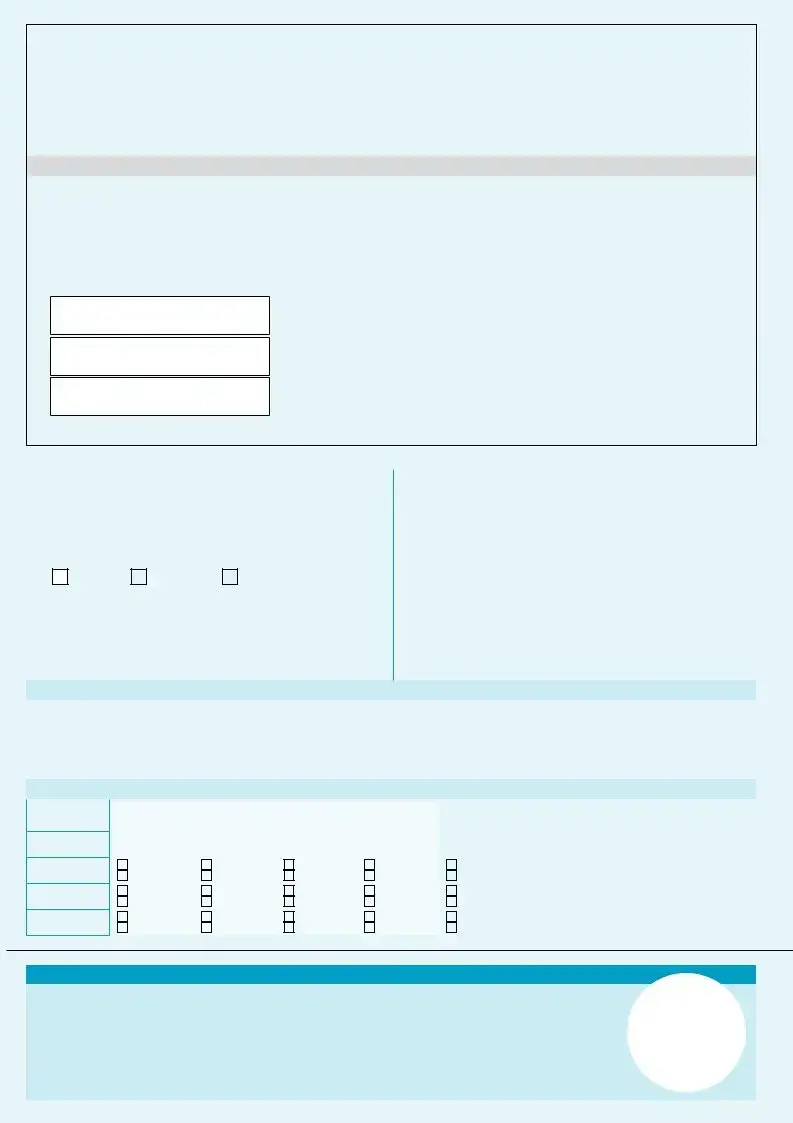

Can I submit a nomination for my account?

Yes, the form includes a section for nominations, where account holders can designate someone to receive their account benefits in case of their demise. This is an important step that adds a layer of security and ensures that your assets can be handled according to your wishes. It's important to complete the nomination correctly and submit a separate nomination form if required.

What documents do I need to submit with the form?

Applicants typically need to submit identification documents that support the details provided in the account opening form. This may include proof of identity, address verification, and any documents relevant to the business or partnership, such as certificates of incorporation or partnership deeds. The form will specify which documents are mandatory versus optional.

How long does it take to open an account after submitting the form?

The time it takes to open an account can vary depending on the bank's internal processes and the completeness of the documentation submitted. Generally, once the form and required documents are verified, the account can be opened within a few working days. Applicants will receive confirmation from the bank once their account is active.

What should I do if I have more questions while filling out the form?

If you have further questions while filling out the form, it’s advisable to contact the bank’s customer service or visit a local branch for assistance. Bank representatives are trained to guide you through the process and ensure you complete the form correctly, making it a smoother experience for you.

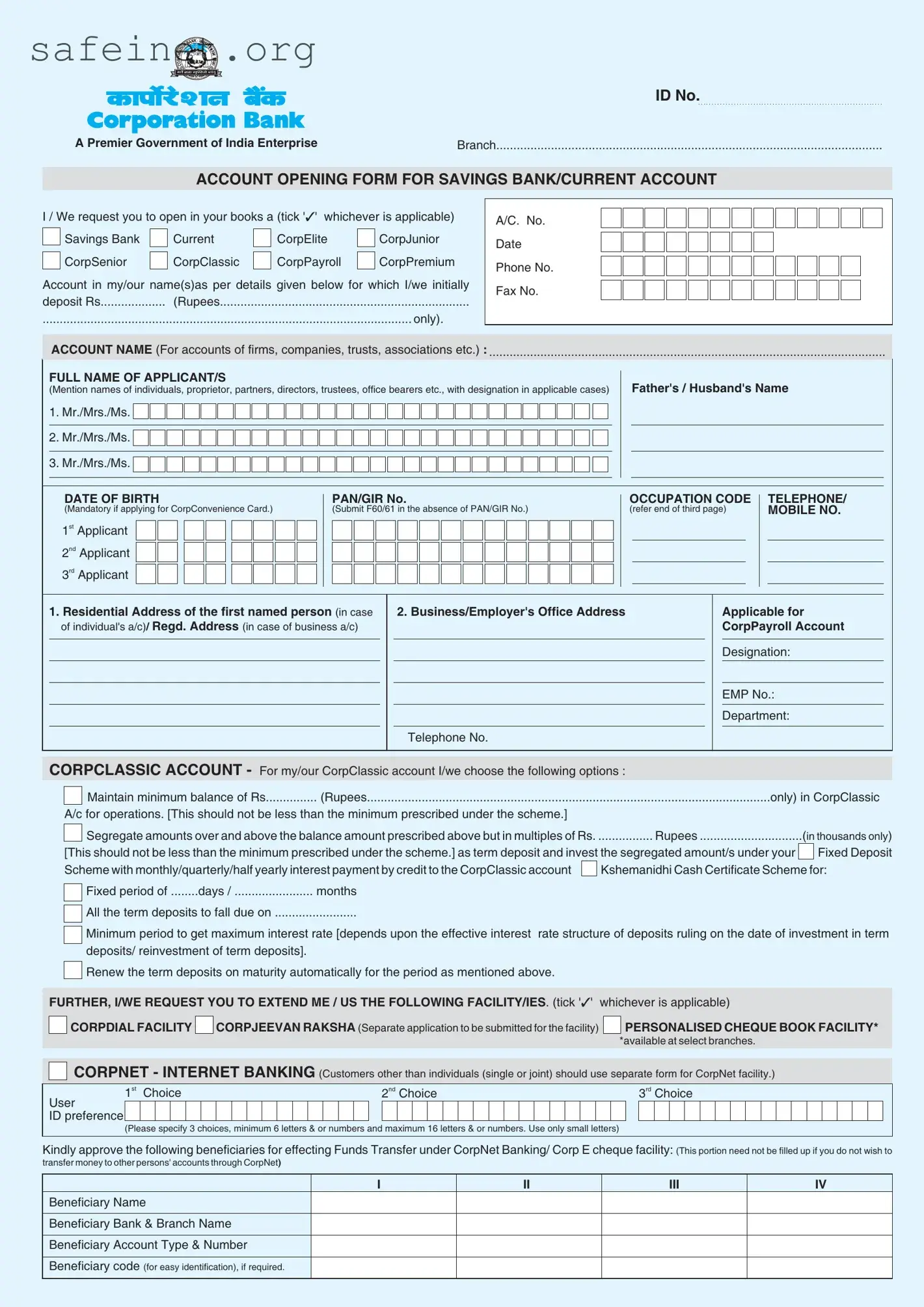

Minimum period to get maximum interest rate [depends upon the effective interest rate structure of deposits ruling on the date of investment in term deposits/ reinvestment of term deposits].

Minimum period to get maximum interest rate [depends upon the effective interest rate structure of deposits ruling on the date of investment in term deposits/ reinvestment of term deposits].

Renew the term deposits on maturity automatically for the period as mentioned above.

Renew the term deposits on maturity automatically for the period as mentioned above.

CORPDIAL FACILITY

CORPDIAL FACILITY

CORPJEEVAN RAKSHA

CORPJEEVAN RAKSHA

PERSONALISED CHEQUE BOOK FACILITY*

PERSONALISED CHEQUE BOOK FACILITY*

Corp Convenience

Corp Convenience

CorpNet

CorpNet

CorpBillPay facilities.

CorpBillPay facilities.

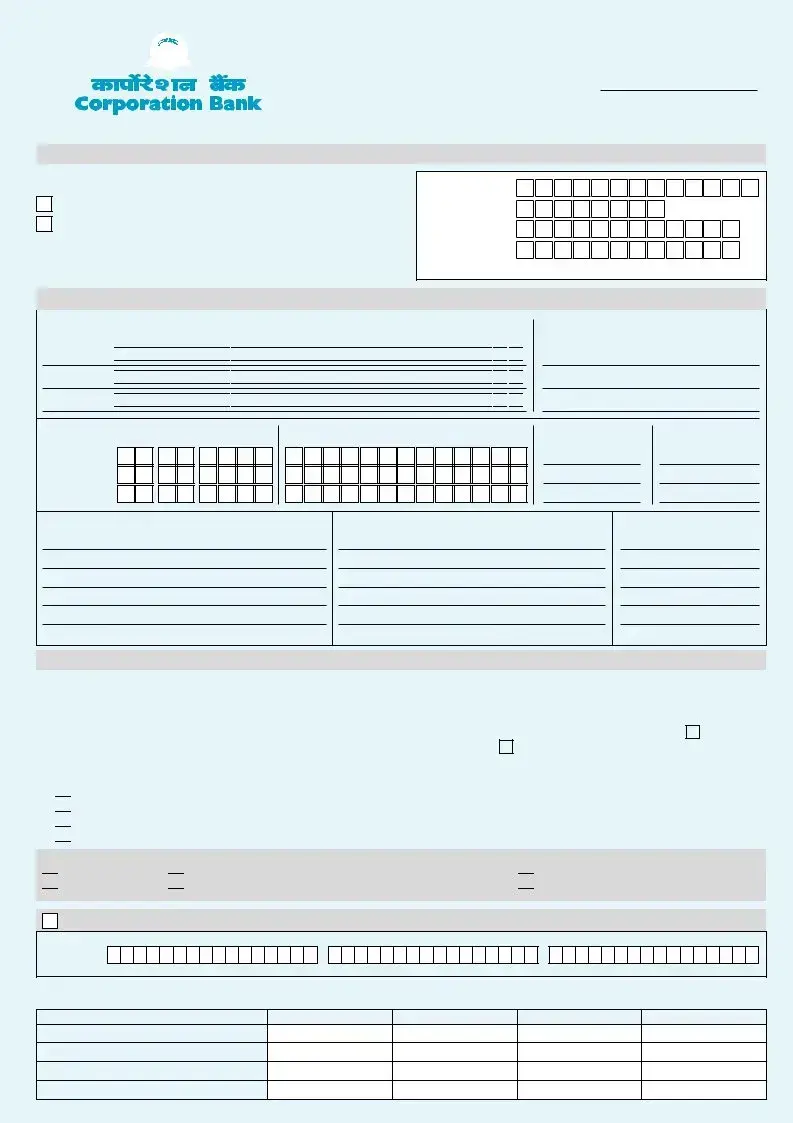

mention

mention

do not mention nomination details on the account pass book. Nomination facility is not required by me.

do not mention nomination details on the account pass book. Nomination facility is not required by me.