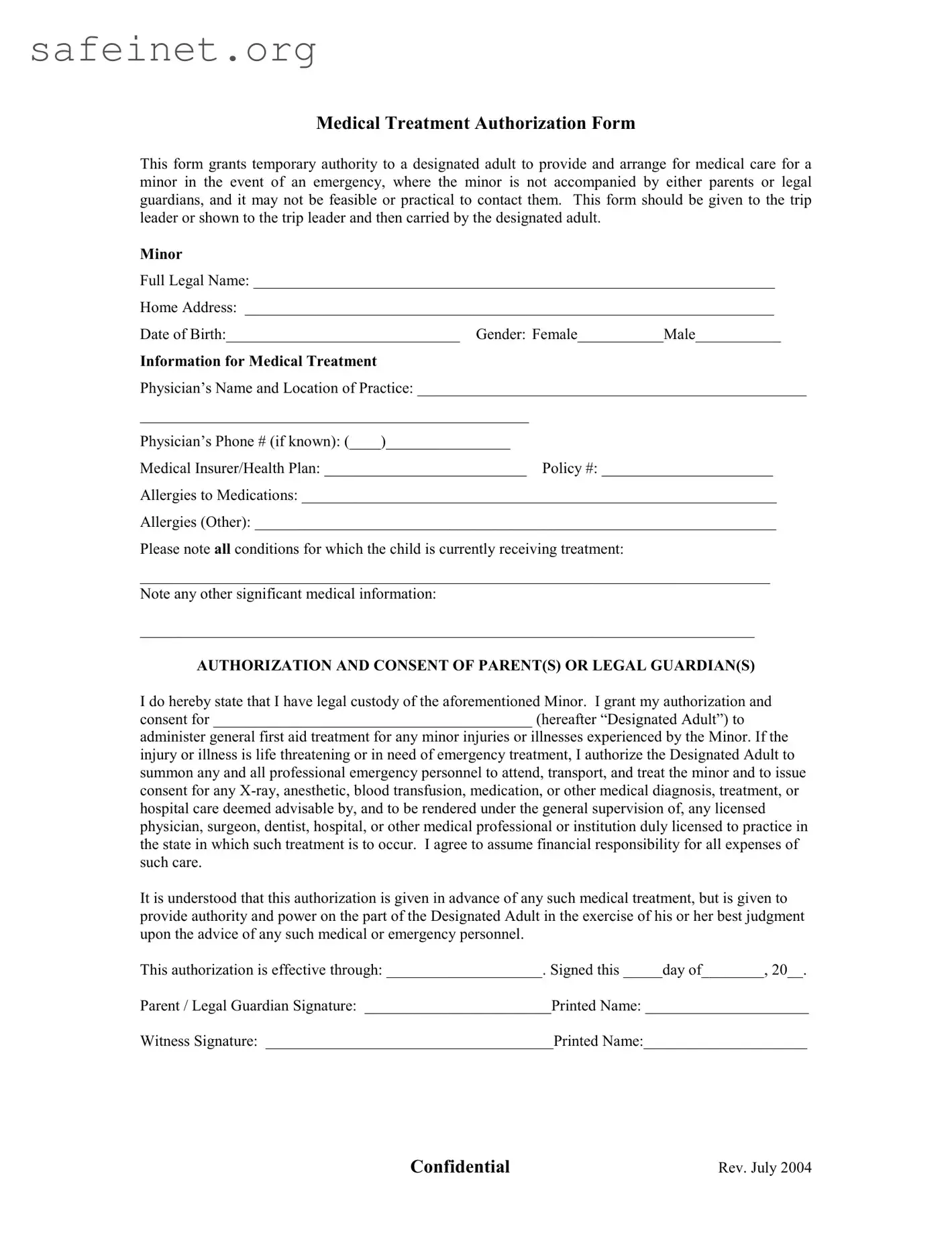

MEDICAL TREATMENT AUTHORIZATION FORM

This form grants temporary authority to a designated adult to provide and arrange for medical care for a minor in the event of an emergency, where the minor is not accompanied by either parents or legal guardians, and it may not be feasible or practical to contact them. This form should be given to the trip leader or shown to the trip leader and then carried by the designated adult.

MINOR

Full Legal Name: ___________________________________________________________________

Home Address: ____________________________________________________________________

Date of Birth:______________________________ Gender: Female___________Male___________

INFORMATION FOR MEDICAL TREATMENT

Physician’s Name and Location of Practice: __________________________________________________

__________________________________________________

Physician’s Phone # (if known): (____)________________

Medical Insurer/Health Plan: __________________________ Policy #: ______________________

Allergies to Medications: _____________________________________________________________

Allergies (Other): ___________________________________________________________________

Please note ALL conditions for which the child is currently receiving treatment:

_________________________________________________________________________________

Note any other significant medical information:

_______________________________________________________________________________

AUTHORIZATION AND CONSENT OF PARENT(S) OR LEGAL GUARDIAN(S)

I do hereby state that I have legal custody of the aforementioned Minor. I grant my authorization and consent for _________________________________________ (hereafter “Designated Adult”) to

administer general first aid treatment for any minor injuries or illnesses experienced by the Minor. If the injury or illness is life threatening or in need of emergency treatment, I authorize the Designated Adult to summon any and all professional emergency personnel to attend, transport, and treat the minor and to issue consent for any X-ray, anesthetic, blood transfusion, medication, or other medical diagnosis, treatment, or hospital care deemed advisable by, and to be rendered under the general supervision of, any licensed physician, surgeon, dentist, hospital, or other medical professional or institution duly licensed to practice in the state in which such treatment is to occur. I agree to assume financial responsibility for all expenses of such care.

It is understood that this authorization is given in advance of any such medical treatment, but is given to provide authority and power on the part of the Designated Adult in the exercise of his or her best judgment upon the advice of any such medical or emergency personnel.

This authorization is effective through: ____________________. Signed this _____day of________, 20__.

Parent / Legal Guardian Signature: ________________________Printed Name: _____________________

Witness Signature: _____________________________________Printed Name:_____________________