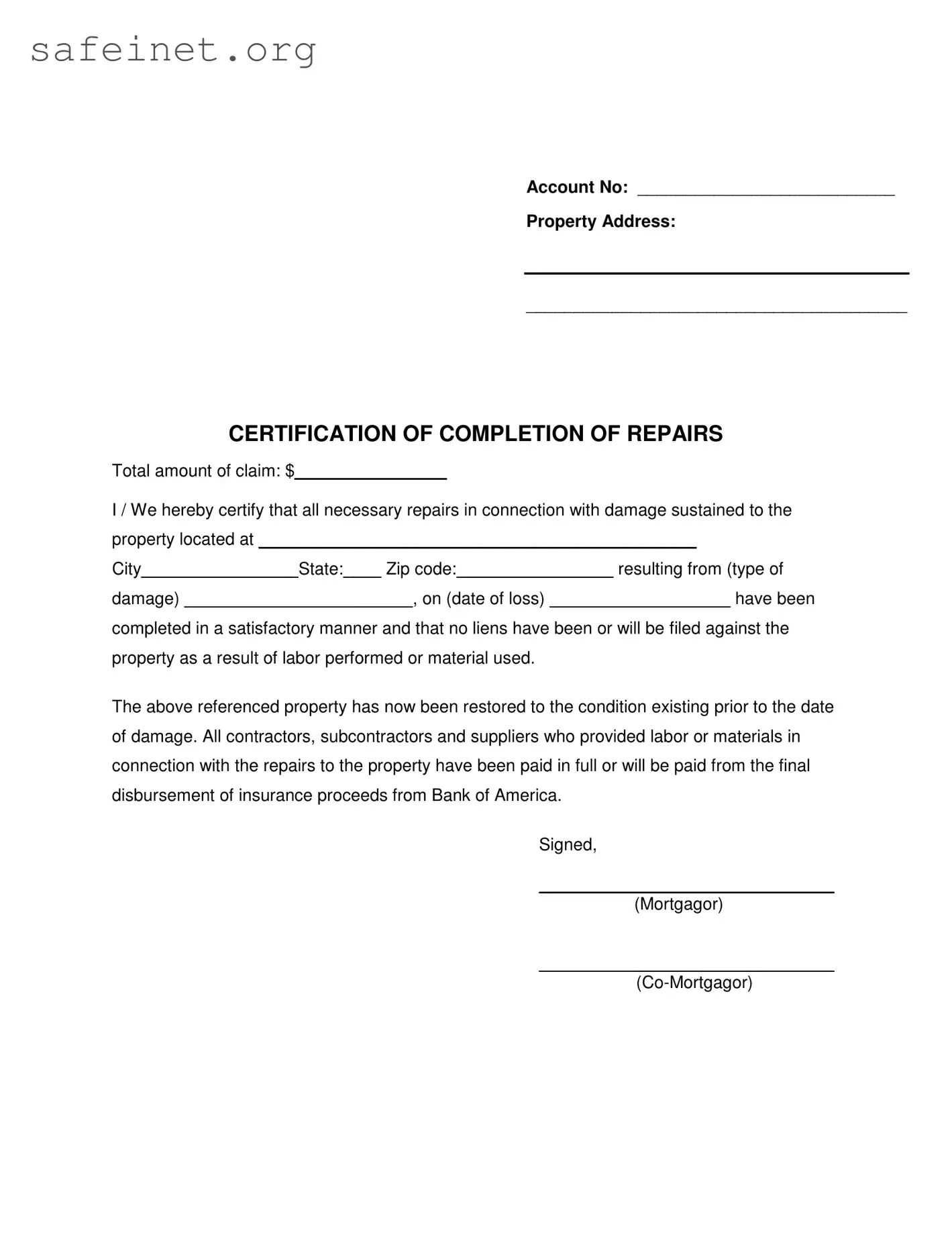

Account No: ___________________________

Property Address:

________________________________________

CERTIFICATION OF COMPLETION OF REPAIRS

Total amount of claim: $________________

I / We hereby certify that all necessary repairs in connection with damage sustained to the property located at ______________________________________________

City________________ State:____ Zip code: ________________ resulting from (type of

damage) ________________________, on (date of loss) ___________________ have been

completed in a satisfactory manner and that no liens have been or will be filed against the property as a result of labor performed or material used.

The above referenced property has now been restored to the condition existing prior to the date of damage. All contractors, subcontractors and suppliers who provided labor or materials in connection with the repairs to the property have been paid in full or will be paid from the final disbursement of insurance proceeds from Bank of America.

Signed,

_______________________________

(Mortgagor)

_______________________________

(Co-Mortgagor)