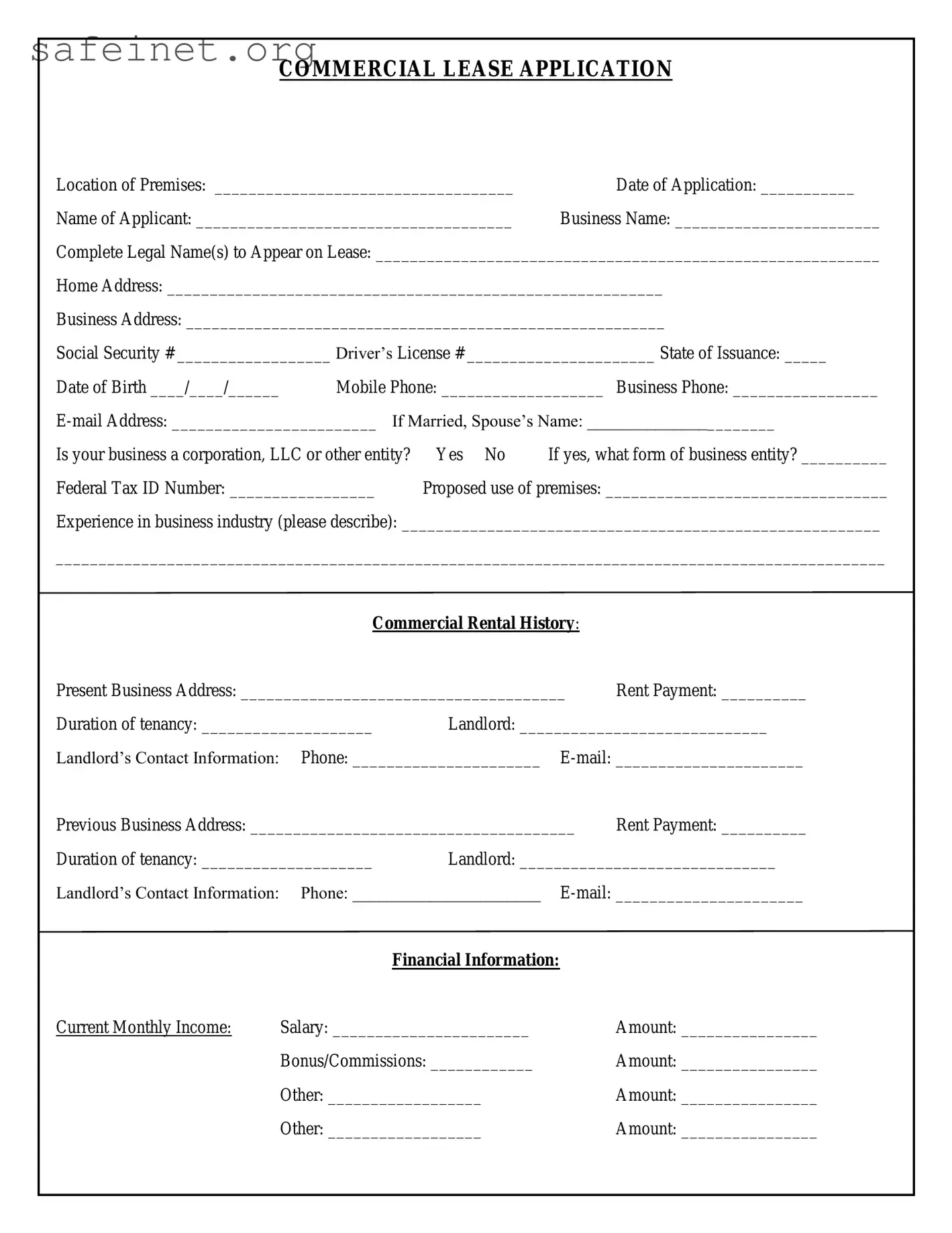

COMMERCIAL LEASE APPLICATION

Location of Premises: ___________________________________ |

Date of Application: ___________ |

Name of Applicant: _____________________________________ |

Business Name: ________________________ |

Complete Legal Name(s) to Appear on Lease: ___________________________________________________________

Home Address: __________________________________________________________

Business Address: ________________________________________________________

Social Security # __________________ Driver’s License # ______________________ State of Issuance: _____

|

|

|

|

Date of Birth ____/____/______ |

Mobile Phone: ___________________ Business Phone: _________________ |

E-mail Address: ________________________ If Married, Spouse’s Name: ______________________ |

Is your business a corporation, LLC or other entity? |

Yes No |

If yes, what form of business entity? __________ |

Federal Tax ID Number: _________________ |

Proposed use of premises: _________________________________ |

Experience in business industry (please describe): ________________________________________________________

_________________________________________________________________________________________________

|

Commercial Rental History: |

|

Present Business Address: ______________________________________ |

Rent Payment: __________ |

Duration of tenancy: ____________________ |

Landlord: _____________________________ |

Landlord’s Contact Information: |

Phone: ______________________ |

E-mail: ______________________ |

Previous Business Address: ______________________________________ |

Rent Payment: __________ |

Duration of tenancy: ____________________ |

Landlord: ______________________________ |

Landlord’s Contact Information: |

Phone: ______________________ |

E-mail: ______________________ |

|

|

Financial Information: |

|

|

Current Monthly Income: |

Salary: _______________________ |

|

Amount: ________________ |

|

Bonus/Commissions: ____________ |

|

Amount: ________________ |

|

Other: __________________ |

|

Amount: ________________ |

|

Other: __________________ |

|

Amount: ________________ |

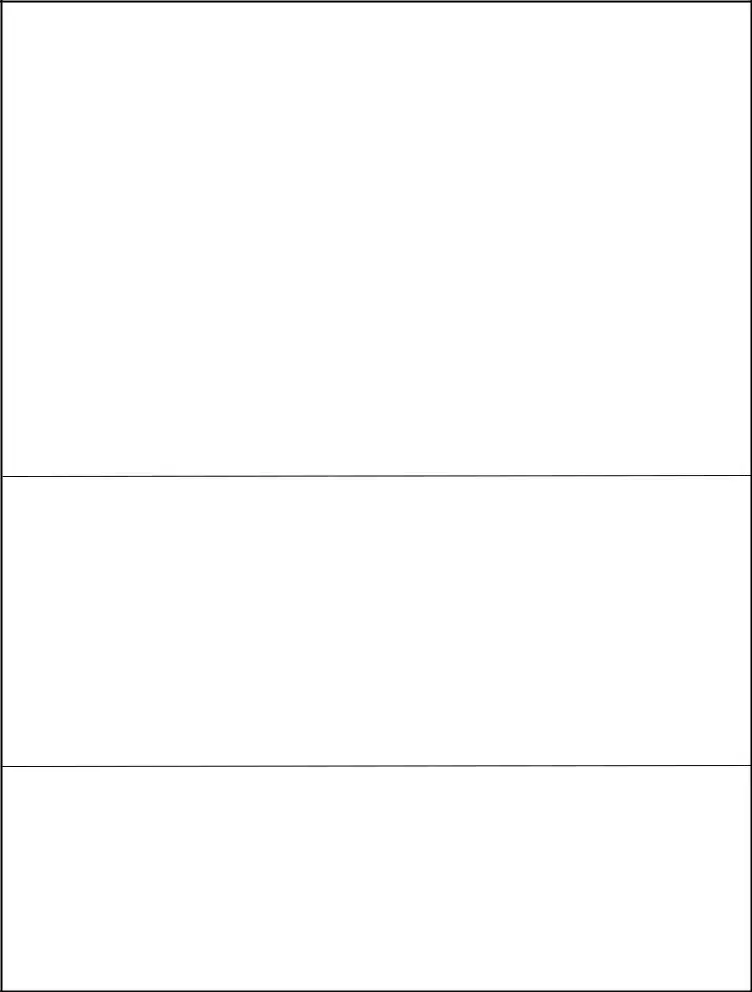

Current Monthly Expenses: |

Home Mortgage: __________________ |

Amount: ________________ |

|

Loan Payments: __________________ |

Amount: ________________ |

|

General Living Expenses: __________ |

Amount: ________________ |

|

Other: __________________ |

Amount: ________________ |

|

Other: __________________ |

Amount: ________________ |

ASSETS |

LIABILITIES |

Cash on Hand & in Banks ____________________ |

Accounts Payable ($ you owe) ___________________ |

Savings Account(s) __________________________ |

Notes/loans Payable to Banks ___________________ |

IRA/Retirement Accounts _____________________ |

Automobile Payments _________________________ |

Accounts Receivable ($ owed to you) ____________ |

Other Installment Accounts _____________________ |

Insurance Cash Surrender _____________________ |

Loans on Life Insurance ________________________ |

Stocks & Bonds _____________________________ |

Mortgages on Real Estate (home) _________________ |

Real Estate (personal residence) ________________ |

Unpaid Taxes _________________________________ |

Real Estate (investments) _____________________ |

Outstanding Credit Card Balances _________________ |

Automobiles ________________________________ |

Other Liabilities _______________________________ |

Other Personal Property _______________________ |

Other Liabilities _______________________________ |

Other Assets ________________________________ |

|

Other Assets ________________________________ |

|

TOTAL ASSETS: ____________________________ |

TOTAL LIABILITIES: ________________________ |

NET WORTH (Total Assets minus Total Liabilities) __________________________

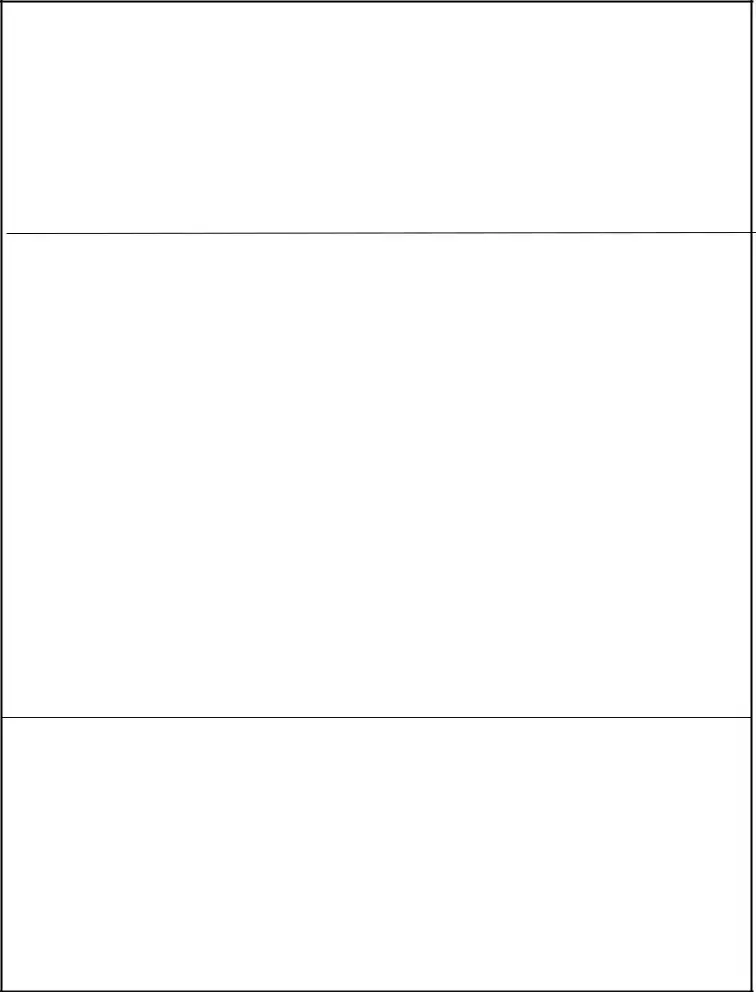

Personal Information

Dependent Children: 1. ____________________DOB: _____________

2. ____________________ DOB: _____________ |

|

3. ____________________ DOB: _____________ |

|

4. ____________________ DOB: _____________ |

|

5. ____________________ DOB: _____________ |

|

Other Dependents: 1. ____________________ DOB: _____________ |

Relation: ______________ |

2. ____________________ DOB: _____________ |

Relation: ______________ |

Business/Occupation: 1. _______________________

2._______________________

3._______________________

|

Credit References: |

Banking Information: |

|

Bank |

Account # |

Business Checking: ________________ #____________________________

Business Checking: _________________#____________________________

Checking: _________________#_________________________

Checking: _________________#_________________________

Savings: __________________#_________________________

Savings: __________________#_________________________

Other: ____________________#_________________________

Other: ____________________#_________________________

Credit Cards: _________________#________________________

_________________#________________________

_________________#________________________

_________________#________________________

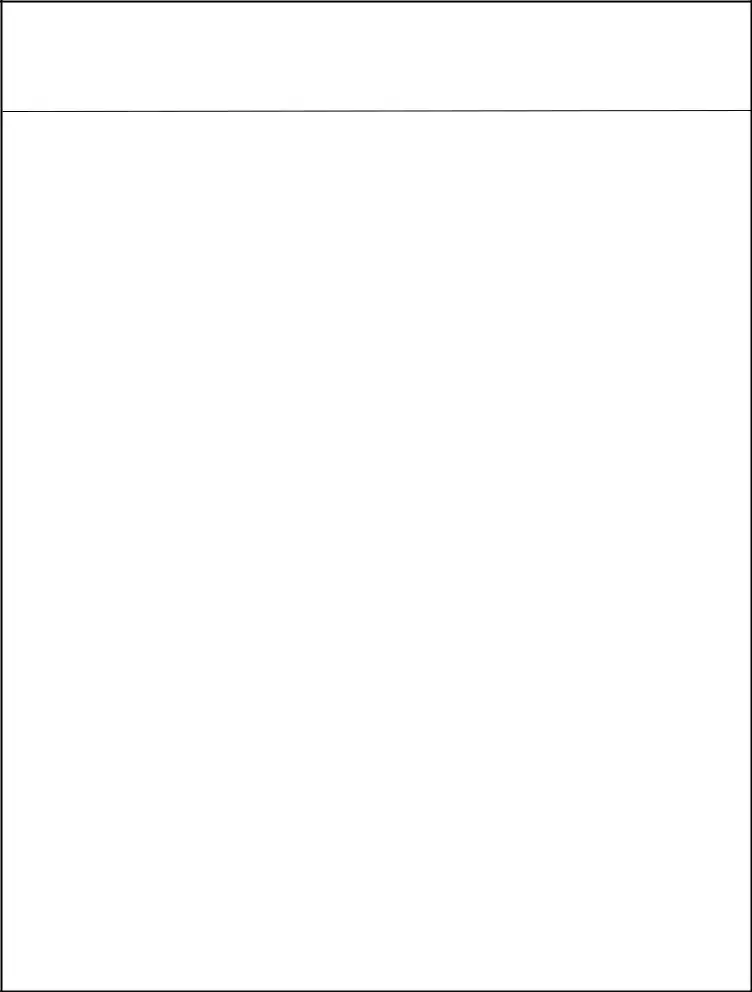

CONSENT TO CREDIT CHECK

I, the undersigned applicant(s), authorize landlord or his/her/their agent to order and review my/our credit and criminal history and investigate the accuracy of the information contained in the application. I/We further authorize all banks, employers, creditors, credit card companies, references, and any and all other persons to provide to Landlord any and all information concerning my/our credit.

By your signature hereon, you agree that the information disclosed by you herein is true, complete and accurate to the best of your knowledge, and you agree that the information disclosed by you herein is material to the potential lessor’s decision with respect to granting or denying your application to enter into a lease agreement.

This application is not a commitment to rent to Applicant(s) or reserve a premises unless a formal lease agreement is fully executed by both parties.

Name: ____________________ |

Signature: _____________________________ |

Date: ____________ |