What is a Transfer-on-Death Deed in Colorado?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Colorado to designate a beneficiary who will automatically receive their property upon their death. This deed allows the transfer of the property without going through probate, simplifying the process for the beneficiary while enabling the owner to retain full control during their lifetime.

How does a Transfer-on-Death Deed work?

The owner of the property fills out a Transfer-on-Death Deed and names one or more beneficiaries. Upon the owner's death, the property automatically transfers to the named beneficiary without the need for probate court proceedings. However, the owner retains the right to sell or change the deed at any time during their life, ensuring flexibility and control over the asset.

Who can be named as a beneficiary?

Beneficiaries can include individuals, such as family members or friends, and even entities like charities or trusts. It is important to ensure that the beneficiary is willing and able to receive the property to avoid complications after the owner's passing.

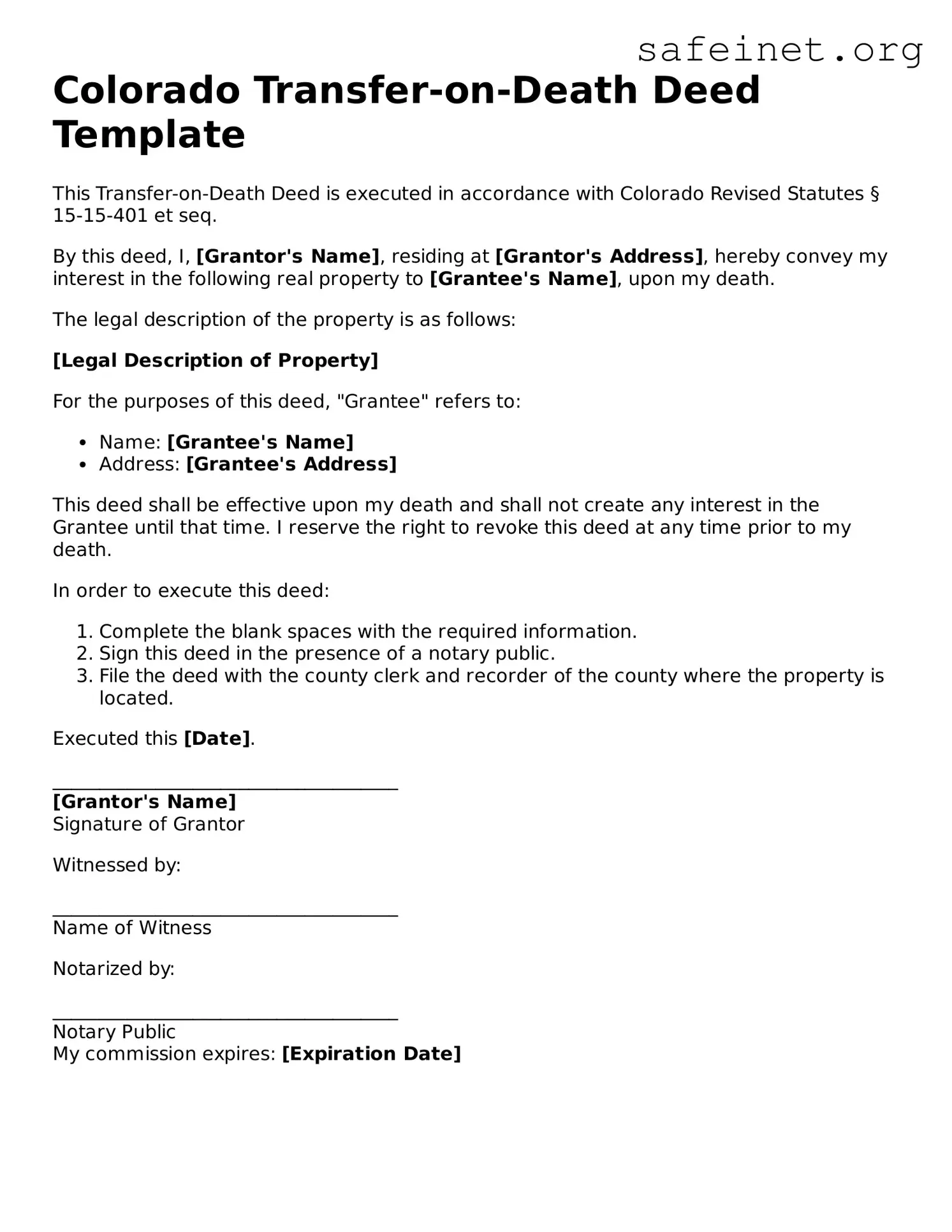

What are the requirements to create a valid Transfer-on-Death Deed?

To create a valid Transfer-on-Death Deed in Colorado, the deed must be in writing, signed by the property owner, and must clearly identify the property and the beneficiary. Additionally, it needs to be filed with the county clerk and recorder in the jurisdiction where the property resides. It is critical that the deed is executed according to the state's specific legal requirements to be enforceable.

Can the Transfer-on-Death Deed be revoked or changed?

Yes, the property owner has the right to revoke or change the Transfer-on-Death Deed at any time before their death. To do so, the owner must either execute a new deed or formally record a revocation. This ability allows property owners to adapt to changing circumstances, such as a change in family dynamics or relationships.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not create immediate tax consequences for the property owner. However, heirs may be subject to estate taxes or other taxes upon the property transfer, depending on its value and other estate factors. It is advisable to consult with a tax professional to understand the specific implications.

Is a Transfer-on-Death Deed suitable for all types of property?

A Transfer-on-Death Deed can be used for most types of real property, including single-family homes, vacation properties, and land. However, it cannot be used for personal property, such as vehicles or bank accounts. Owners should consider their entire estate plan to ensure all aspects are appropriately addressed.

What happens if a beneficiary predeceases the property owner?

If a beneficiary named in the Transfer-on-Death Deed passes away before the owner, the interest in the property typically does not transfer to that beneficiary’s heirs unless the deed specifies otherwise. The property owner can amend the deed to name a new beneficiary if desired. It is important to regularly review the designated beneficiaries to avoid unintended consequences.