What is a Colorado Promissory Note?

A Colorado Promissory Note is a legal document where one party promises to pay a specific sum of money to another party at a future date. It outlines the terms of the loan, including the amount borrowed, interest rates, repayment schedule, and any consequences of default. This document helps protect the rights of both the lender and the borrower.

Who typically uses a Promissory Note?

People use Promissory Notes in various situations. Individuals often draft them for personal loans between family or friends. Business owners may use them when borrowing from private lenders or when setting up payment plans. Basically, anyone who wants to formalize a loan agreement can benefit from a Promissory Note.

What essential elements should be included in a Colorado Promissory Note?

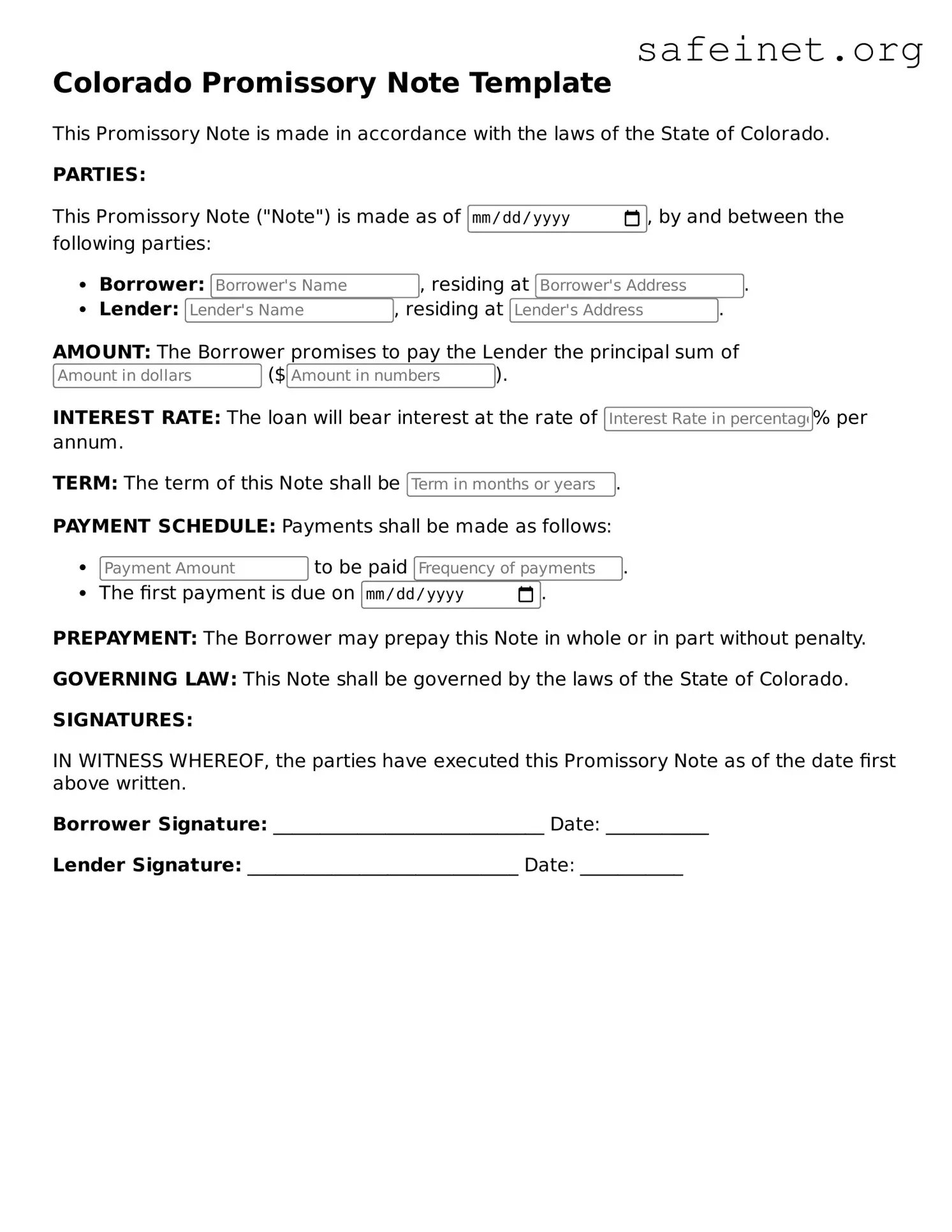

A well-crafted Colorado Promissory Note should include several key details: the names and addresses of the borrower and lender, the principal amount, interest rate, repayment terms, due dates, and any penalties for missed payments. Additionally, it should state whether the note is secured or unsecured, which adds clarity regarding collateral if any is involved.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified if both parties agree to the changes. It’s important to document any amendments in writing, as verbal agreements may lead to misunderstandings. Keep in mind that both parties should sign the modified note to ensure that it is legally binding.

Is it necessary to have a witness or notary for a Promissory Note in Colorado?

In Colorado, a Promissory Note does not need to be notarized or witnessed to be legally valid. However, having a notary can provide an extra layer of protection and ensure that the signatures are authenticated, which can be helpful if disputes arise later.

What happens if the borrower defaults on the Promissory Note?

If the borrower fails to repay according to the terms outlined in the Promissory Note, the lender has several options. They may initiate legal action or pursue collection efforts to recover the owed amount. The specific consequences of default should be clearly stated in the note to avoid confusion and protect both parties' interests.

Are there any tax implications for using a Promissory Note?

Yes, there can be tax implications. The lender may need to report interest income on their taxable earnings. For borrowers, the interest paid on the loan could potentially be tax-deductible, depending on the loan's purpose. Consulting a tax professional is recommended to understand all potential tax responsibilities.

How can I ensure that my Promissory Note is enforceable?

To ensure enforceability, include clear terms and conditions, document all agreements in writing, and have both parties sign the note. Keeping a copy of the note, along with any related correspondence or payment records, will also help in case of any future disputes.

Where can I find a template for a Colorado Promissory Note?

Templates for Colorado Promissory Notes can be found online through various legal document websites, local courthouse resources, or by consulting an attorney. Make sure to choose a reliable source and tailor the template to suit your specific needs before use.