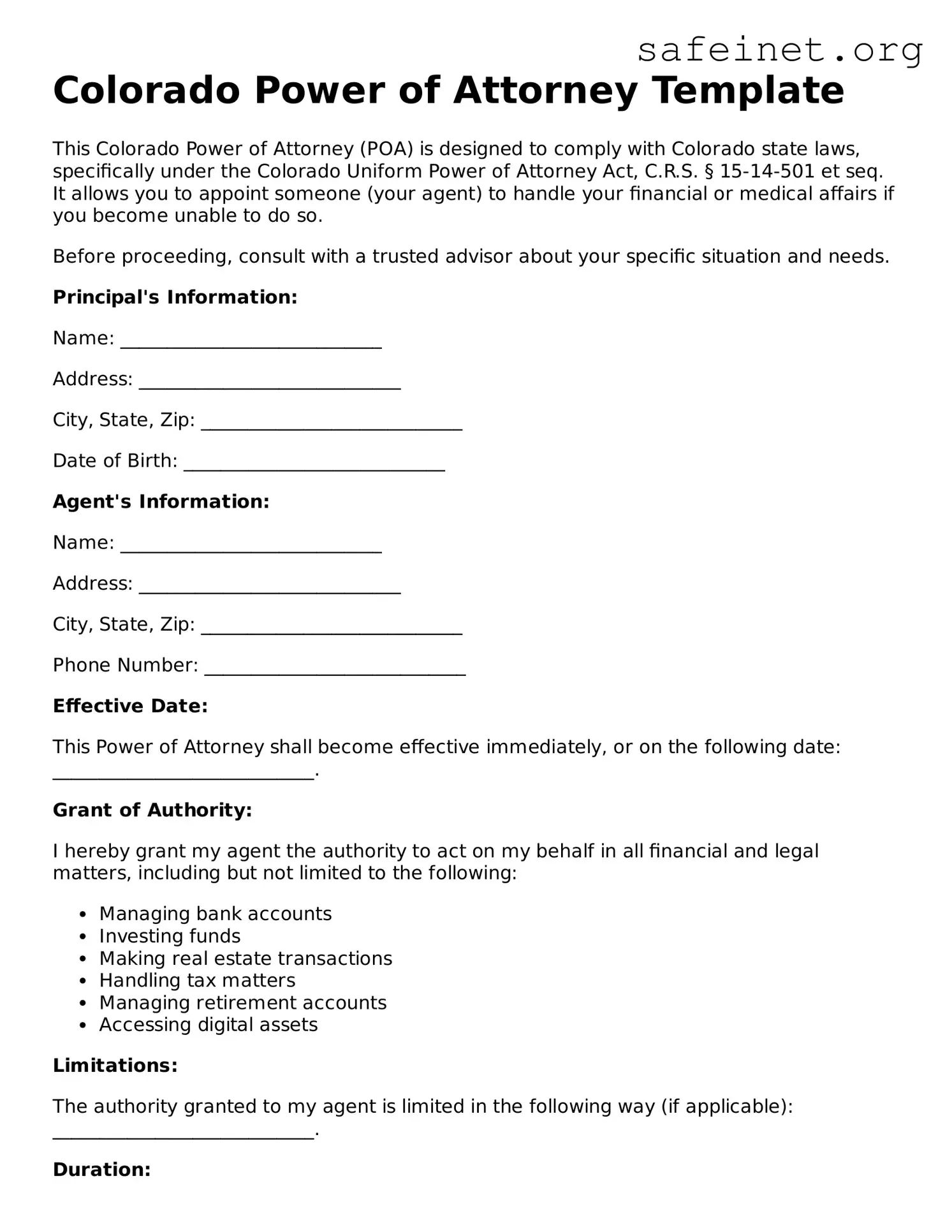

Colorado Power of Attorney Template

This Colorado Power of Attorney (POA) is designed to comply with Colorado state laws, specifically under the Colorado Uniform Power of Attorney Act, C.R.S. § 15-14-501 et seq. It allows you to appoint someone (your agent) to handle your financial or medical affairs if you become unable to do so.

Before proceeding, consult with a trusted advisor about your specific situation and needs.

Principal's Information:

Name: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

Date of Birth: ____________________________

Agent's Information:

Name: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

Phone Number: ____________________________

Effective Date:

This Power of Attorney shall become effective immediately, or on the following date: ____________________________.

Grant of Authority:

I hereby grant my agent the authority to act on my behalf in all financial and legal matters, including but not limited to the following:

- Managing bank accounts

- Investing funds

- Making real estate transactions

- Handling tax matters

- Managing retirement accounts

- Accessing digital assets

Limitations:

The authority granted to my agent is limited in the following way (if applicable): ____________________________.

Duration:

This Power of Attorney shall remain in effect until revoked by me in writing or until my death.

Signatures:

Principal’s Signature: ____________________________

Date: ____________________________

Witnesses:

This document must be signed in the presence of two witnesses:

- Witness 1: ____________________________ (Signature) Date: _________________

- Witness 2: ____________________________ (Signature) Date: _________________

Notary Public:

State of Colorado

County of ____________________________

Subscribed and sworn before me on this ___ day of __________, 20__.

Notary Public: ____________________________

My Commission Expires: ____________________

Notice:

This Power of Attorney is durable, meaning it remains effective even if you become incapacitated unless otherwise revoked.