What is a Colorado Independent Contractor Agreement?

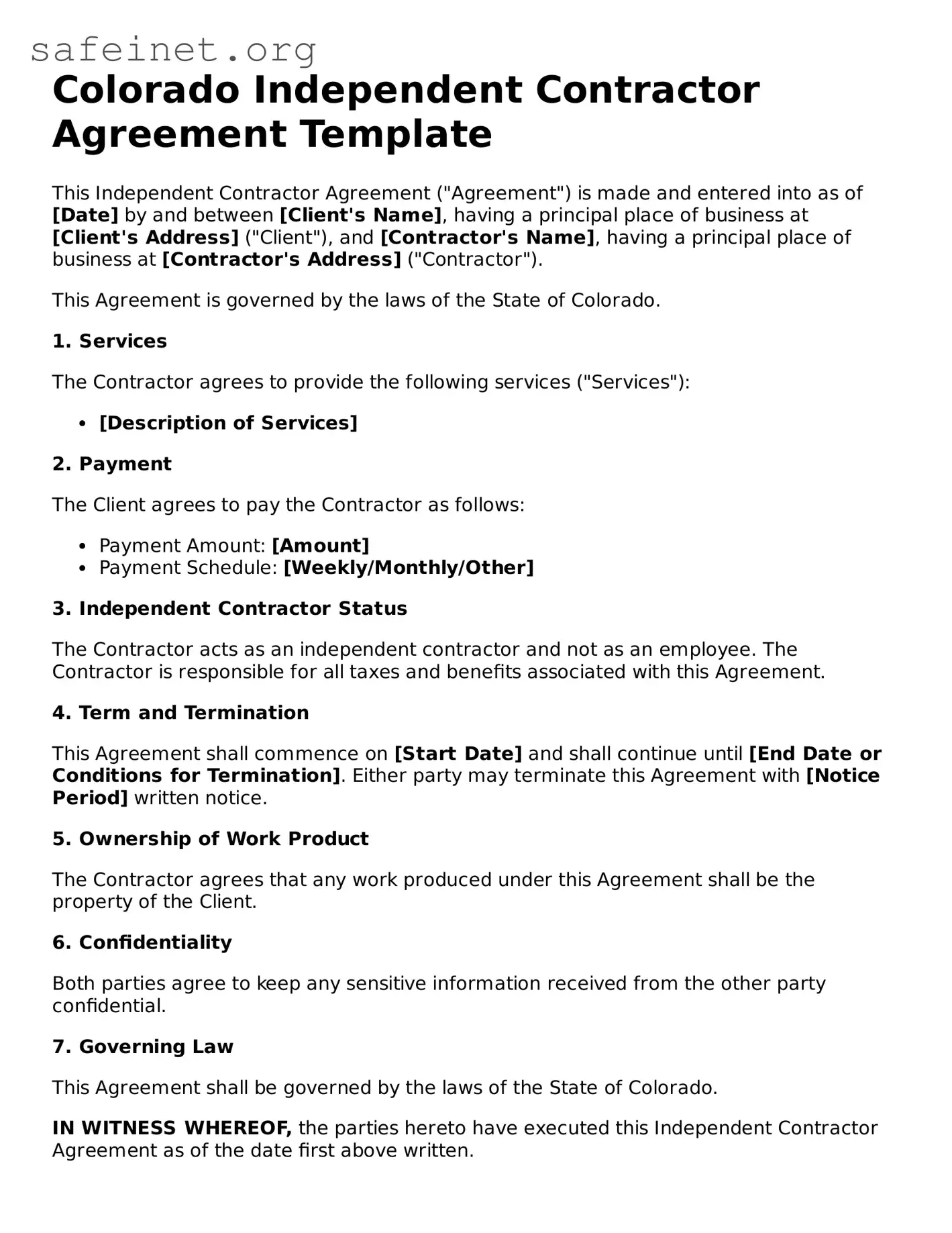

An Independent Contractor Agreement in Colorado is a legal document that outlines the terms and conditions between a hiring party and an independent contractor. This agreement typically includes details about the work being performed, payment terms, and the rights and responsibilities of both parties. It helps ensure clarity and protects the interests of everyone involved.

Why is an Independent Contractor Agreement important?

This agreement is crucial because it sets clear expectations for both the contractor and the hiring party. Without a formal contract, misunderstandings may arise, leading to potential disputes or inadequate work. Having a written agreement helps to safeguard both parties by delineating their roles and responsibilities.

What key elements should be included in the agreement?

Essential elements of a Colorado Independent Contractor Agreement should include: a description of the services to be provided, payment details (such as rate and schedule), duration of the agreement, confidentiality obligations, and termination clauses. Including these elements can prevent confusion and disputes in the future.

Are independent contractors in Colorado required to have insurance?

While it isn’t mandatory for independent contractors to carry insurance in Colorado, having liability insurance is highly recommended. It provides protection against potential losses or claims that could arise from the services provided. Clients may also prefer or require contractors to have insurance coverage as a precaution.

Can an Independent Contractor Agreement be terminated early?

Yes, most Independent Contractor Agreements include termination clauses which outline the conditions under which either party can terminate the contract early. This typically involves providing notice and may involve specific reasons, such as breach of contract or failure to meet performance standards.

How does this agreement affect the contractor's taxes?

Independent contractors in Colorado are considered self-employed, meaning they are responsible for reporting and paying their own taxes. Unlike employees, taxes are not withheld from their payments. Contractors should keep meticulous records of their earnings and expenses to accurately report their income when tax season arrives.

Is it necessary for both parties to sign the agreement?

Yes, obtaining signatures from both the hiring party and the independent contractor is essential. A signed agreement indicates that both parties have reviewed and agreed to the terms laid out in the document. This signature process helps enforce the contract and offers protection in case of any disputes.

Where can I find a Colorado Independent Contractor Agreement template?

Many resources are available for finding templates for Colorado Independent Contractor Agreements. Websites offering legal forms, business publications, or professional organizations often provide customizable templates. Ensure to review any templates carefully or consult with a legal expert to tailor the agreement to specific needs and compliance with Colorado regulations.