What is the purpose of the Colorado DR 1102 form?

The Colorado DR 1102 form is designed for businesses to notify the Colorado Department of Revenue about changes regarding their name, address, or to formally close their tax accounts. This form is crucial for ensuring that the department has the most current information related to a business’s tax liabilities, which include sales tax, withholding tax, or retailer’s use tax.

Who needs to complete the DR 1102 form?

Any business with a Colorado tax account is required to complete the DR 1102 form if they are changing their business name or address, or if they are no longer liable for certain tax types. This includes businesses that have sold, discontinued operations, or restructured. It is important for the new owners to also register for a new account if they have taken over the business.

What information must be included on the form?

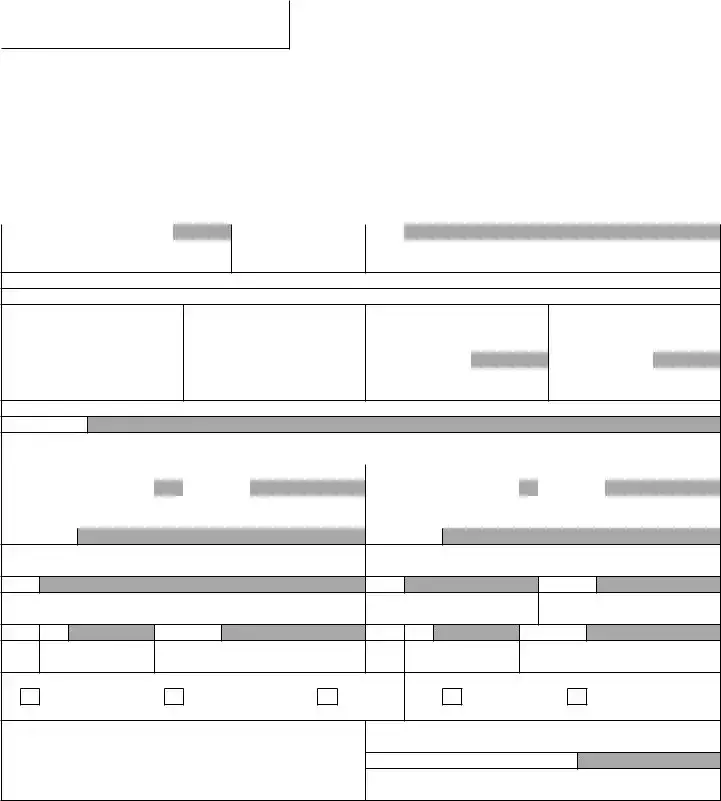

The form requires several key pieces of information, including the business's Colorado Account Number (CAN), the last four digits of the branch or site ID, the Federal Employer Identification Number (FEIN), and relevant details about the changes being made such as the effective dates. It is also necessary to check the appropriate tax type box and indicate the date of business closure if applicable.

How should the DR 1102 form be submitted?

The completed DR 1102 form should be mailed to the Colorado Department of Revenue at the specified address. The address is: Registration Center Section - Room 102, PO Box 17087, Denver, CO 80217-0087. Businesses can also submit changes electronically through Revenue Online if they have an existing login.

What happens after the form is submitted?

Once the Colorado Department of Revenue receives the DR 1102 form, they will process the changes. If applicable, businesses will start receiving updated tax forms such as DR 0100, which are used for sales and withholding tax filings. However, if a business opts for electronic filing, they will not receive paper forms.

Are there any extra documents needed if changing a corporate name?

If a business is changing its corporate name, it is necessary to include the Amended Articles of Incorporation from the Secretary of State’s Office. This documentation ensures that the name change is officially recognized and minimizes the risks of discrepancies in tax liabilities.

Is there a deadline for submitting the DR 1102 form?

While there is no specific deadline tied to the submission of the DR 1102 form, it is advisable to submit it promptly after any changes occur. Delays could result in incorrect tax assessments or miscommunications with the department. For instance, businesses that change locations during a filing period should file separate returns for each location to accurately reflect their tax liabilities.