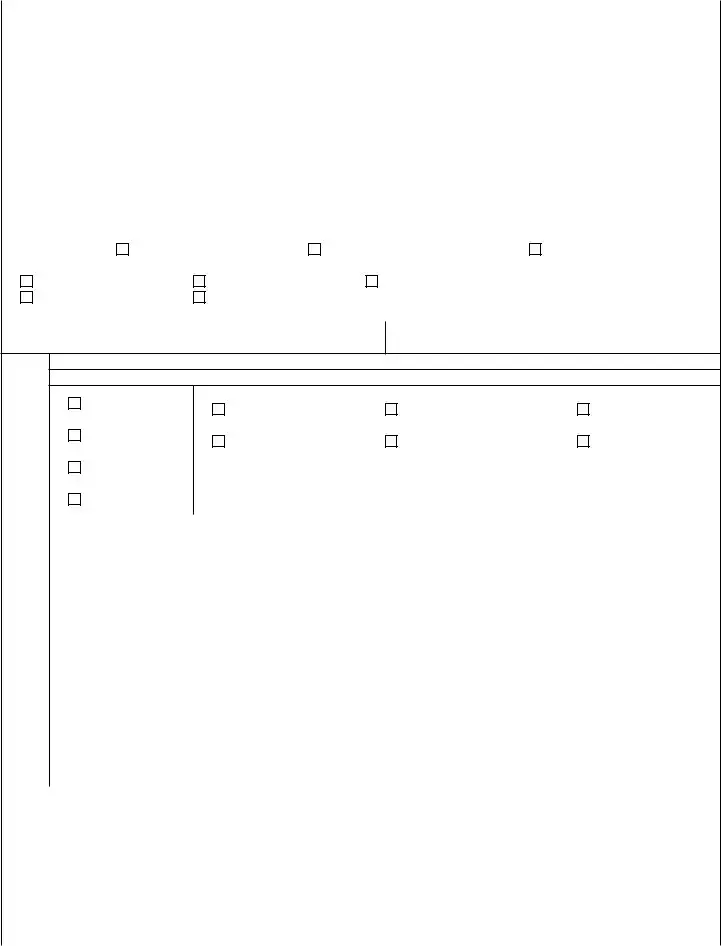

What is the Colorado CR 100 form used for?

The Colorado CR 100 form, also known as the Colorado Sales Tax and Withholding Account Application, is designed for businesses that need to open a sales tax, W-2 withholding, 1099 withholding, or oil/gas withholding account. It can also be used to add additional business locations to an existing account.

How do I apply using the CR 100 form?

You can apply in several ways. The easiest method is to apply online through MyBiz Colorado. This allows you to receive your license number the same day. If you prefer to apply by mail, download the form from the Colorado Department of Revenue’s website, complete it, and send it to the specified address. Alternatively, you may visit a walk-in service center to submit your application in person and receive your license immediately.

What fees are associated with the CR 100 application?

The fees vary depending on the type of license you are applying for. Generally, a standard sales tax license costs $16 for two years. If you are a charitable organization, the fee is only $8. There may also be a $50 deposit required for your first retail sales tax license, which is refundable after you collect and remit $50 in state sales taxes.

What identification do I need to provide when submitting the CR 100 form?

All applicants must provide valid proof of identification. This can include items such as a Colorado driver’s license, a US passport, or a resident alien card. If the application is submitted by someone other than the business owner, additional identification of the owner is required.

How long does it take to process the CR 100 application?

If you apply online, you’ll receive your license number the same day, with the paper license mailed within 2 to 3 weeks. For mail-in applications, processing takes about four to six weeks. If you apply in person at a service center, you will receive your license on the spot.

Can a business operate without a sales tax license in Colorado?

No, any business selling tangible personal property must obtain a sales tax license, regardless of whether sales are made at retail or wholesale. Exceptions apply only to businesses engaged exclusively in tax-exempt sales.

What if my business is structured as a partnership?

For partnerships, the application requires the names of all principal partners. If there are more than two partners, you will need to attach a separate sheet with the additional information. Make sure to provide all necessary details for accurate record-keeping.

Are there any training options available for understanding Colorado sales tax requirements?

Yes, the Colorado Department of Revenue offers live classes and online training to help new businesses understand the sales tax rates, collection, and reporting requirements. It is advisable to participate in these sessions to ensure compliance with Colorado laws.

What should I do if I need to update my information after applying?

If you need to make updates, such as changing your business address or closing your account, you can use the DR 1102 form to handle these changes. Keeping your information current ensures you receive important communications and helps avoid any potential compliance issues.