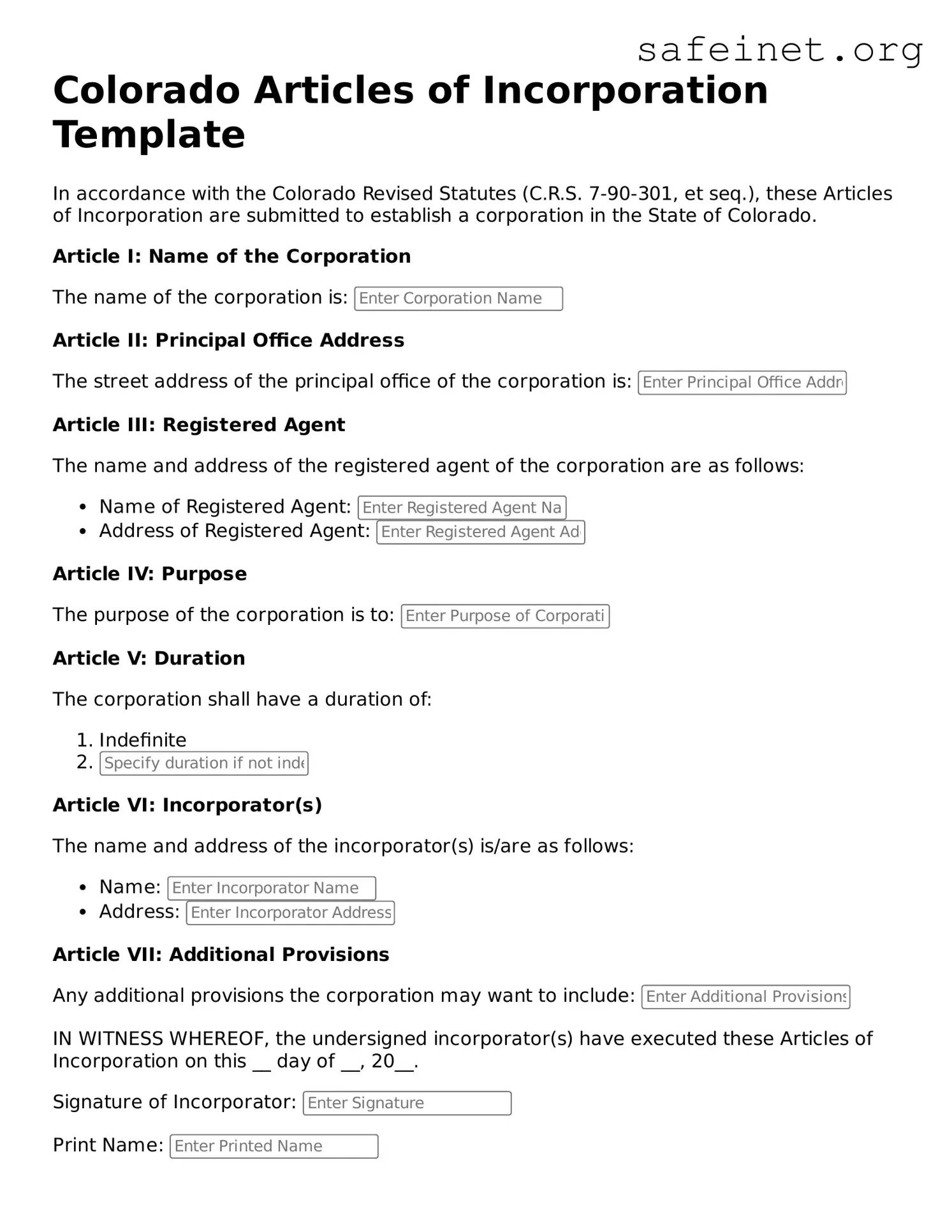

Valid Articles of Incorporation Template for the State of Colorado

The Colorado Articles of Incorporation form is a legal document required to establish a corporation in the state of Colorado. This form outlines essential information about the corporation, including its name, purpose, and structure. Completing the Articles of Incorporation is a crucial first step for entrepreneurs looking to formalize their business organization.

To get started on setting up your corporation, click the button below to fill out the necessary form.