The Colorado 25 form, also known as the “Writ of Garnishment,” is similar to the Colorado 26 form in that both are used to seek the garnishment of a debtor's wages. The Colorado 25 specifically allows creditors to claim amounts owed directly from an individual's earnings. Much like the Colorado 26, it entails providing detailed information about the debtor, the judgment amount, and the garnishee, ensuring that proper procedures are followed for service and response. Both forms aim to facilitate the collection of debts while respecting legal requirements for notification.

The Colorado 27 form, or the “Garnishee's Response,” closely mirrors the Colorado 26 form as it is also a response document that garnishees receive. This form enables the garnishee to report the amounts they owe to the debtor and confirm whether earnings are nonexempt or exempt. Like the Colorado 26, it requires the garnishee to provide accurate information about their payments to the debtor. The clear communication established through both forms ensures that the garnishment process is tracked correctly and allows debtors to know how much is being withheld.

The Colorado 36 form, titled “Writ of Garnishment for Child Support,” serves a similar purpose to the Colorado 26 but is specifically aimed at collecting child support payments. This form requires a similar detailed account of the debtor's finances and the garnishee's responsibilities. Its structure aligns closely with that of the Colorado 26, maintaining the same urgency for garnishees to comply with reporting requirements. Both documents illustrate the legal avenues available to collect financial obligations, emphasizing the necessity of timely responses to prevent defaults.

The Colorado 10 form, known as the “Answer to a Complaint,” shares the function of the Colorado 26 when it comes to addressing a legal financial matter. While it does not directly enable the garnishment of wages, it allows defendants in a financial dispute to respond to claims against them. This form initiates communication with the court, akin to how the Colorado 26 initiates the garnishment process. Both processes are designed to provide transparency and foster a timely resolution of disputes.

The Colorado 24 form, or “Writ of Attachment,” is another document similar to the Colorado 26. While the Colorado 26 seeks to garnishee wages, the Colorado 24 form allows for the seizure of property or assets to satisfy a judgment. Both forms require detail about the judgment and debtor and serve to inform all parties of their rights and responsibilities. Their similar structure and objectives highlight the various enforcement mechanisms available in debt recovery procedures.

The Colorado 12 form, known as the “Notice of Hearing,” plays a crucial role in the process of garnishment. While it doesn’t directly initiate a garnishment like the Colorado 26, it informs parties about hearings related to the enforcement of judgments. This form ensures that all stakeholders are aware of legal proceedings and their potential outcomes, similar to how the Colorado 26 ensures that debtors and garnishees are informed of garnishment actions.

The Colorado 28 form, titled “Objection to Calculation of Exempt Earnings,” is designed for debtors who wish to challenge the amounts being withheld by their garnishee. Similar to the Colorado 26 form, it provides the framework for debtors to express concerns about garnishment calculations. It empowers individuals to advocate for their rights and understand the garnishment process, thereby ensuring that both the creditors and debtors have pathways to communicate their positions.

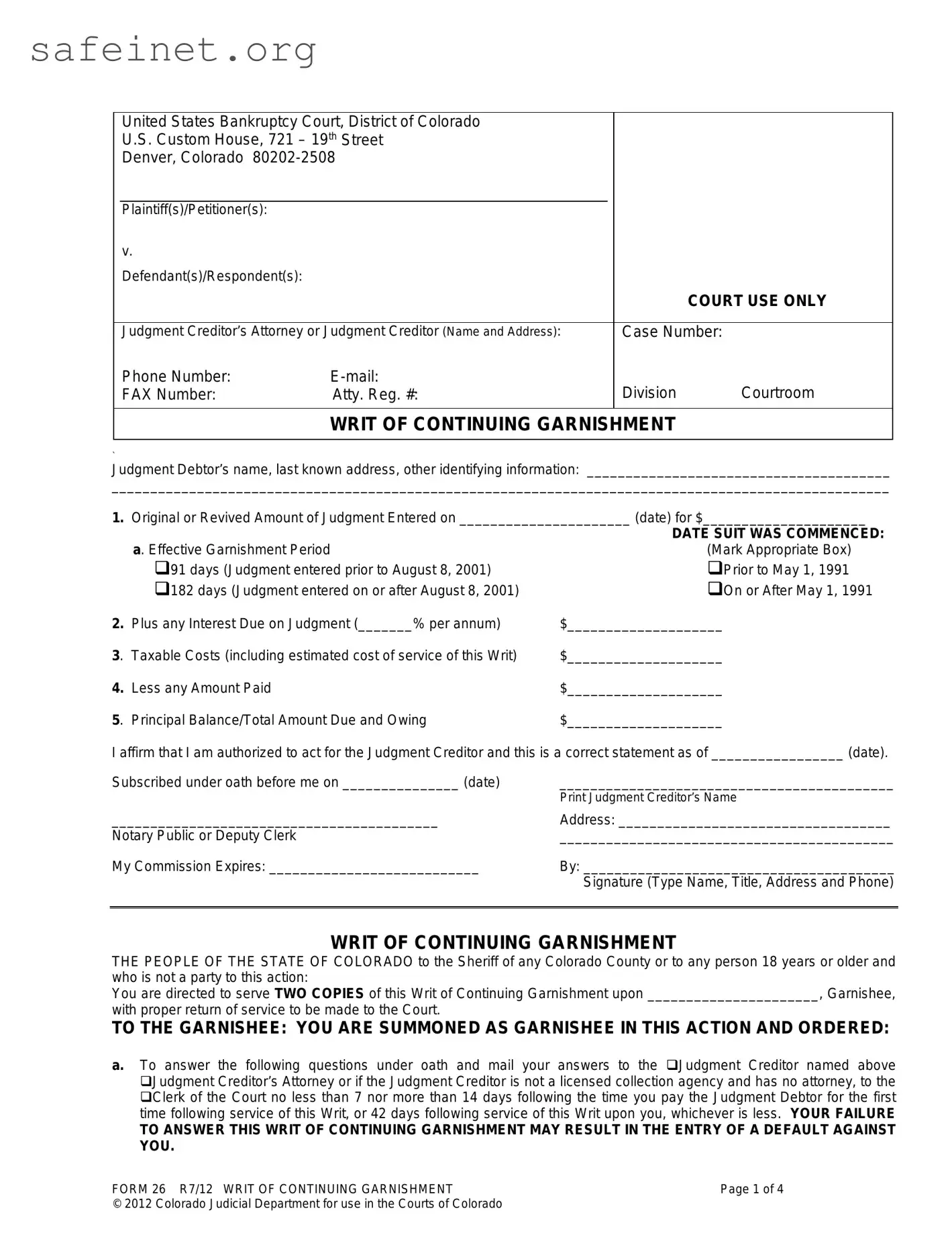

The Colorado 11 form, or the “Continuing Writ of Garnishment,” also overlaps with the Colorado 26. This form allows creditors to continue garnishing a debtor's wages after an initial garnishment order is in place. By establishing ongoing obligations, both forms are instrumental in securing debt recovery while abiding by statutory requirements. They create a structured approach to managing debt that aids in accountability for all parties involved.

The Colorado 34 form, known as the “Motion for Hearing,” can also be likened to the Colorado 26. This form enables parties to request a court hearing regarding various financial disputes, including those linked to garnishment proceedings. By facilitating communication between the court and involved parties, it maintains the balance of fairness established by the Colorado 26, ensuring that everyone has access to legal recourse in financial matters.

Lastly, the Colorado 18 form, or the “Affidavit of Service,” is essential in documenting the service of court papers, including the Colorado 26. This form serves to confirm that all parties were properly notified of their legal obligations and rights concerning the garnishment. Similar to the Colorado 26, it reinforces the importance of following proper procedures and maintains the integrity of the legal process by documenting compliance with legal notifications.