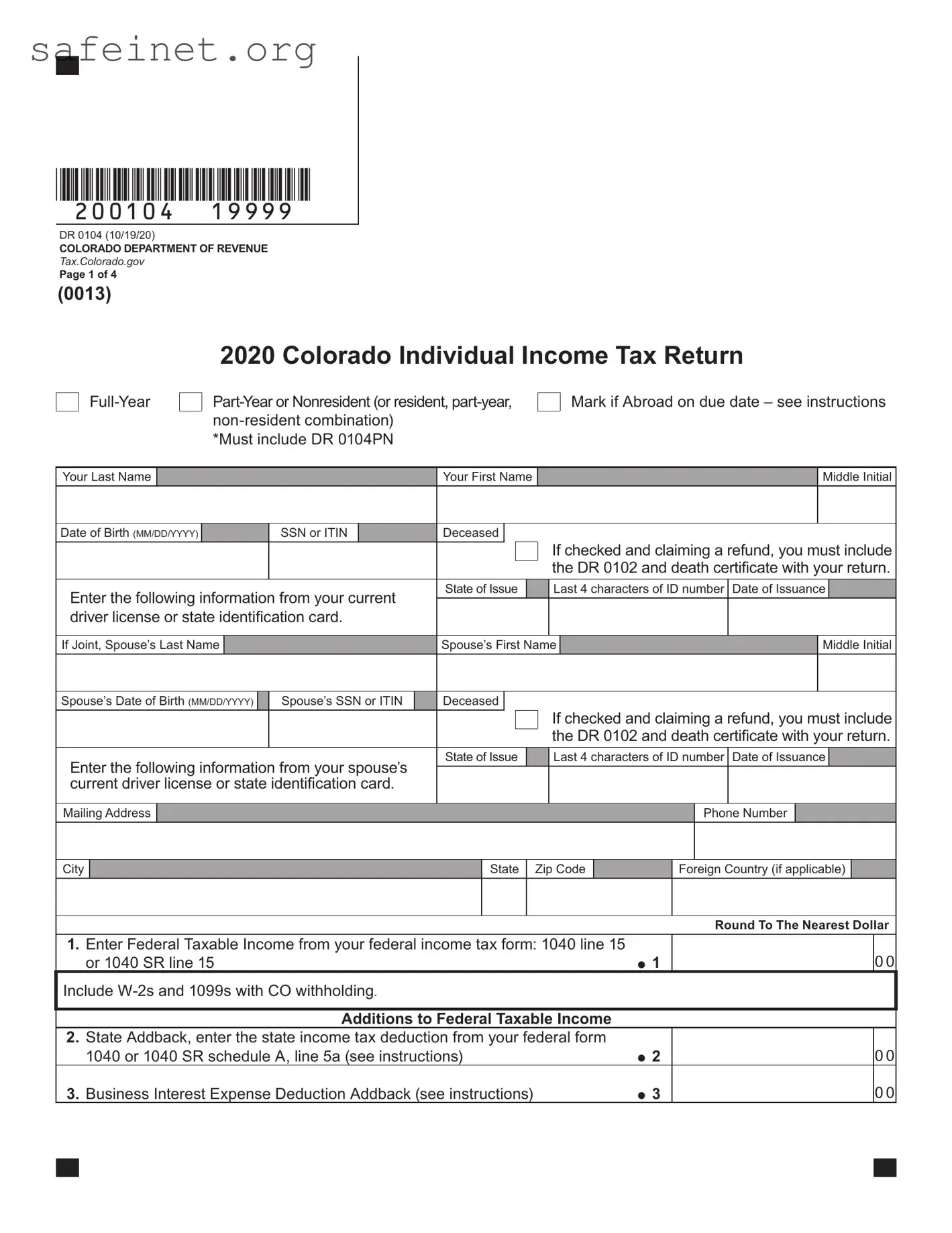

The Colorado 104 form closely resembles the IRS Form 1040, which is the standard individual income tax return used in the United States. Both forms require detailed personal information, such as taxpayer identification numbers, marital status, and income details. Additionally, both forms allow for various adjustments to income and claim deductions or credits. The structure and purpose of the forms are fundamentally similar, as they both facilitate the reporting of income and calculation of tax liability based on federal standards.

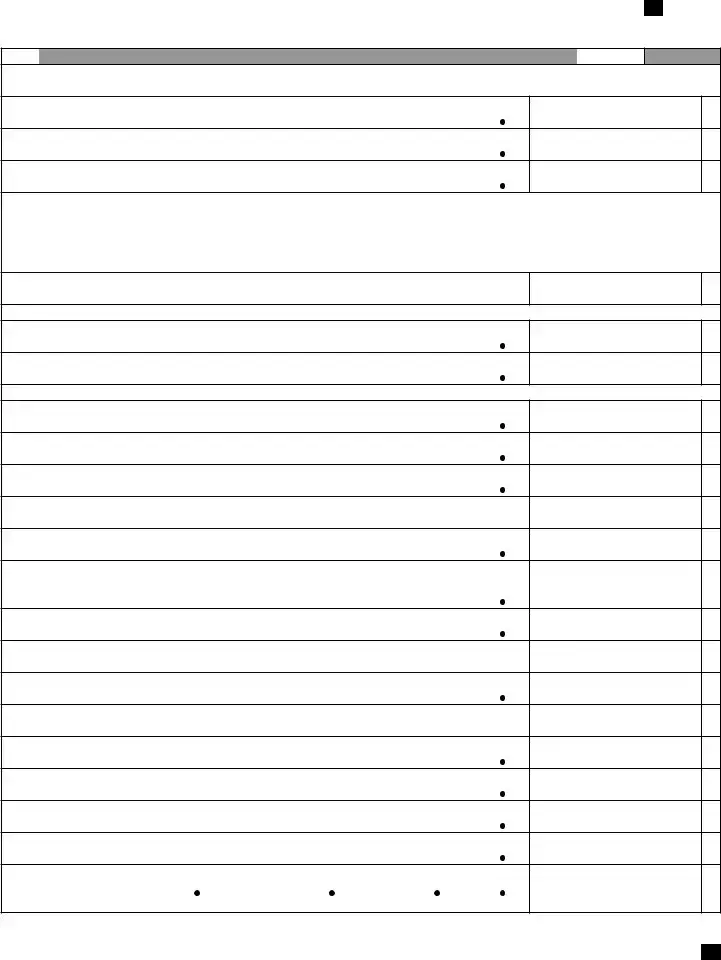

Another document comparable to the Colorado 104 form is the state-specific Schedule A for itemized deductions. Like the Colorado 104 form, Schedule A is used to report detailed expenses that may lower taxable income. Both forms require accurate reporting of deductibles based on taxpayer eligibility. In essence, while the Colorado 104 serves a broader purpose of reporting overall income and taxing implications, the Schedule A provides a more nuanced view for itemized deductions that contribute to the final taxable amount.

The Colorado 104 form is also similar to IRS Form 1040NR, which is designed for non-resident aliens. This document, like the Colorado 104, must be completed by individuals who are not fully resident for tax purposes and need to report their U.S.-sourced income. Both forms require information on income received, applicable deductions, and tax credits. The focus on residency status impacts how taxes are calculated, and both forms require accurate representation of income to ensure compliance with respective regulations.

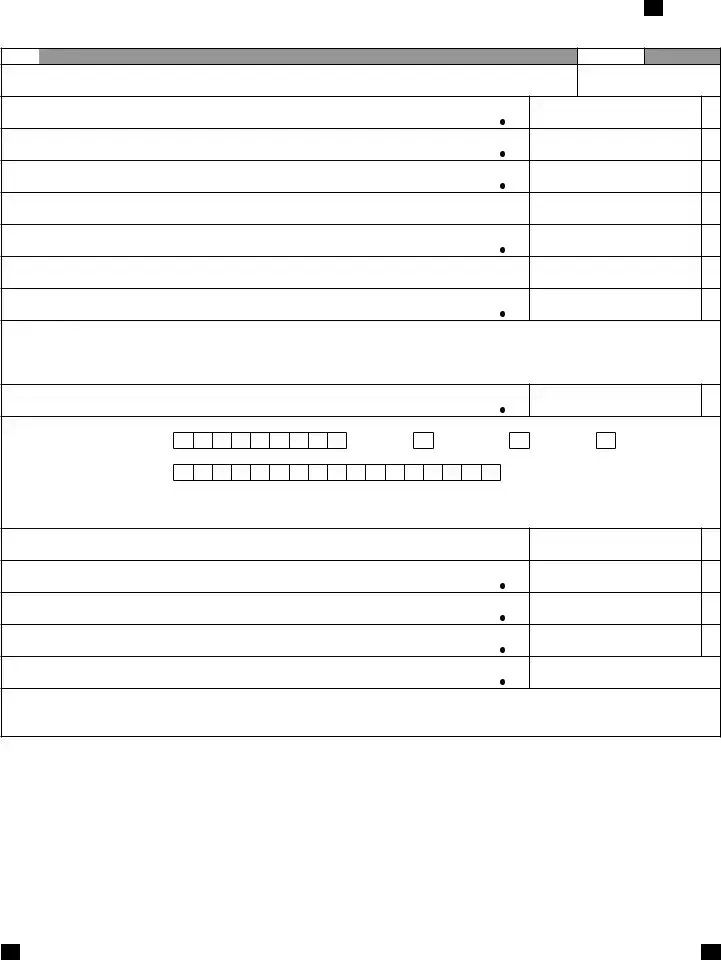

Additionally, the Colorado DR 0104PN form, a part-year resident tax return, parallels the Colorado 104 form in function and structure. When individuals move in or out of Colorado within a tax year, they should file the DR 0104PN to accurately report income earned during the time they resided in the state. This form allows for specific adjustments similar to those on the Colorado 104, facilitating the calculation of state tax based on prorated income and deductions.

The Colorado DR 0104CR, which is used to claim credits against Colorado income tax, shares similarities with the 104 form. Both require comprehensive information regarding credit eligibility and enumeration of refundable and nonrefundable credits. The DR 0104CR must accompany the Colorado 104 to ensure that all applicable tax credits are considered in calculating the income tax owed to Colorado, presenting a cohesive representation of tax liabilities and credits.

The Colorado DR 0104AMT form, which concerns the Alternative Minimum Tax, aligns with the Colorado 104 in its intent to provide a thorough account of tax liabilities. For individuals subject to AMT, the data reported is crucial for calculating additional tax obligations. Both forms demand detailed information, supporting schedules, and adjustments that affect overall tax calculations, ensuring that taxpayers meet their complete tax responsibilities according to state standards.

Lastly, the DR 0104US form, which notes use tax, complements the Colorado 104 form in tracking how tax applies to certain purchases. The inclusion of the DR 0104US is necessary when reporting tax owed on goods purchased outside of Colorado but used within the state. This document aligns with the comprehensive income reporting of the Colorado 104 by capturing an additional layer of tax liability that might otherwise be overlooked in general income reporting.