California Community Colleges 2014-15 Board of Governors Fee Waiver Application

This is an application to have your ENROLLMENT FEES WAIVED. If you need money to help with books, supplies, food, rent, transportation and other costs, please complete a FREE APPLICATION FOR FEDERAL STUDENT AID (FAFSA) or the California Dream Application (for eligible AB 540 students) immediately. The FAFSA is available at www.fafsa.ed.gov and the Dream Application is available at http://www.csac.ca.gov/dream_act.asp. Contact the Financial Aid Office for more information.

IMPLEMENTATION OF Assembly Bill 1899: Victims of Trafficking, Domestic Violence and other Serious Crimes

AB 1899, chaptered in September of 2012, provides for a non-resident enrollment fee exemption for “Victims of trafficking, domestic violence and other serious crimes”. In addition, the legislation allows these students to apply for and, if eligible, receive financial aid from programs administered by public postsecondary institutions or the state of California. Finally, the legislation provides that enrollment fees shall be waived for these students who apply for and are eligible to receive Board of Governor enrollment fee waivers.

This FEE WAIVER application is for California residents, eligible AB 540 students, and eligible AB 1899 students, as determined by the Admissions or Registrar’s Office. If you have not had your California residency or eligibility status determined by the Admissions or the Registrar, please see one of those offices to obtain the valid determination. Fee waiver eligibility cannot be determined until your status has been verified.

Has the Admissions or Registrar's Office determined that you are a California resident? Yes No

If no, has the Admissions or Registrar's Office determined that you are eligible for a non-resident tuition exemption as an AB 540

student? Yes No

If no, has the Admissions or Registrar's Office determined that you are eligible for a non-resident tuition exemption granted as a result of your immigration status under Section 1101(a)(15)(T)(i) or (ii), or Section1101 (a)(15)(U)(i) or (ii), of Title 8 of the United States

|

|

|

|

|

|

|

|

|

|

|

|

Code? |

|

|

|

|

|

|

|

Yes No |

Name: |

|

|

|

|

|

Student ID # |

|

Last |

First |

|

Middle Initial |

Email (if available): |

|

|

|

|

|

Telephone Number: |

|

Home Address: |

|

|

|

|

|

Date of Birth: |

|

|

|

Street |

|

City,State |

Zip Code |

IMPLEMENTATION OF THE CALIFORNIA DOMESTIC PARTNER RIGHTS AND RESPONSIBILITIES ACT

The California Domestic Partner Rights and Responsibilities Act extends rights, benefits, responsibilities and obligations to individuals in domestic partnerships registered with the California Secretary of State under Section 297 of the Family Code. If you are in a Registered Domestic Partnership (RDP), you will be treated as an Independent married student to determine eligibility for this Enrollment Fee Waiver and will need to provide income and household information for your domestic partner. If you are a dependent student and your parent is in a Registered Domestic Partnership, you will be treated the same as a student with married parents and income and household information will be required for the parent’s domestic partner.

Note: These provisions apply to state student financial aid ONLY, and not to federal student financial aid.

Are you or your parent in a Registered Domestic Partnership with the California Secretary of State under Section 297 of the Family Code? (Answer “Yes” if you or your parent are separated from a Registered Domestic Partner but have NOT FILED a Notice of

Termination of Domestic Partnership with the California Secretary of State’s Office.) |

Yes No |

If you answered “Yes” to the question above, treat the Registered Domestic Partner as a spouse. You are required to include your domestic partner’s income and household information or your parent’s domestic partner’s income and household information in Questions 4, 11, 12, 13, 14, 15, 16, 17.

Student Marital Status

Single Married Divorced Separated Widowed Registered Domestic Partnership

DEPENDENCY STATUS

The questions below will determine whether you are considered a Dependent student or Independent student for fee waiver eligibility and whether parental information is needed. If you answer “Yes” to ANY of the questions 1-10 below, you will be considered an INDEPENDENT student. If you answer “No” to all questions, you will be considered a Dependent student thereby reporting parental information and should continue with Question 11.

1. |

Were you born before January 1, 1991? |

Yes |

|

No |

2. |

As of today, are you married or in a Registered Domestic Partnership (RDP)? |

(Answer "Yes" if you are separated but not divorced |

|

or have not filed a termination notice to dissolve partnership. |

Yes |

|

No |

3.Are you a veteran of the U.S. Armed Forces or currently serving on active duty for purposes other than training?

Yes No

4.Do you have children who will receive more than half of their support from you between July 1, 2014-June 30, 2015, or other dependents who live with you (other than your children or spouse/RDP) who receive more than half of their support from you, now

|

and through June 30, 2015 |

Yes |

No |

5. |

At any time since you turned age 13, were both your parents deceased, were you in foster care, or were you a dependent or ward |

|

of the court? |

Yes |

No |

6. |

Are you or were you an emancipated minor as determined by a court in your state of legal residence? |

Yes |

No |

|

|

7. |

Are you or were you in legal guardianship as determined by a court in your state of legal residence? |

|

|

|

|

Yes |

No |

8. |

At any time on or after July 1, 2013, did your high school or school district homeless liaison determine that you were an |

|

|

unaccompanied youth who was homeless |

Yes |

No |

9.At any time on or after July 1, 2013, did the director of an emergency shelter or transitional housing program funded by the U.S. Department of Housing and Urban Development determine that you were an unaccompanied youth who was homeless?

Yes No

10.At any time on or after July 1, 2013, did the director of a runaway or homeless youth basic center or transitional living program determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless?

Yes No

•If you answered "Yes" to any of the questions 1 - 10, you are considered an INDEPENDENT student for enrollment fee waiver purposes and must provide income and household information about yourself (and your spouse or RDP if applicable). Skip to Question #13.

•If you answered "No" to all questions 1 - 10, complete the following questions:

11. |

If your parent(s) or his/her RDP filed or will file a 2013 U.S. Income Tax Return, were you, or will you be claimed on their tax return |

|

as an exemption by either or both of your parents? |

|

Will Not File Yes No |

12. |

Do you live with one or both of your parent(s) and/or his/her RDP? |

|

Yes No |

•If you answered "No" to questions 1 - 10 and "Yes" to either question 11 or 12, you must provide income and household information about your PARENT(S)/RDP. Please answer questions for a DEPENDENT student in the sections that follow.

•If you answered "No" or "Parent(s) will not file" to question 11, and "No" to question 12, you are a dependent student for all student aid except this enrollment fee waiver. You may answer questions as an INDEPENDENT student on the rest of this application, but please try to get your PARENT information and file a FAFSA so you may be considered for other student aid. You cannot get other student aid without your parent(s’) information.

13. Are you (the student ONLY) currently receiving monthly cash assistance for yourself or any dependents from:

TANF/CalWORKs? |

Yes |

No |

SSI/SSP (Supplemental Security Income/State Supplemental Program)? |

Yes |

|

No |

General Assistance? |

Yes |

|

No |

14. If you are a dependent student, are your parent(s)/RDP receiving monthly cash assistance from TANF/CalWORKs or SSI/SSP as

a primary source of income? |

Yes No |

If you answered "Yes" to question 13 or 14 you are eligible for an ENROLLMENT FEE WAIVER. Sign the Certification at the end of this form. You are required to show current proof of benefits. Submit application and documentation to the financial aid office.

METHOD B ENROLLMENT FEE WAIVER

15.DEPENDENT STUDENT: How many persons are in your parent(s)/RDP household? (Include yourself, your parent(s)/RDP, and anyone who lives with your parent(s)/RDP and receives more than 50% of their support from your parents/RDP, now and through June 30, 2015.)

16.INDEPENDENT STUDENT: How many persons are in your household? (Include yourself, your spouse/RDP, and anyone who lives with you and receives more than 50% of their support from you, now and through June 30, 2015.)

17.2013 Income Information

(Dependent students should not include their income information for Q 17 a and b below.)

a.Adjusted Gross Income (If 2013 U.S. Income Tax Return was filed, enter the amount from Form 1040, line 37; 1040A, line 21; 1040EZ, line 4).

b.All other income (Include ALL money received in 2013 that is not included in line (a) above (such as disability, child support, military living allowance, Workman’s Compensation, untaxed pensions).

TOTAL Income for 2013 (Sum of a + b)

|

DEPENDENT STUDENT: |

INDEPENDENT STUDENT: |

|

PARENT(S)/ RDP |

STUDENT (& SPOUSE'S/ |

|

INCOME ONLY |

RDP) INCOME |

$ |

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

|

$ |

|

|

$ |

|

|

The Financial Aid Office will review your income and let you know if you qualify for an ENROLLMENT FEE WAIVER under Method B. Submit application and documentation to the financial aid office.

If you do not qualify using Method A or Method B, you should file a FAFSA (for U.S. citizens or eligible non-citizens) or the California Dream Application (for undocumented AB 540 students). The FAFSA is available at www.fafsa.ed.gov and the Dream Application is available at http://www.csac.ca.gov/dream_act.asp . Contact the Financial Aid Office for more information.

|

SPECIAL CLASSIFICATIONS ENROLLMENT FEE WAIVERS |

|

|

|

|

|

|

|

|

|

|

18. |

Do you have certification from the CA Department of Veterans Affairs that you are eligible for a dependent's fee waiver? |

|

|

|

Submit certification. |

Yes |

|

No |

|

|

19. |

Do you have certification from the National Guard Adjutant General that you are eligible for a dependent's fee waiver? |

|

|

|

|

|

Submit certification. |

Yes |

No |

|

|

20. |

Are you eligible as a recipient of the Congressional Medal of Honor or as a child of a recipient? |

Yes |

No |

|

|

|

Submit documentation from the Department of Veterans Affairs. |

|

|

21. |

Are you eligible as a dependent of a victim of the September 11, 2001, terrorist attack? |

Yes |

No |

|

|

|

Submit documentation from the CA Victim Compensation and Government Claims Board. |

|

|

22. |

Are you eligible as a dependent of a deceased law enforcement/fire suppression personnel killed in the line of duty? |

|

|

|

|

|

Submit documentation from the public agency employer of record. |

Yes |

|

No |

|

|

|

|

|

•If you answered "Yes" to any of the questions from 18-22, you are eligible for an ENROLLMENT FEE WAIVER and perhaps other fee waivers or adjustments. Sign the Certification below. Submit application and documentation to the financial aid office. Contact the Financial Aid Office if you have questions.

CERTIFICATION FOR ALL APPLICANTS: READ THIS STATEMENT AND SIGN BELOW

I hereby swear or affirm, under penalty of perjury, that all information on this form is true and complete to the best of my knowledge. If asked by an authorized official, I agree to provide proof of this information, which may include a copy of my and my spouse/registered domestic partner and/or my parent's/registered domestic partner’s 2013 U.S. Income Tax Return(s). I also realize that any false statement or failure to give proof when asked may be cause for the denial, reduction, withdrawal, and/or repayment of my waiver. I authorize release of information regarding this application between the college, the college district, and the Chancellor's Office of the California Community Colleges.

I understand the following information (please check each box):

Federal and state financial aid programs are available to help with college costs (including enrollment fees, books & supplies, transportation and room and board expenses). By completing the FAFSA or the California Dream Application, additional financial assistance may be available in the form of Cal Grants, Pell and other grants, work study and other aid.

I may apply for and receive financial assistance if I am enrolled, either full time or part time, in an eligible program of study (certificate, associate degree or transfer).

Financial aid program information and application assistance is available in the college financial aid office.

|

|

|

|

|

|

|

|

Applicant’s Signature |

Date |

|

Parent Signature (Dependent Students Only) |

Date |

CALIFORNIA INFORMATION PRIVACY ACT

State and federal laws protect an individual’s right to privacy regarding information pertaining to oneself. The California Information Practices Act of 1977 requires the following information be provided to financial aid applicants who are asked to supply information about themselves. The principal purpose for requesting information on this form is to determine your eligibility for financial aid. The Chancellor’s Office policy and the policy of the community college to which you are applying for aid authorize maintenance of this information. Failure to provide such information will delay and may even prevent your receipt of financial assistance. This form’s information may be transmitted to other state agencies and the federal government if required by law. Individuals have the right of access to records established from information furnished on this form as it pertains to them.

The officials responsible for maintaining the information contained on this form are the financial aid administrators at the institutions to which you are applying for financial aid. The SSN may be used to verify your identity under record keeping systems established prior to January 1, 1975. If your college requires you to provide an SSN and you have questions, you should ask the financial aid officer at your college for further information. The Chancellor’s Office and the California community colleges, in compliance with federal and state laws, do not discriminate on the basis of race, religion, color, national origin, gender, age, disability, medical condition, sexual orientation, domestic partnership or any other legally protected basis. Inquiries regarding these policies may be directed to the financial aid office of the college to which you are applying.

FOR OFFICE USE ONLY

BOGFW-A |

BOGFW-B |

Special Classification |

RDP |

Student is not |

TANF/CalWORKs |

|

|

|

|

Veteran |

National Guard |

Student |

eligible |

GA |

BOGFW-C |

|

|

Dependent |

Parent |

|

|

SSI/SSP |

|

Medal of Honor |

9/11 Dependent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dep. of deceased law enforcement/fire |

|

|

|

|

|

|

|

|

|

|

personnel |

|

|

|

|

|

|

Comments: |

|

|

|

|

|

|

|

|

|

|

|

|

Certified by: |

|

|

|

|

|

|

|

Date: |

|

|

|

|

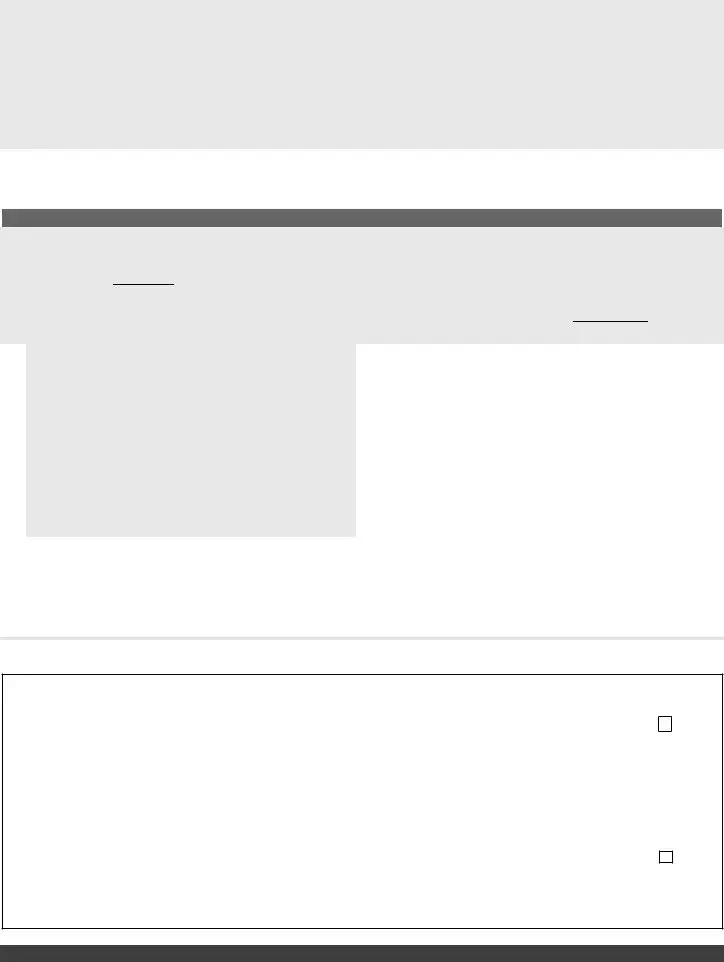

Board of Governors Fee Waiver Program

BOGFW-B

2014-2015 Income Standards*

Family Size |

2013 Income |

|

|

1 |

$17,235 |

2 |

$23,265 |

3 |

$29,295 |

4 |

$35,325 |

5 |

$41,355 |

6 |

$47,385 |

7 |

$53,415 |

8 |

$59,445 |

Each Additional Family |

|

Member |

$6,030 |

|

|

*These standards are based upon the federal poverty guidelines, as published each year by the US Department of Health and Human Services. Under Title 5 of the California Code of Regulations, the student or student’s family must have a total income in the prior year (in this case, 2013) that is equal to or less than 150% of the U.S. Department of Health and Human Services Poverty Guidelines based on family size.

The U.S. Department of Health and Human Services published the 2013 Poverty Guidelines in January 2013 (Fed er al Regist er , Vol . 7 8 , No. 1 6 , Jan u ar y 2 4 , 2 0 1 3 , p p . 5 1 8 2 - 5 1 8 3 ). https://federalregister.gov/a/2013-01422

These income standards are for the 2014-2015 academic year and are to be used to determine BOGFW-B eligibility EFFECTIVE July 1, 2014.

http://aspe.hhs.gov/poverty/12poverty.shtml