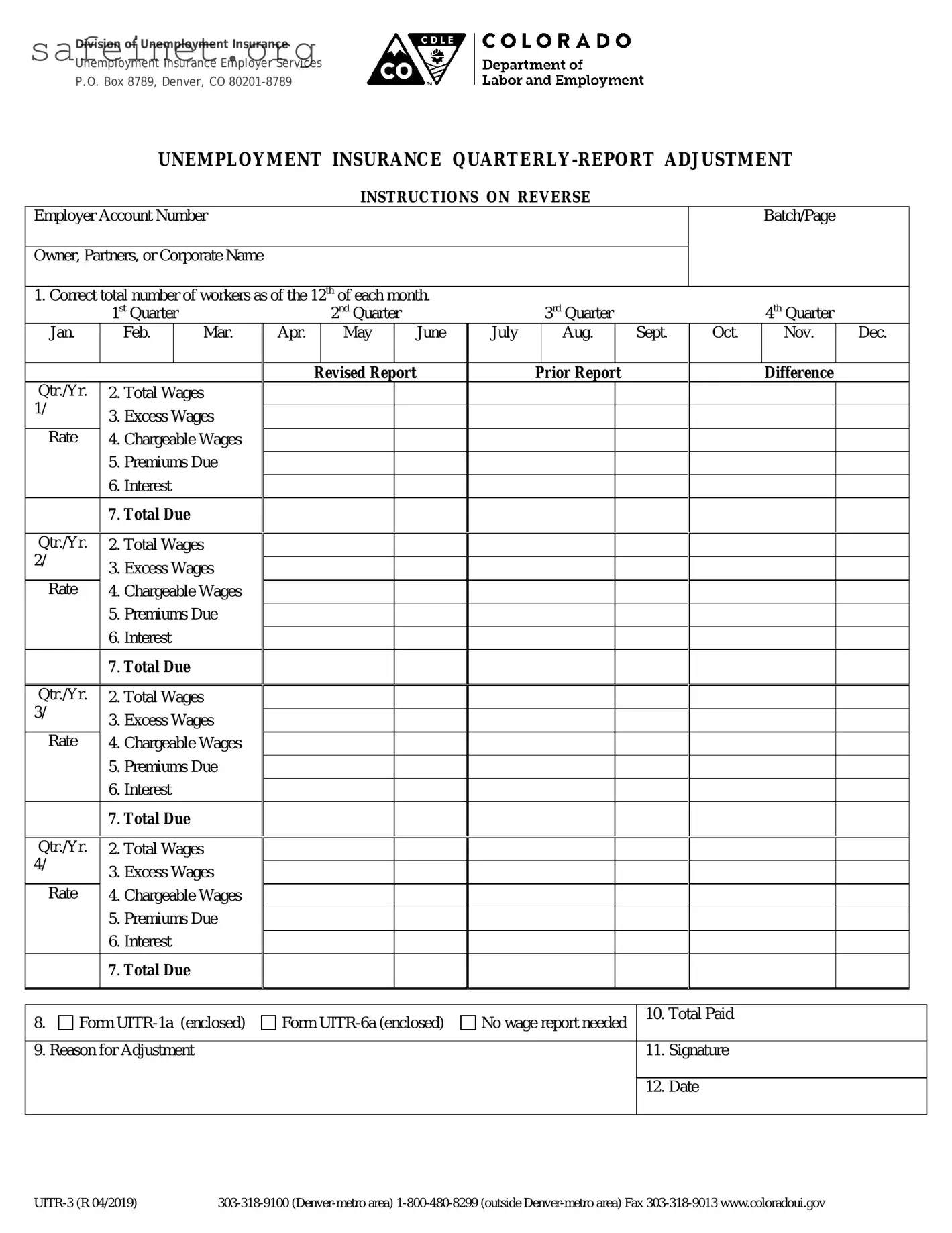

1.Number of Workers–Complete this item if the number of workers reported on the original Form UITR-1, Unemployment Insurance Quarterly Report, was incorrect. Enter the correct total number of workers for each month.

2.Total Wages–Enter the wages paid in the quarters that are subject to unemployment insurance premiums (total wages minus allowable deductions). Enter only wages you actually paid during the quarter.

NOTE: Form UITR-6a, Multiple Quarter Adjustment of Worker’s Wages, must be completed and attached to show any quarterly wage adjustments.

3.Excess Wages–Enter wages paid during the quarter in excess of the chargeable wage limit for the calendar years below. You can download the Premiums Calculator by going to the Unemployment Insurance Website; click on Forms & Publications; and then Calculator: Premiums Calculator “to track excess wages per year.

Chargeable wage limits: 2019: |

$13,100 |

2017: |

$12,500 |

2015: |

$11,800 |

2018: |

$12,600 |

2016: |

$12,200 |

2014: |

$11,700 |

4. Chargeable Wages–This is the first $13,100 wages paid to a worker during calendar year 2019.

EXAMPLE OF COMPUTING CHARGEABLE WAGES FOR 2019

|

1st Quarter |

2nd Quarter |

3rd Quarter |

4th Quarter |

Gross Wages |

$6,000 |

$6,000 |

$4,000 |

$6,000 |

Excess of $13,100 |

-0- |

-0- |

$4,900 |

$6,000 |

Chargeable Wages |

$6,000 |

$6,000 |

$1,100 |

-0- |

5.Premiums Due–Calculate this amount by multiplying the employer’s rate times the chargeable wages. Example: 0.0170 x $6,000=$102.00.

6.Interest Due–Enter the amount of interest due. Interest is charged at a rate of 1.5 percent (.015) per month or any portion of a month for premiums paid after the due date.

7.Check the appropriate box as described below:

Form UITR-1a, Your Report of Individual Employee’s Wages (enclosed)–Check this box if you are reporting wages using a single quarter form.

Form UITR-6a, Multiple Quarter Adjustment of Worker’s Wages (enclosed)–Check this box if you are correcting wages previously reported or if wages were incorrectly reported under the wrong unemployment insurance account number and must be transferred to another account.

No Wage Report Needed–Check this box if completing this form does not affect worker wages previously reported.

8.Reason for Adjustment–List the reasons the original report is being changed.

If you have any questions, please call Unemployment Insurance Employer Services at 303-318-9100 (Denver-metro area) or 1-800-480-8299 (outside the Denver-metro area) Fax 303-318-9103.