DEPARTMENT OF HEALTH AND HUMAN SERVICES |

Form Approved |

CENTERS FOR MEDICARE & MEDICAID SERVICES |

OMB No. 0938-0685 |

WHO SHOULD COMPLETE THIS APPLICATION

Institutional providers can apply for enrollment in the Medicare program or make a change in their enrollment information using either:

•The Internet-based Provider Enrollment, Chain and Ownership System (PECOS), or

•The paper enrollment application process (e.g., CMS 855A).

For additional information regarding the Medicare enrollment process, including Internet-based PECOS,

go to www.cms.gov/MedicareProviderSupEnroll.

Institutional providers who are enrolled in the Medicare program, but have not submitted the CMS 855A

г2003, are required to submit a Medicare enrollment application (i.e., Internet-based PECOS or the S 855A) as an initial application when reporting a change for the first time.

following health care organizations must complete this application to initiate the enrollment process:

• |

Community Mental Health Center |

• |

Hospital |

• Comprehensive Outpatient Rehabilitation Facility • Indian Health Services Facility |

• |

Critical Access Hospital |

• |

Organ Procurement Organization |

• |

End-Stage Renal Disease Facility |

• |

Outpatient Physical Therapy/Occupational |

• |

Federally Qualified Health Center |

|

Therapy /Speech Pathology Services |

• |

Histocompatibility Laboratory |

• |

Religious Non-Medical Health Care Institution |

• |

Home Health Agency |

• |

Rural Health Clinic |

• |

Hospice |

• |

Skilled Nursing Facility |

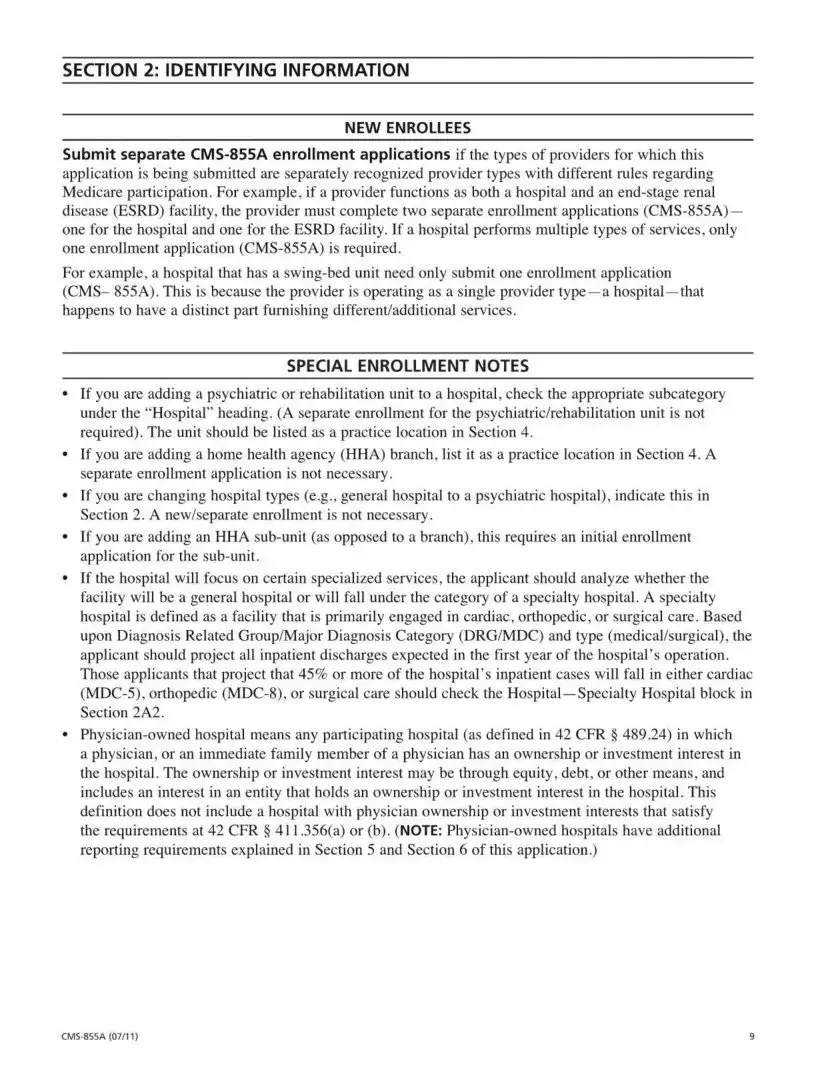

If your provider type is not listed above, contact your designated fee-for-service contractor before you submit this application.

Complete this application if you are a health care organization and you:

•Plan to bill Medicare for Part A medical services, or

•Would like to report a change to your existing Part A enrollment data. A change must be reported within 90 days of the effective date of the change; per 42 C.F.R. 424.516(e), changes of ownership or control must be reported within 30 days of the effective date of the change.

BILLING NUMBER INFORMATION

The National Provider Identifier (NPI) is the standard unique health identifier for health care providers and is assigned by the National Plan and Provider Enumeration System (NPPES). Medicare healthcare

providers, except organ procurement organizations, must obtain an NPI prior to enrolling in Medicare or before submitting a change to your existing Medicare enrollment information. Applying

for an NPI is a process separate from Medicare enrollment. To obtain an NPI, you may apply online at https://NPPES.cms.hhs.gov. As an organizational health care provider, it is your responsibility to determine if you have “subparts.'' A subpart is a component of an organization that furnishes healthcare and is not itself a legal entity. If you do have subparts, you must determine if they should obtain their own unique NPIs. Before you complete this enrollment application, you need to make those determinations and obtain NPl(s) accordingly.

IMPORTANT: For NPI purposes, sole proprietors and sole proprietorships are considered to be

“Type 1” providers. Organizations (e.g., corporations, partnerships) are treated as “Type 2” entities. When reporting the NPI of a sole proprietor on this application, therefore, the individual’s Type 1 NPI should be reported; for organizations, the Type 2 NPI should be furnished.

For more information about subparts, visit www.cms.gov/NationalProvldentStand to view the “Medicare

Expectations Subparts Paper.”

The Medicare Identification Number, often referred to as the CMS Certification Number (CCN) or Medicare “legacy” number, is a generic term for any number other than the NPI that is used to identify a Medicare provider.