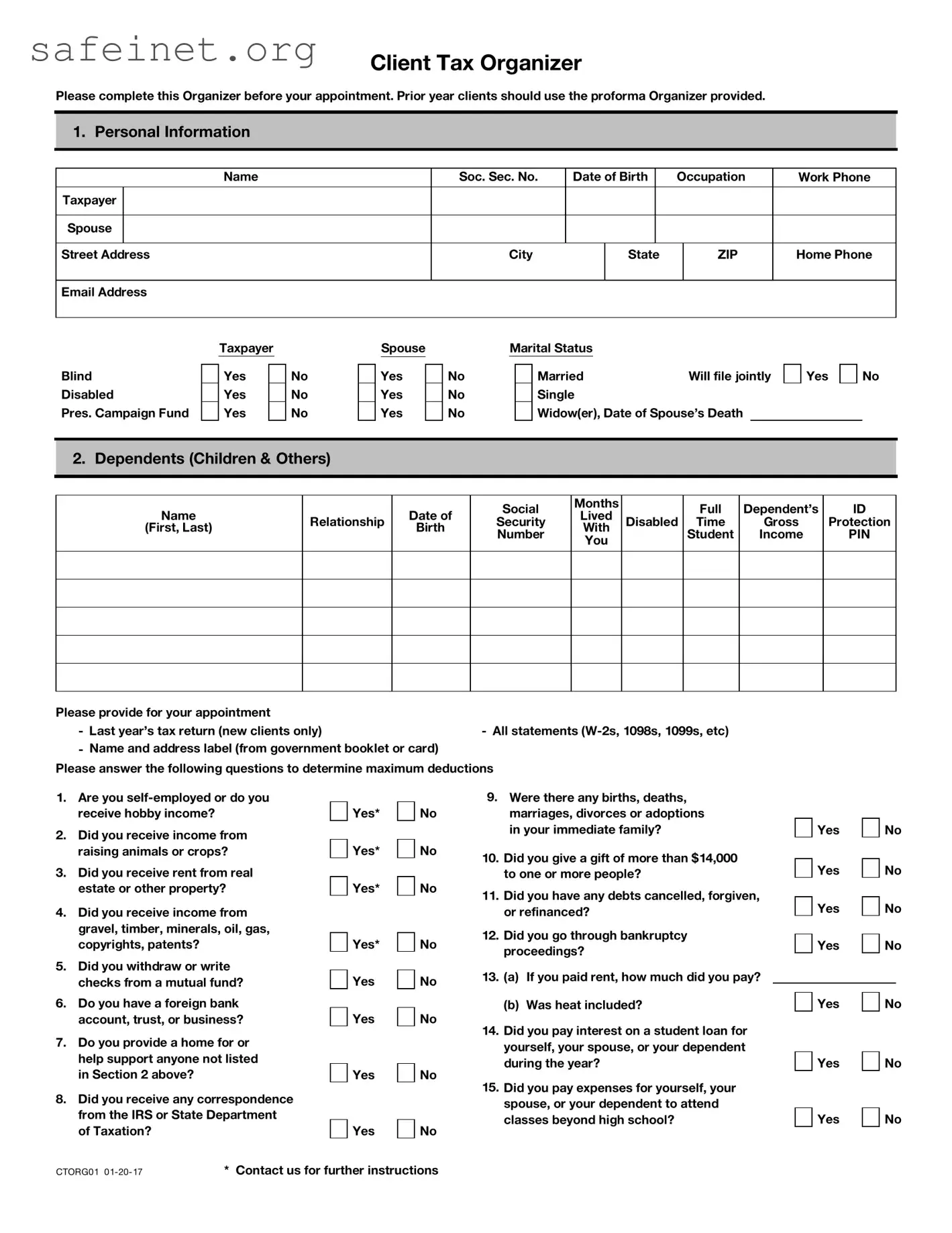

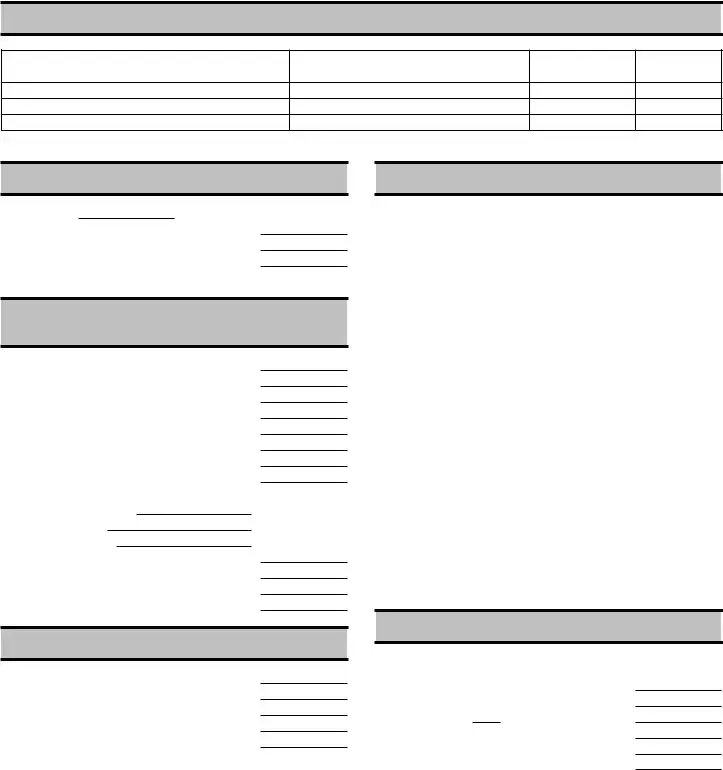

What is the purpose of the Client Tax Organizer form?

The Client Tax Organizer serves as a comprehensive checklist and information-gathering tool. It helps clients prepare for their tax appointments by consolidating essential personal details, income sources, and potential deductions. By completing this form, clients can ensure they bring all necessary documents and information to maximize their deductions and streamline the filing process.

Who should complete the Client Tax Organizer?

All clients, particularly new ones, should complete the Client Tax Organizer before their tax appointment. It is especially important for prior-year clients to use the proforma Organizer provided to streamline the process. This ensures that all relevant information is collected, making it easier for tax professionals to assist in preparing taxes accurately.

What information needs to be provided about dependents?

When listing dependents, clients should include each dependent's name, relationship to the taxpayer, date of birth, social security number, and information about their disability status and student status. Additionally, it is crucial to note how many months the dependent lived with the taxpayer to ensure compliance with tax regulations and eligibility for various credits.

What should new clients bring to their appointment?

New clients must bring last year’s tax return and all relevant statements, such as W-2s, 1098s, and 1099s. Furthermore, it’s important to provide a name and address label from a government booklet or card, which helps ensure that all personal information is recorded correctly during the appointment.

How does the form address self-employment income?

Self-employed clients or those with hobby income should answer specific questions regarding their income sources, including income from animals, crops, or real estate. This information helps tax professionals determine applicable deductions and ensure all income is reported accurately, forming a complete financial picture for the year.

What should clients do if they experienced identity theft?

If clients have been victims of identity theft, they should provide the IRS identity theft protection PIN on the Organizer form. This six-digit number is essential for the IRS to verify their identity during the tax filing process and helps protect against fraudulent filings.

Are there any questions about health coverage?

Yes, the form inquires whether clients had healthcare coverage for themselves, their spouse, and dependents throughout the tax year. If applicable, clients should bring Forms 1095-A, 1095-B, and 1095-C to the appointment. This information is crucial for fulfilling compliance requirements under the Affordable Care Act.

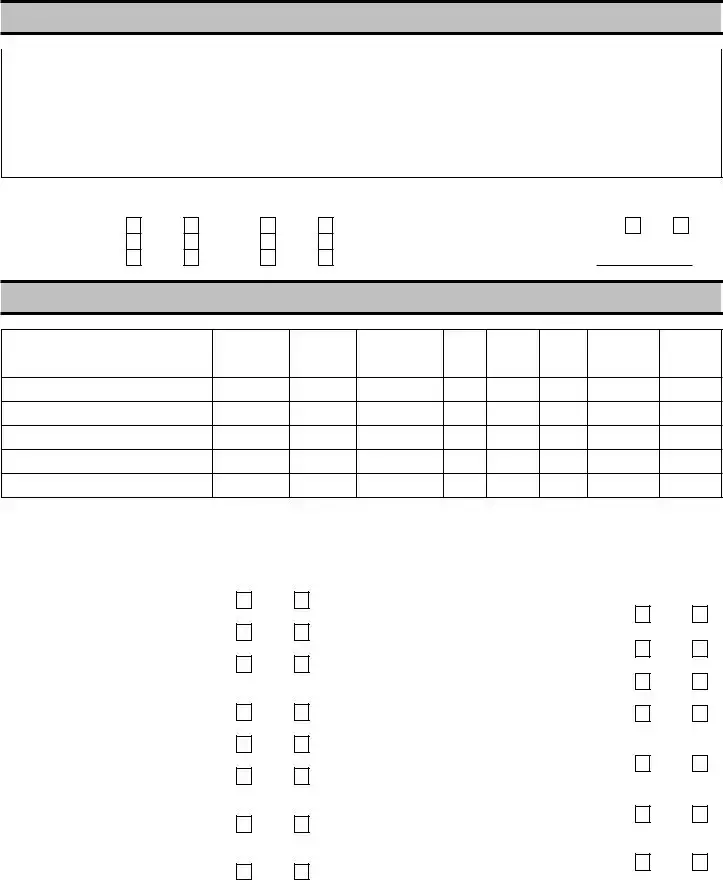

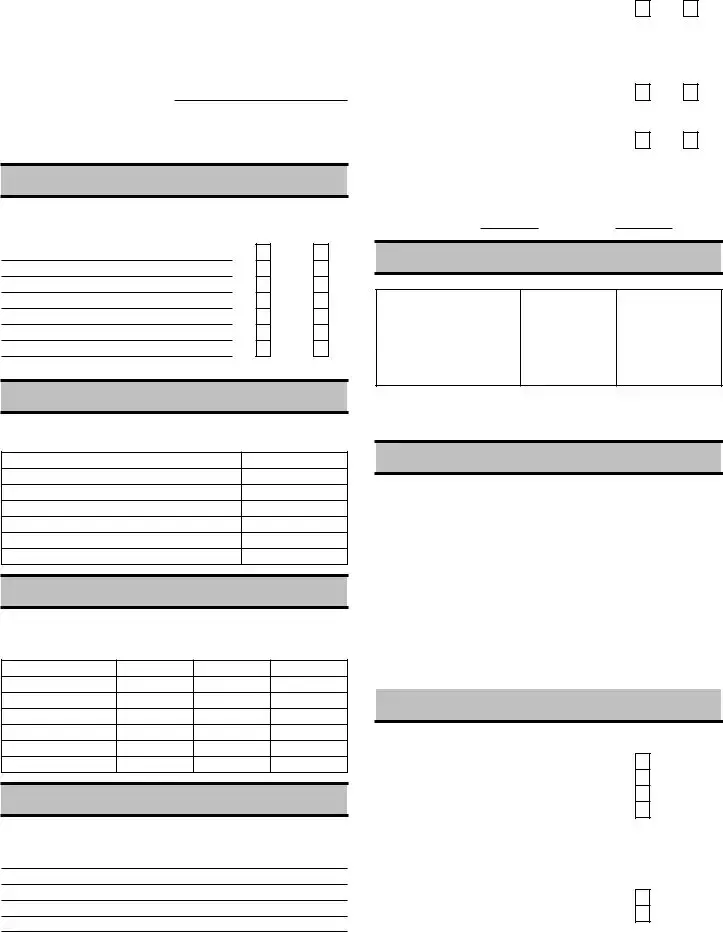

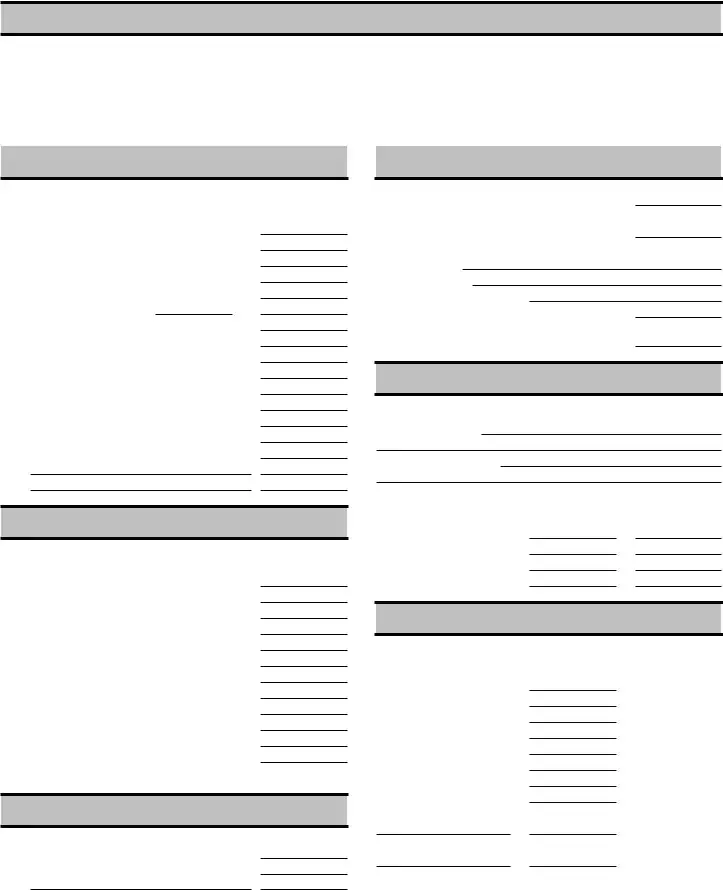

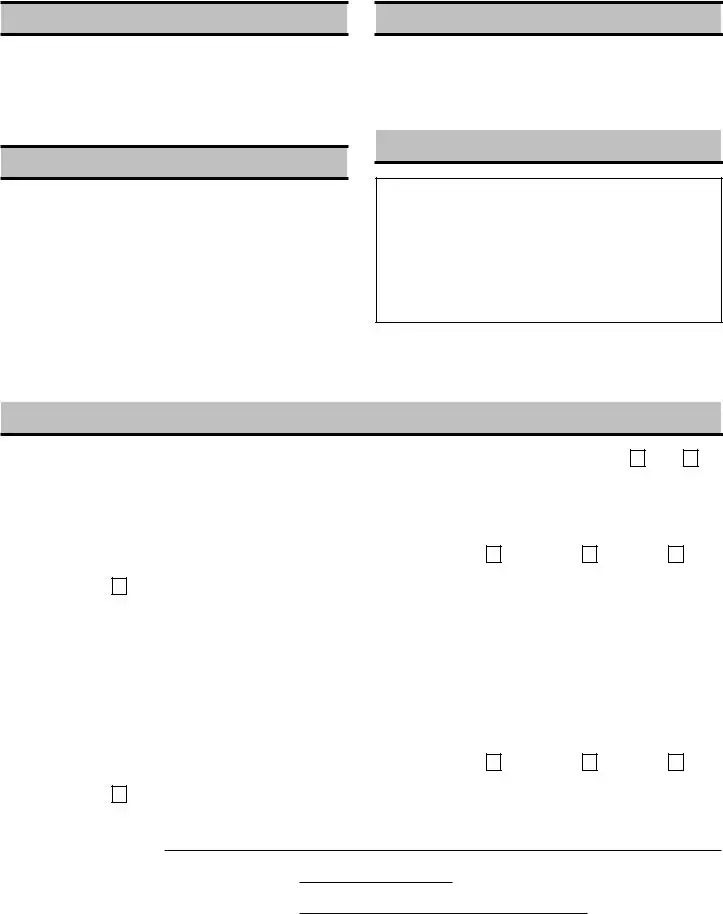

What kind of deductions does the Organizer help clients identify?

The Organizer assists clients in identifying numerous deductions, including medical expenses, taxes paid, mortgage interest, and charitable donations. It also includes specific sections for educational expenses and job-related moving costs. By collecting this information, clients can maximize their potential deductions and reduce their tax liabilities.

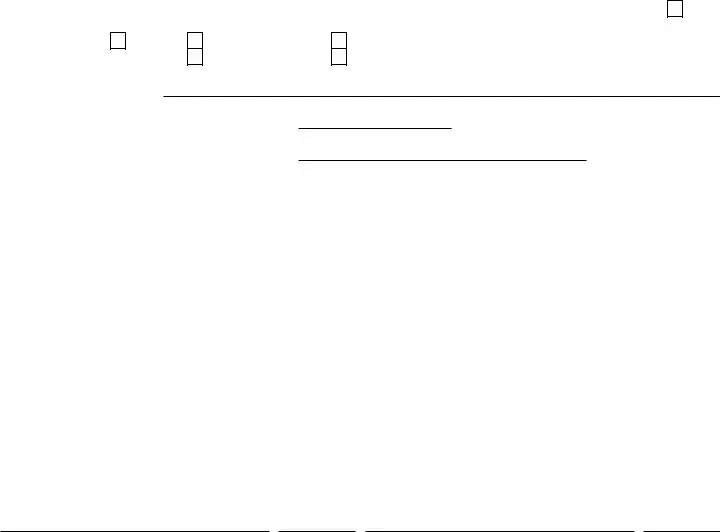

What does 'direct deposit of refund' mean?

Direct deposit of refund refers to the option for clients to have their tax refund deposited directly into their bank account. Clients can choose up to three different accounts for deposit. The Organizer requests information such as account type, routing transit number, and account number, providing a convenient way to receive refunds quickly and securely.