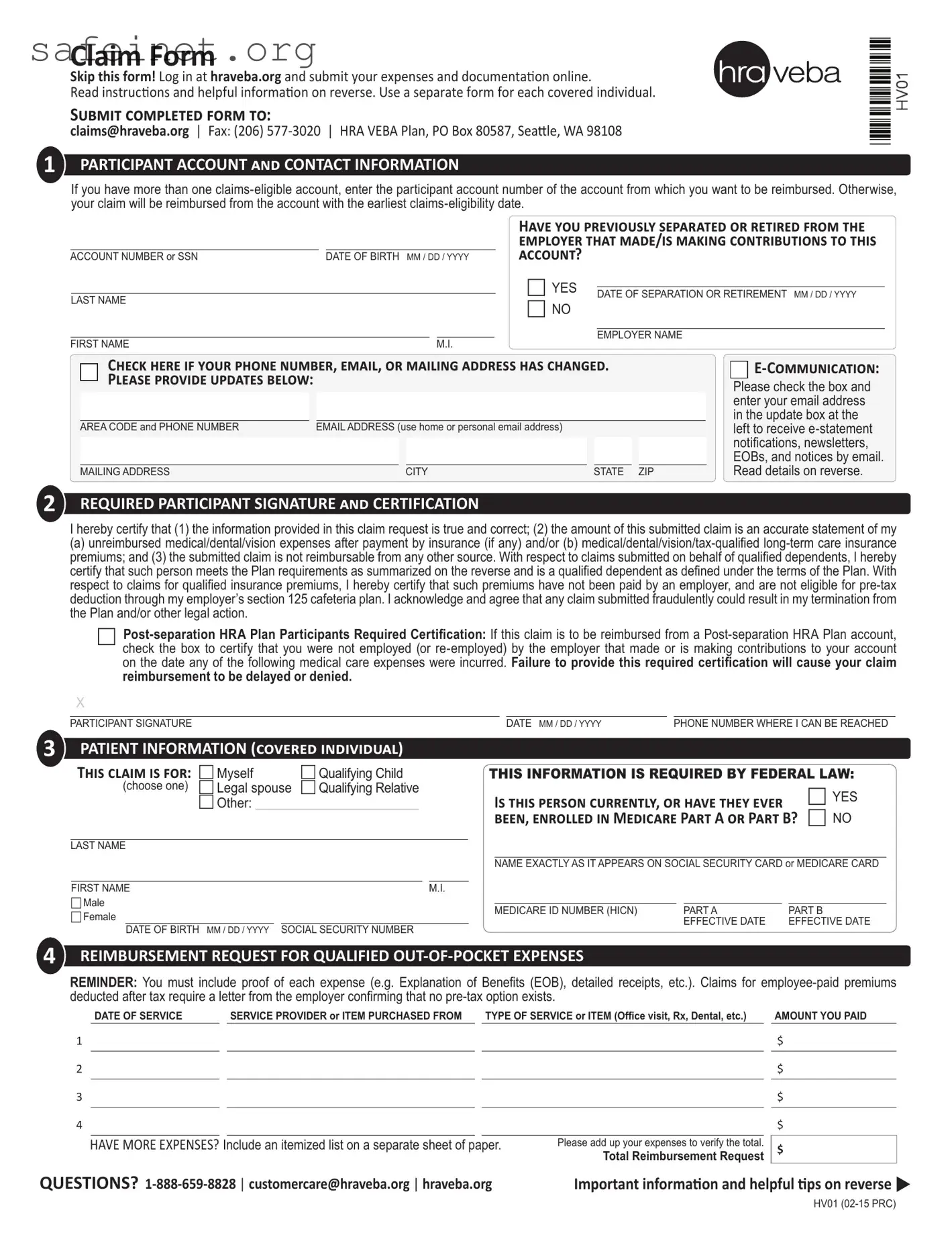

Submit proof of expense

Make sure you atach proof of each expense. Missing, incomplete, or illegible forms of documentaion are the most common reasons claims are denied. You can help avoid denied claims by making sure the proof you submit is legible and contains all of the following:

1.Name of covered individual who received the item or service;

2.Date item was purchased or service was provided;

3.Service Provider name (e.g. doctor, pharmacy, hospital, etc.);

4.Descripion of the item purchased or service received; and

5.Amount of out-of-pocket expense.

Cancelled checks, carbon copy checks, credit or debit card receipts, bank statements and balance forward or payment on account statements are not acceptable. Proper proof includes:

1.Explanaion of beneits (EOB) from your insurance company (recommended);

2.Itemized statement of services from your doctor or other service provider;

3.Stub from a prescripion (not the cash register receipt); or

4.Detailed receipt and prescripion for over-the-counter medicines.

Certain claims, such as insurance premiums, dental/orthodonia, and massage therapy require addiional proof. For more details read the How to File a Claim handout available online ater logging in at hraveba.org or upon request from the customer care center.

Reimburse your qualified insurance premiums automatically

You don’t have to submit a Claim Form every month for your qualiied insurance premiums. Auto premium reimbursement is available. Simply complete and submit an Auto Premium Reimbursement form. Forms are available online ater logging in at hraveba.org or upon request from the customer care center.

HELPFUL CHECkLIST:

Atach legible proof of each expense - use an EOB whenever possible.

Enter the correct account number.

Sign your Claim Form.

Keep copies of completed Claim Form and atachments for your iles.

Do not submit more than one receipt for each expense.

Handwriten receipts must have provider informaion stamped on them.

If you want to note certain items on your receipts, circle the items - do not use a highlighter.