What is the City of Massillon Income Tax rate?

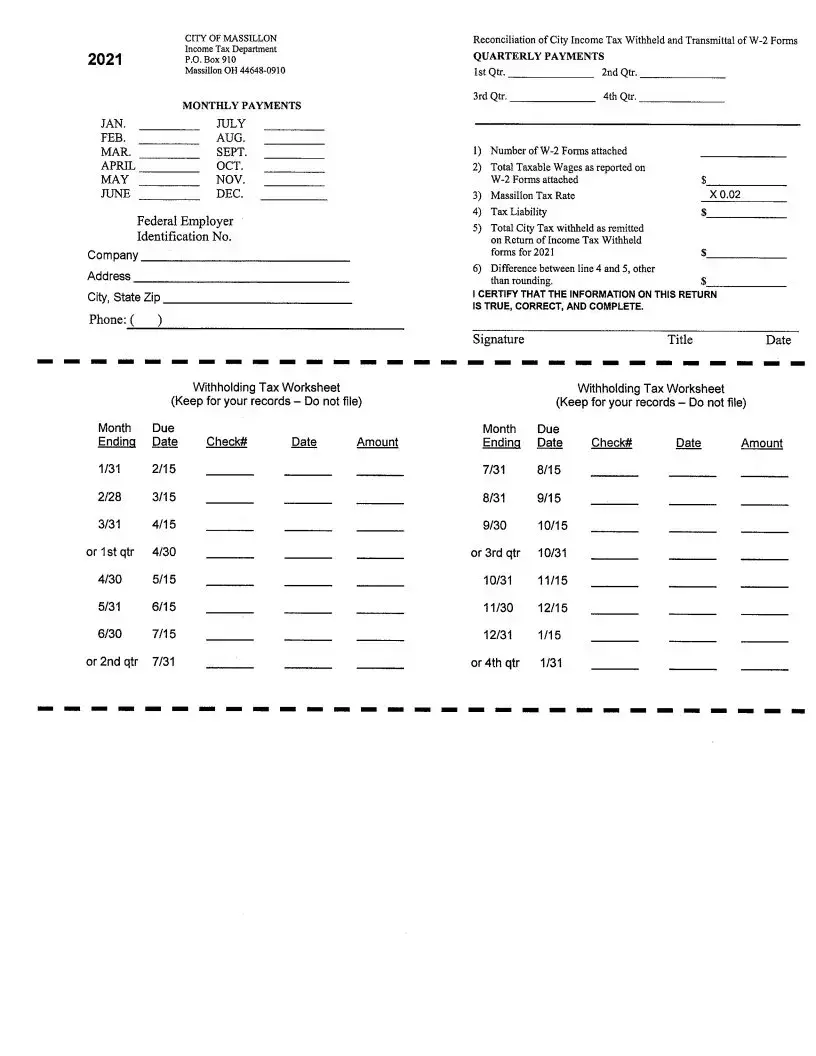

The tax rate for the City of Massillon is currently set at 2%. Employers are required to withhold this rate from the wages of employees who are subject to Massillon’s income tax. It is important for employers to ensure that the correct amount is withheld and reported to avoid discrepancies.

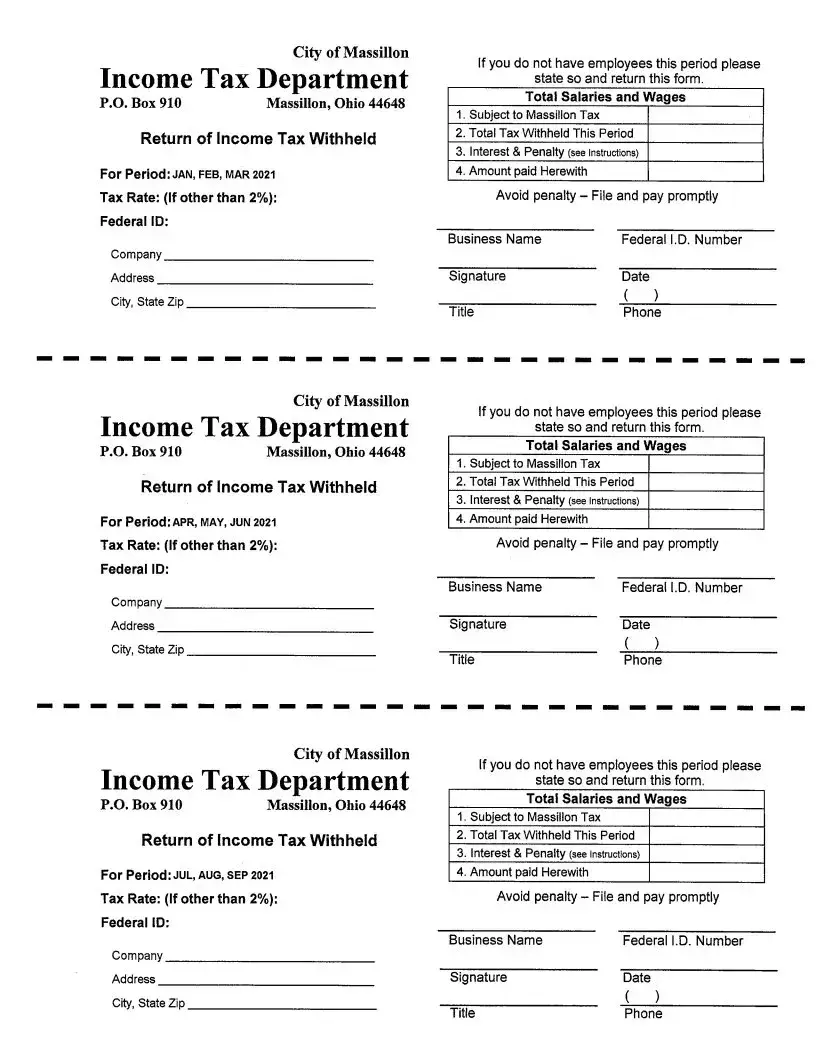

When are the due dates for withholding tax remittances?

Employers must remit withholding taxes on a monthly or quarterly basis, depending on their annual withholding amounts. Monthly filers must submit payments by the 15th of the month following the reporting period. For quarterly filers, payments are due by the last day of the month following the end of the quarter. Adhering to these deadlines is crucial for avoiding penalties.

What happens if an employer does not pay on time?

Late payments incur a one-time penalty of 50% of the unpaid balance at the time the payment is due. Additionally, interest accrues at a rate determined by the July federal short-term interest rate plus 5%. Timely filing and payments help avoid such penalties and ensure compliance with tax obligations.

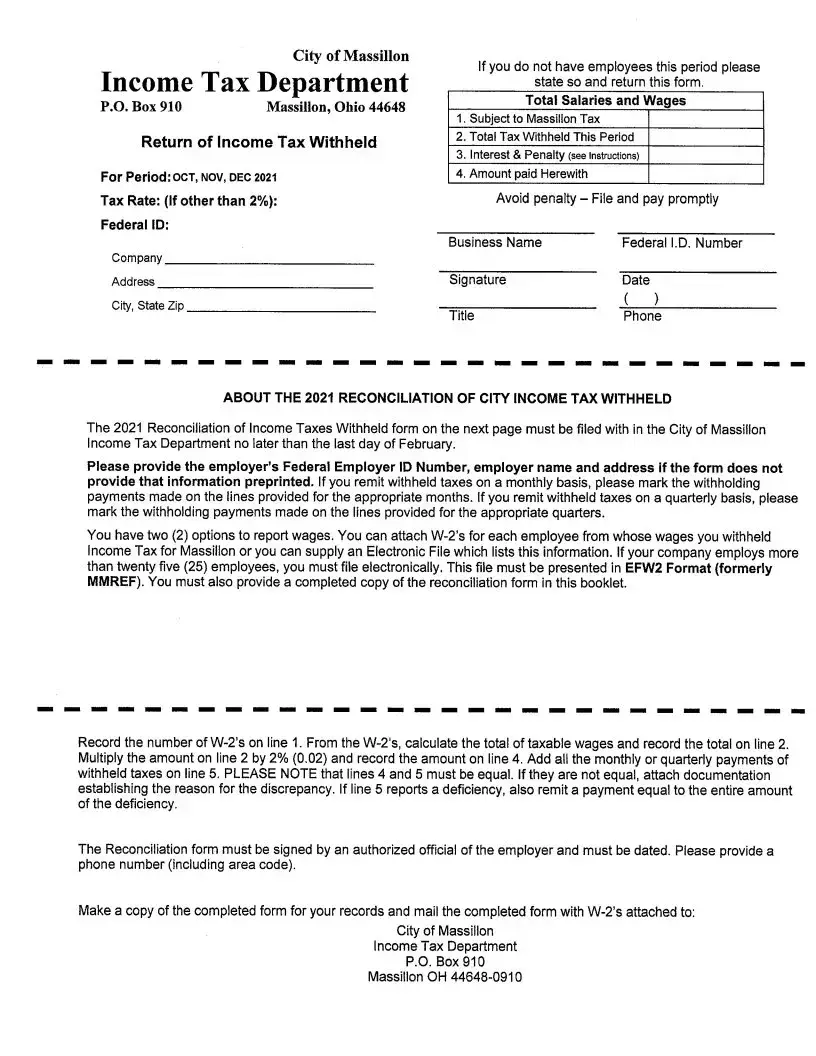

How should employers prepare the Return of Income Tax Withheld?

Employers should provide their Federal ID number, or Social Security Number if a sole proprietorship, along with the name and address of the business. The return must be signed and dated by an authorized officer. In cases where there are no employees during a specific period, it is necessary to indicate this on the form and submit it accordingly.

Are there different forms for monthly and quarterly filings?

Yes, the City of Massillon provides twelve Return of Income Tax Withheld forms for monthly filers and four forms for quarterly filers in the tax booklet. Employers must ensure they are using the correct forms that correspond to the filing frequency required for their business.

What should an employer do if their employer information changes?

Employers need to notify the City of Massillon Income Tax Department in writing about any changes to their name, address, Federal identification number, or any other relevant information. Keeping the account information current is essential for accurate tax reporting and compliance.