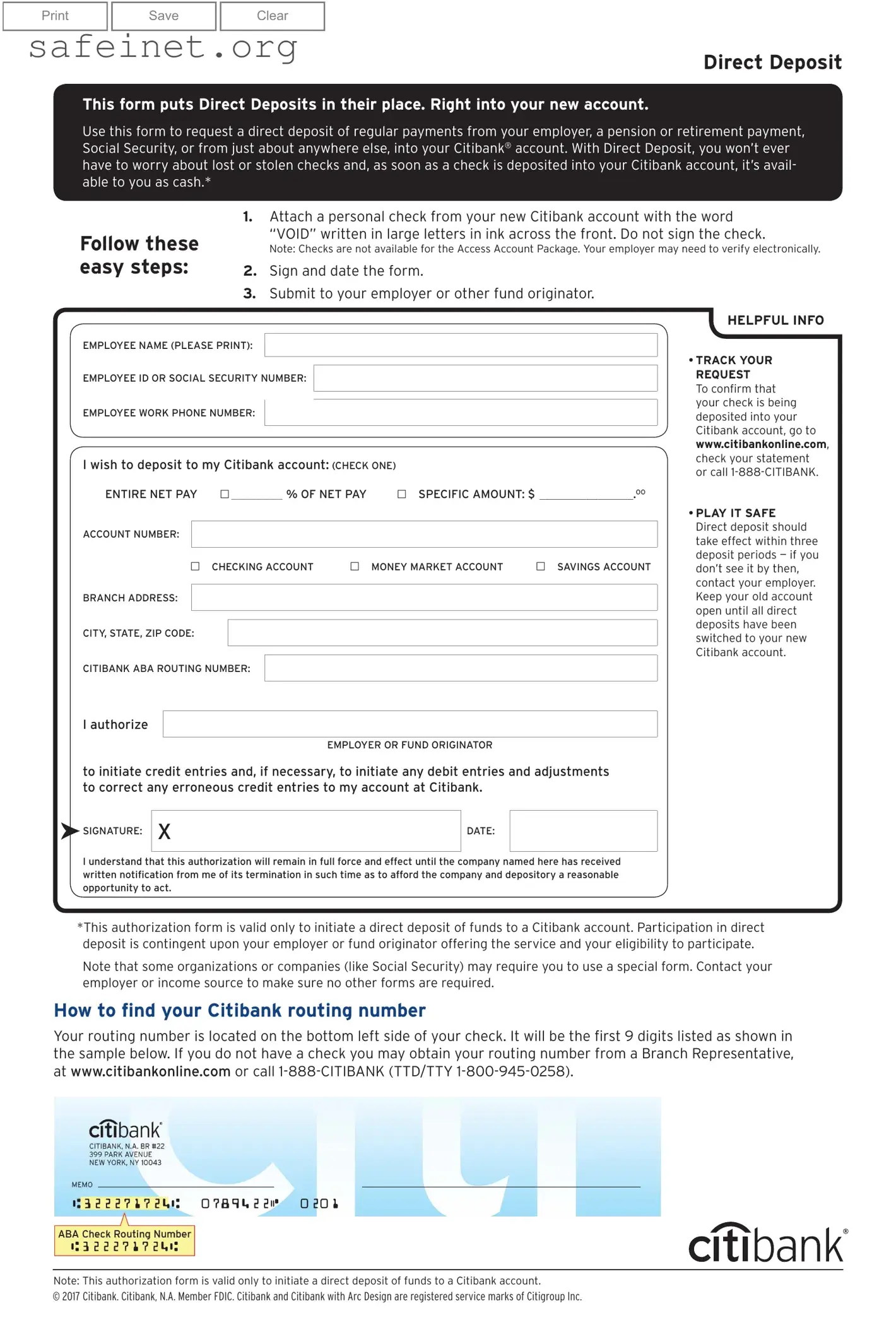

The Citibank Payroll Account form shares characteristics with the Direct Deposit Authorization form used by many financial institutions. Like the Citibank form, this document allows individuals to authorize their employers or payers to deposit their wages directly into their bank accounts. The key similarity lies in the requirement for account details, typically including the banking institution's routing number and the account number. Both forms aim to streamline the payment process, ensuring that funds are available quickly and securely without the risk associated with physical checks.

Another document similar to the Citibank Payroll Account form is the Social Security Direct Deposit form. This form is necessary for beneficiaries to receive their Social Security benefits directly into their bank accounts instead of via mailed checks. It mirrors the Citibank form in that it also collects essential banking information, including routing and account numbers. This document facilitates timely payments while protecting recipients from potential issues such as lost or stolen checks.

The W-4 form, used by employees to indicate their tax withholding preferences, relates to payroll processes in the sense that it affects how much is deposited into an employee's account through payroll. Without the W-4 on file, an employer may withhold more from paychecks than necessary. While it doesn't direct deposits itself, the information it contains can impact the net pay deposited into accounts like those at Citibank, showing the connection between various financial documents in managing employee compensation.

Similar to the Citibank Payroll Account form is the Automated Clearing House (ACH) Authorization form, used by businesses to authorize electronic transactions. This form allows debits or credits to be made to and from bank accounts. Much like the Citibank form, it includes critical account details such as the account number and routing number. The ACH Authorization simplifies transactions for both parties and ensures that payments are processed securely without paper checks.

The PayPal Direct Deposit form is yet another related document, enabling users to receive money directly into their PayPal accounts. Just like the Citibank Payroll Account form, it permits users to set up recurring payments, such as salaries or benefits, to their PayPal wallets. Both documents emphasize the shift toward electronic transactions, wherein users prefer swift access to their funds without relying on physical check delivery.

The Employee Direct Deposit form commonly employed by employers also shares features with the Citibank Payroll Account form. This document initiates the direct deposit process for employees, requiring personal information alongside banking details to ensure proper fund allocation. Both forms strive to minimize the inconvenience of paper checks while enhancing the efficiency and safety of payments.

Another document akin to the Citibank Payroll Account form is the Retirement Plan Distribution form. This form facilitates the direct deposit of retirement plan benefits directly into the retiree's bank account. Just as with the Citibank form, individuals must provide their account details, including routing and account numbers, to allow their funds to be deposited securely and quickly, reflecting a common goal of providing efficient access to funds.

The IRS Form 8888, which allows taxpayers to split their tax refund into multiple bank accounts, relates to the Citibank Payroll Account form in its objective of direct deposit. Taxpayers provide bank account details, and similar to the Citibank document, it ensures that funds are transferred electronically to designated accounts. Both forms represent a modern approach to handling financial transactions while promoting efficiency and safety.

The State Unemployment Benefits Direct Deposit form bears resemblance to the Citibank Payroll Account form as well. This document enables individuals receiving unemployment benefits to provide their banking information for direct deposits. Much like the Citibank Payroll Account form, it eliminates the risks associated with paper checks, ensuring timely and secure access to vital funds for those who may be facing financial difficulties.

Lastly, the Vendor Payment Authorization form used by businesses to facilitate direct payment to suppliers and contractors is similar in nature to the Citibank Payroll Account form. This document collects bank account information for the purpose of direct deposits, ensuring that payments are made swiftly and securely. Both forms enhance financial transactions by reducing the reliance on checks, streamlining the payment process for all involved.

SIGNATURE:

SIGNATURE: