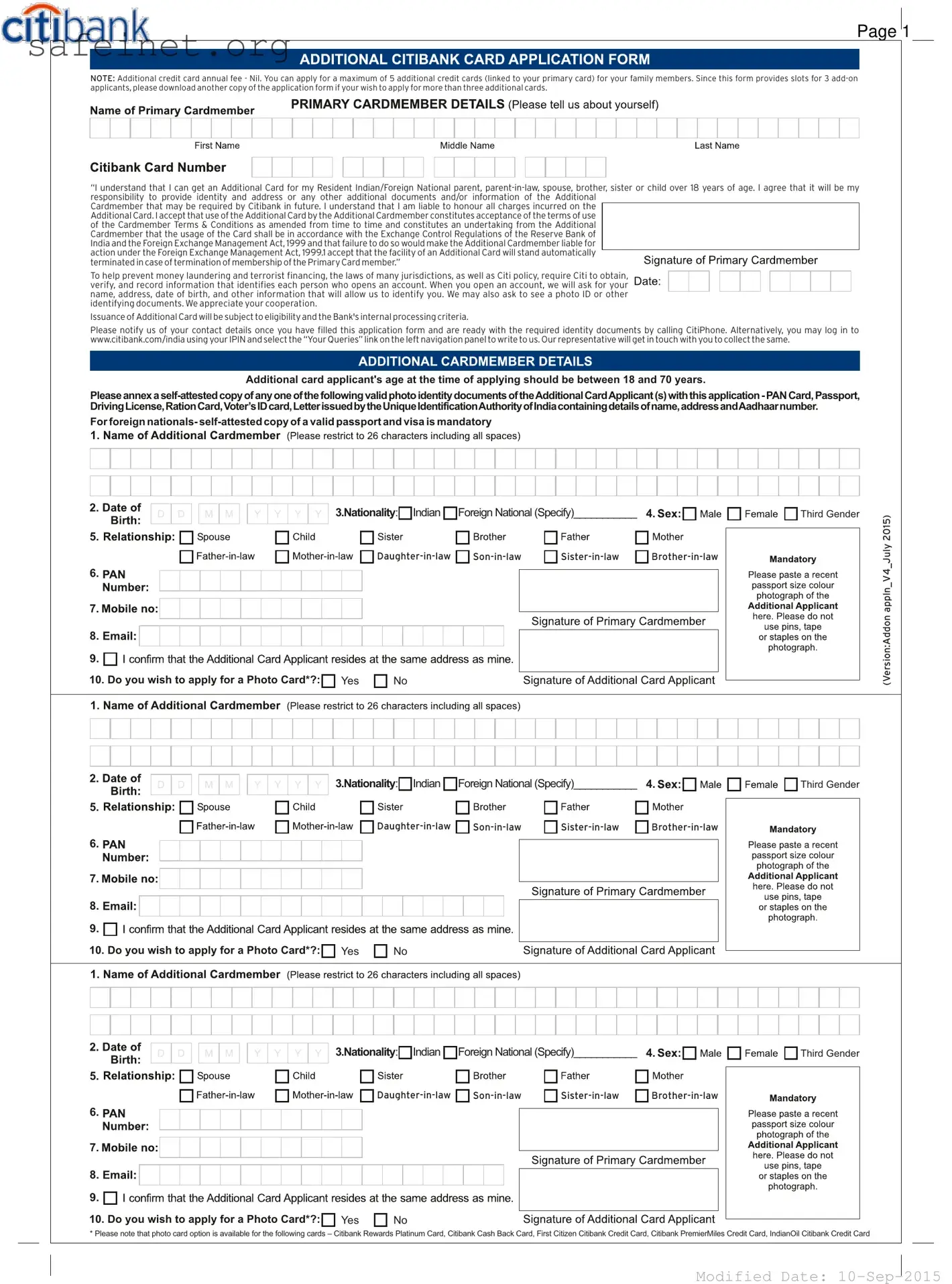

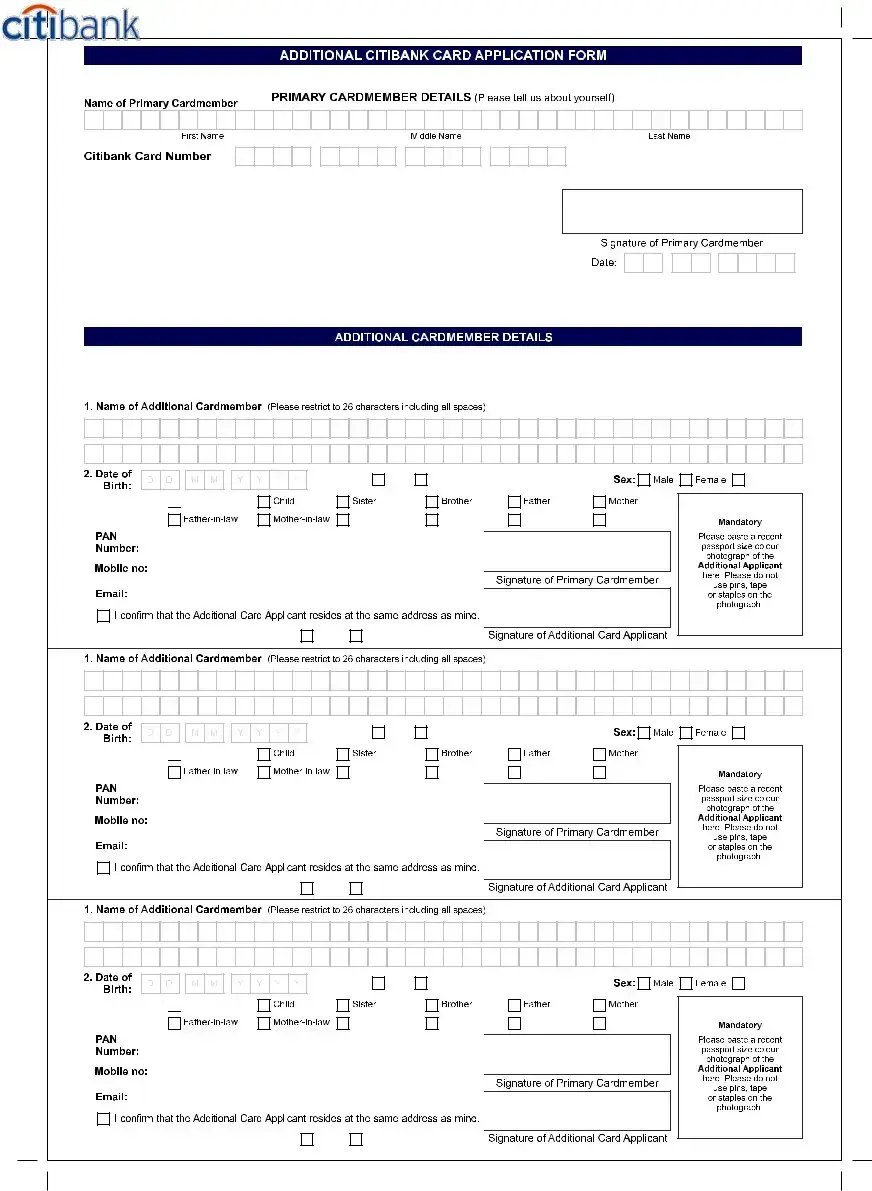

What is the Citi Beneficiary form?

The Citi Beneficiary form is a document that allows primary cardholders to add additional cardholders to their credit card account. This form can provide slots for up to three add-on applicants, and if more than three are needed, additional copies of the application form must be downloaded.

Who can be an additional cardholder?

Additional cardholders can include family members such as Resident Indian or Foreign National parents, in-laws, spouses, siblings, or children over 18 years of age. It is the primary cardholder's responsibility to ensure that the required identity and address documents are provided for the additional cardmember.

Are there any fees associated with adding an additional card?

No, there is no additional annual fee for obtaining extra cards linked to the primary account, making it an economically feasible option for expanding cardholder access among family members.

What documents are required for additional card applications?

The primary cardholder must submit a self-attested copy of a valid photo identity document for each additional card applicant. Acceptable forms of identification include a PAN Card, Passport, Driving License, Ration Card, Voter's ID, or a letter from the Unique Identification Authority of India containing the applicant's name, address, and Aadhaar number. For foreign nationals, a self-attested copy of a valid passport and visa is mandatory.

What is the age requirement for additional card applicants?

Applicants for additional cards must be between the ages of 18 and 70 at the time of application. This ensures that cardholders are of an appropriate age to handle credit responsibly.

How can I notify Citi once the application form is completed?

After completing the application form and gathering the necessary identity documents, cardholders can contact CitiPhone to inform the bank of their readiness. Alternatively, they can log into www.citibank.com/india with their IPIN and select the “Your Queries” link to communicate with a representative.

What happens if the primary cardholder's account is terminated?

If the primary cardholder's membership is terminated for any reason, the facility for additional cards will also be automatically terminated. This policy underscores the link between the primary cardholder and any additional cardholders.

What is the application process for getting a photo card?

The option to apply for a photo card is available for certain card types, such as the Citibank Rewards Platinum Card and the Citibank Cash Back Card. Cardholders will need to specify whether they wish to obtain a photo card during the application process.

Why does Citibank require identification information when opening an account?

In compliance with various laws aimed at preventing money laundering and terrorist financing, Citibank must collect and verify personal information from individuals opening an account. This process helps ensure the security of financial transactions and compliance with regulations.

What is Citibank's policy regarding compliance with Exchange Control Regulations?

All usage of additional cards must adhere to the terms set forth by Citibank, which includes compliance with the Exchange Control Regulations of the Reserve Bank of India and the Foreign Exchange Management Act. Not adhering to these regulations may result in serious consequences for cardholders.