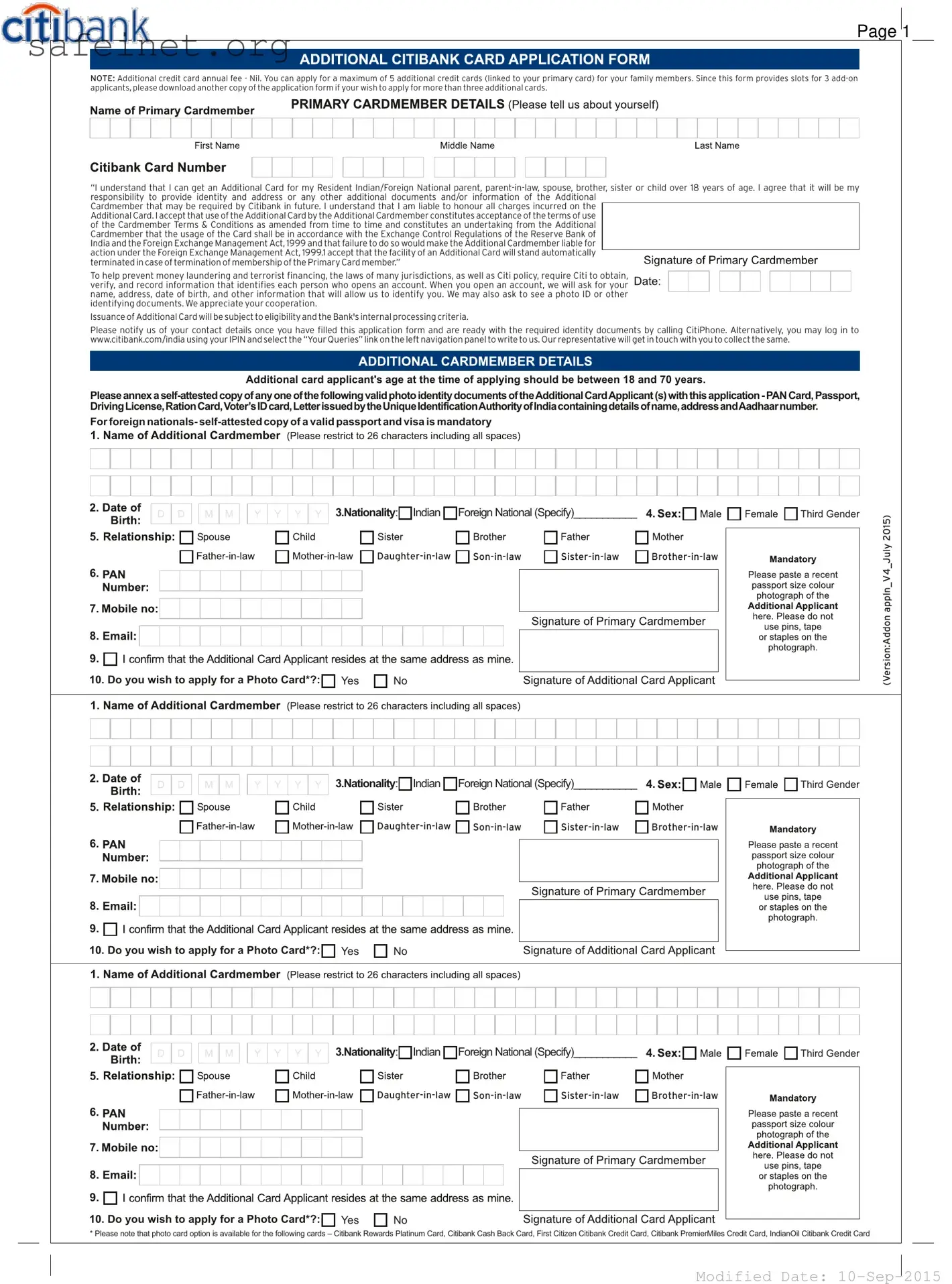

What is the Citi Bank Application Card form used for?

The Citi Bank Application Card form is used to apply for credit cards, including the option for additional cards for family members. By filling out this form, you initiate the process of obtaining a primary credit card and potentially requesting up to five additional cards linked to it.

Who can receive an additional card?

You can request additional cards for your Resident Indian or Foreign National parent, parent-in-law, spouse, brother, sister, or child over the age of 18. This flexibility allows you to share the benefits of your credit card with family while maintaining control over the account.

What documents do I need to provide for additional card applicants?

You’ll need to submit a valid photo ID for each additional applicant. This can include options such as a PAN Card, Passport, Driving License, Ration Card, a Voter’s ID card, or a letter from the Unique Identification Authority containing the necessary details. For foreign nationals, a valid passport and visa must be provided.

Is there an annual fee for the additional cards?

No, there is no annual fee for the additional credit cards linked to your primary card. This feature makes it easier for you to manage your family's credit needs without worrying about additional costs.

How do I apply for more than three additional cards?

If you wish to apply for more than three additional cards, simply download an extra copy of the application form. Each form allows for three extra applicants, so additional submissions are required for larger families.

What are the age requirements for additional card applicants?

Additional card applicants must be between 18 and 70 years old at the time of applying. This ensures that all cardholders are legally able to engage in credit transactions responsibly.

How are eligibility and processing for additional cards determined?

The issuance of additional cards is subject to the eligibility requirements and internal processing criteria of Citibank. Details may vary, so it’s important to provide accurate information to increase your chances of approval.

What do I do if I need help after filling out the application?

If you require further assistance after completing your application, you can contact CitiPhone using your contact details. Alternatively, you can log in to www.citibank.com/india, use your IPIN, and access the “Your Queries” link to send your questions. A representative will get back to you to help.

Can I apply for a photo card with the application?

Yes, you have the option to apply for a photo card with certain types of cards, including the Citibank Rewards Platinum Card and others specified in the application form. Be sure to indicate your preference when filling out the application.