What is the purpose of the Child Support Worksheet form?

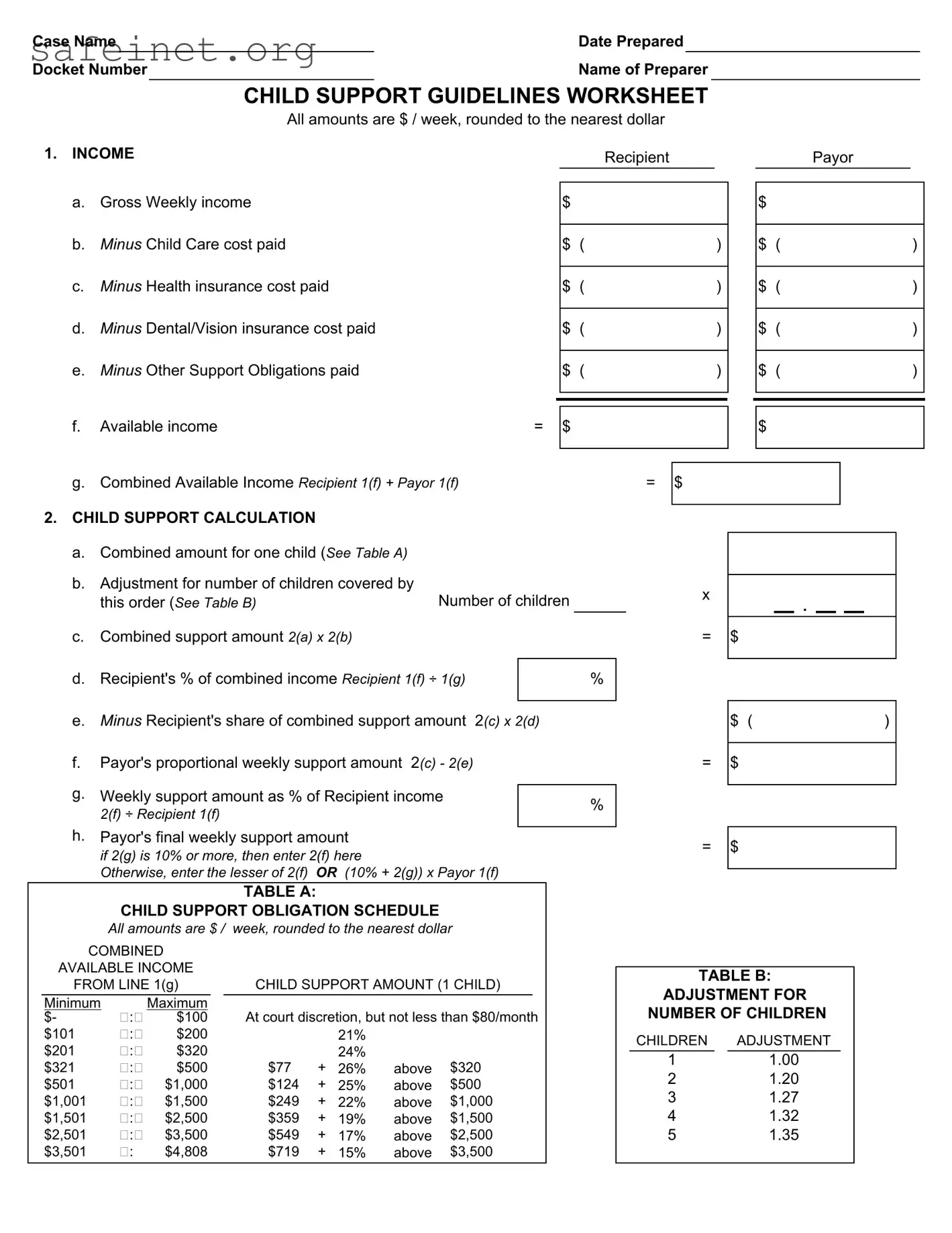

The Child Support Worksheet is designed to assist in determining the appropriate amount of child support that should be paid in a custody arrangement. It provides a structured format to calculate the incomes of both parents, taking into account various deductions such as childcare costs, health insurance, and any other support obligations. The calculations lead to a fair and standardized support amount based on the needs of the child and the financial capabilities of each parent.

Who should fill out the Child Support Worksheet?

The worksheet should be completed by both parties involved in the child support arrangement, typically the recipient of child support and the payor. Each parent must provide accurate financial information pertinent to their situation. Having both parties fill it out ensures transparency and fairness in the support calculation process.

How is the "Combined Available Income" calculated?

The Combined Available Income is derived by first calculating the available income for both the recipient and the payor separately. This involves taking their gross weekly income and subtracting specific costs like childcare expenses, health insurance, dental/vision insurance, and any other existing support obligations. Once the available income for both parents is determined, you add those amounts together to find the combined figure.

What role do Tables A and B play in the calculations?

Tables A and B provide the necessary guidelines to determine the child support obligation based on the combined income and the number of children involved. Table A specifies the minimum and maximum support amounts based on the combined available income, while Table B outlines adjustments based on the number of children for whom support is being calculated. These tables are essential in ensuring that the calculations align with established benchmarks for child support in your jurisdiction.

How are adjustments made based on the number of children?

Adjustments for the number of children covered by the child support order are made using Table B. This table assigns specific adjustment percentages based on the total number of children involved. When calculating the combined support amount, this adjustment is important as it reflects the increased financial responsibility that typically comes with supporting multiple children.

What if the calculated support amount seems unfair?

If the child support amount resulting from the worksheet appears to be unfair or unmanageable, either parent can request a review or modification of the support order. Changes in income, significant shifts in living expenses, or a substantial change in the needs of the child may warrant a reassessment. Courts strive to ensure that child support arrangements are reasonable and meet the child's best interests.

Is this worksheet the only factor considered in determining child support?

No, while the Child Support Worksheet provides a solid foundation for determining child support obligations, it is not the only factor that courts consider. Other elements, such as the child's needs, the parents' financial circumstances, and any special requirements of the child, can influence the final decision. The court ultimately has discretion in these matters, balancing guidelines with the unique circumstances of each case.