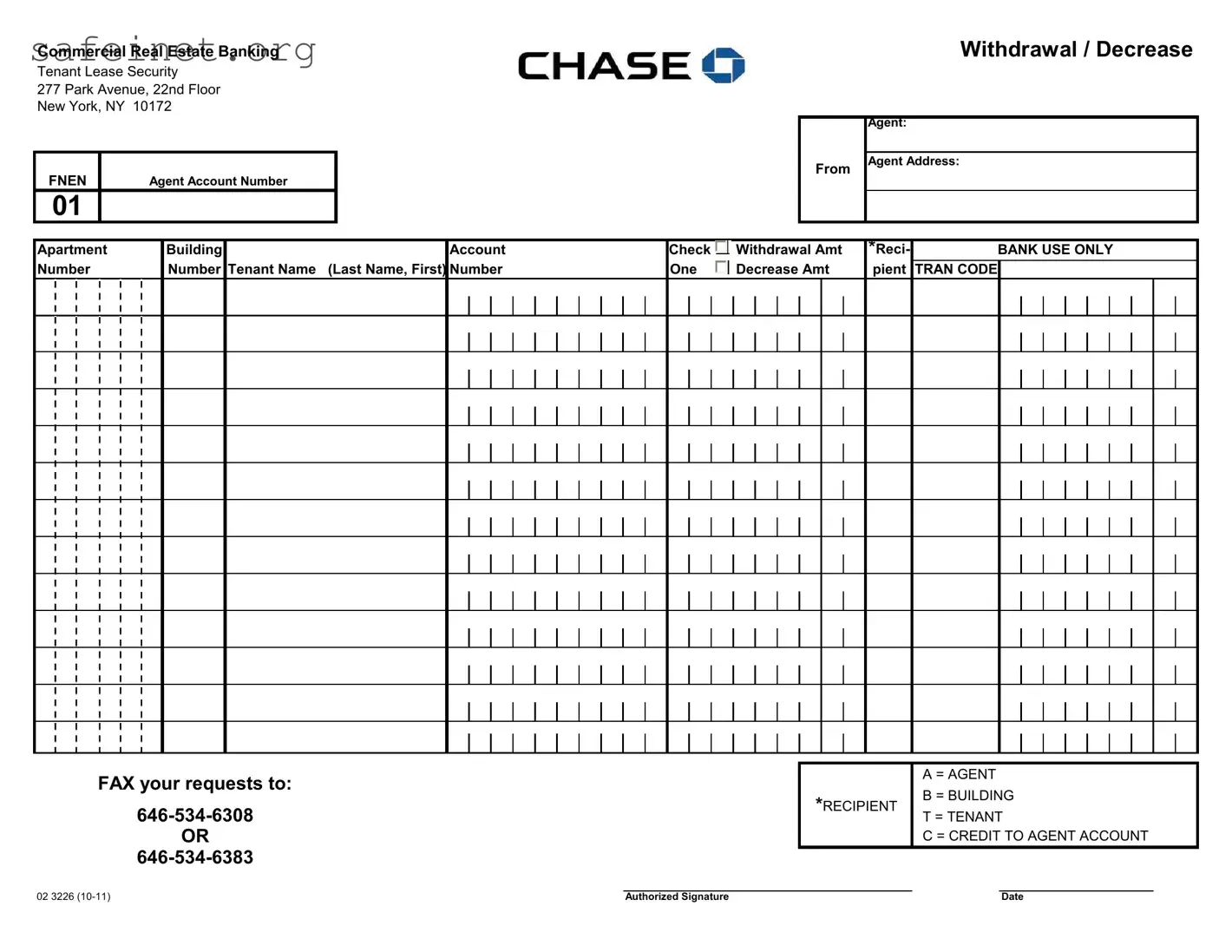

The Chase Withdrawal Slips form shares similarities with a standard bank withdrawal slip. Both documents serve the primary purpose of facilitating monetary withdrawals from a specified account. While the bank withdrawal slip typically includes fields for the account holder's information, the amount to be withdrawn, and a signature for authorization, the Chase form expands on this by also detailing the recipient of the funds and provides additional context for real estate transactions. This additional information is essential to ensure proper handling of funds associated with tenant leases or agent transactions.

Another comparable document is the direct deposit form. Just like the Chase Withdrawal Slips, direct deposit forms are used to manage money transfers, but in the opposite direction. Instead of withdrawing funds, direct deposit forms allow individuals or businesses to authorize their employer or other parties to deposit funds directly into their accounts. Both forms require account-specific details and an authorization signature. However, the key difference lies in the purpose; one withdraws money while the other deposits it into the account.

The rent payment form aligns closely with the Chase Withdrawal Slips, as both involve transactions related to leasing properties. A rent payment form captures the details of monthly payments made by tenants to property managers or landlords. This document often includes spaces for tenant and property information similarly to how the Chase form identifies agents, amounts, and recipients. Both forms are crucial in tracking financial activities concerning tenants and property management, ensuring all parties maintain accurate records for financial accounting.

The invoice serves as another similar document. Invoices facilitate financial transactions by requesting payment for services rendered or goods provided, much like how the Chase Withdrawal Slips facilitate a transaction involving withdrawals or decreases in account balance. Invoices detail the purpose of charges, client details, and payment terms. Just as the Chase form requires a signature to authorize transactions, invoices frequently require approval from clients before payment can be processed. Both ensure transparency and record-keeping for financial activities.

Customer deposit slips present another analogy to the Chase Withdrawal Slips. Both documents involve banking transactions, but customer deposit slips allow account holders to deposit money, much like bank withdrawal slips allow for cashing out. Each form requires account details, including names and account numbers, ensuring accuracy during the transaction. The fundamental connection between these documents lies in their role of facilitating account management for financial institutions while serving different transaction purposes.

Another relevant document is the transfer request form. This form enables account holders to request the movement of funds from one account to another within the banking system, similar to the Chase Withdrawal Slips. Both require detailed account information and authorization signatures to ensure that the transactions are legitimate and correctly processed. While the Chase form shows a withdrawal action, the transfer request form indicates a change of location for funds without impacting overall account balance.

Finally, the lease termination notice can be seen as parallel to the Chase Withdrawal Slips in the context of real estate. Both documents are used in transactions involving property management. The lease termination notice signals the end of a rental agreement, while the Chase form handles financial withdrawals related to that property. Each serves its purpose in managing the terms and conditions of agreements, ultimately striving to protect the interests of all parties involved.