What is the Chase UCard?

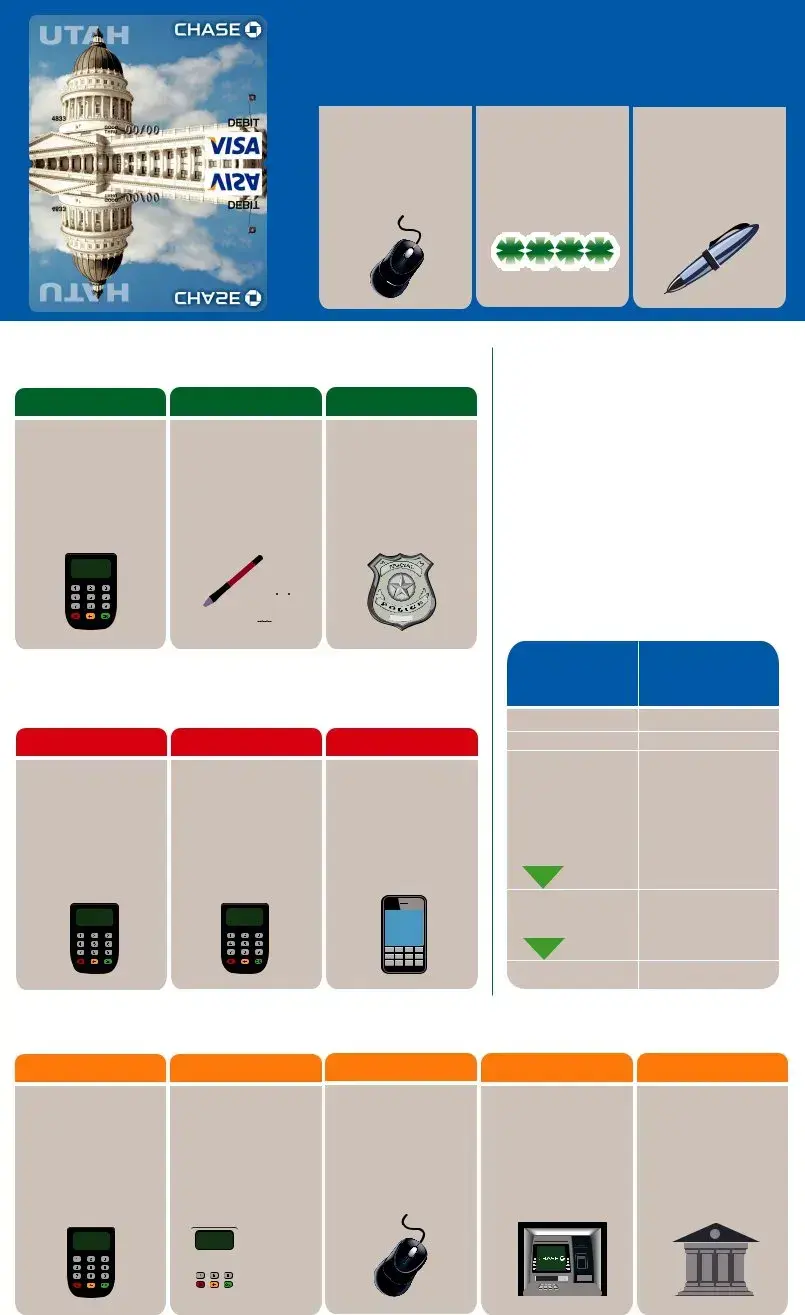

The Chase UCard is a prepaid card designed for individuals receiving benefits such as food stamps, cash payments, child care funds, or employment and training funds. This card allows easy access to your funds, making it convenient to make purchases or withdraw cash. You will need to activate the card and select a Personal Identification Number (PIN) before using it.

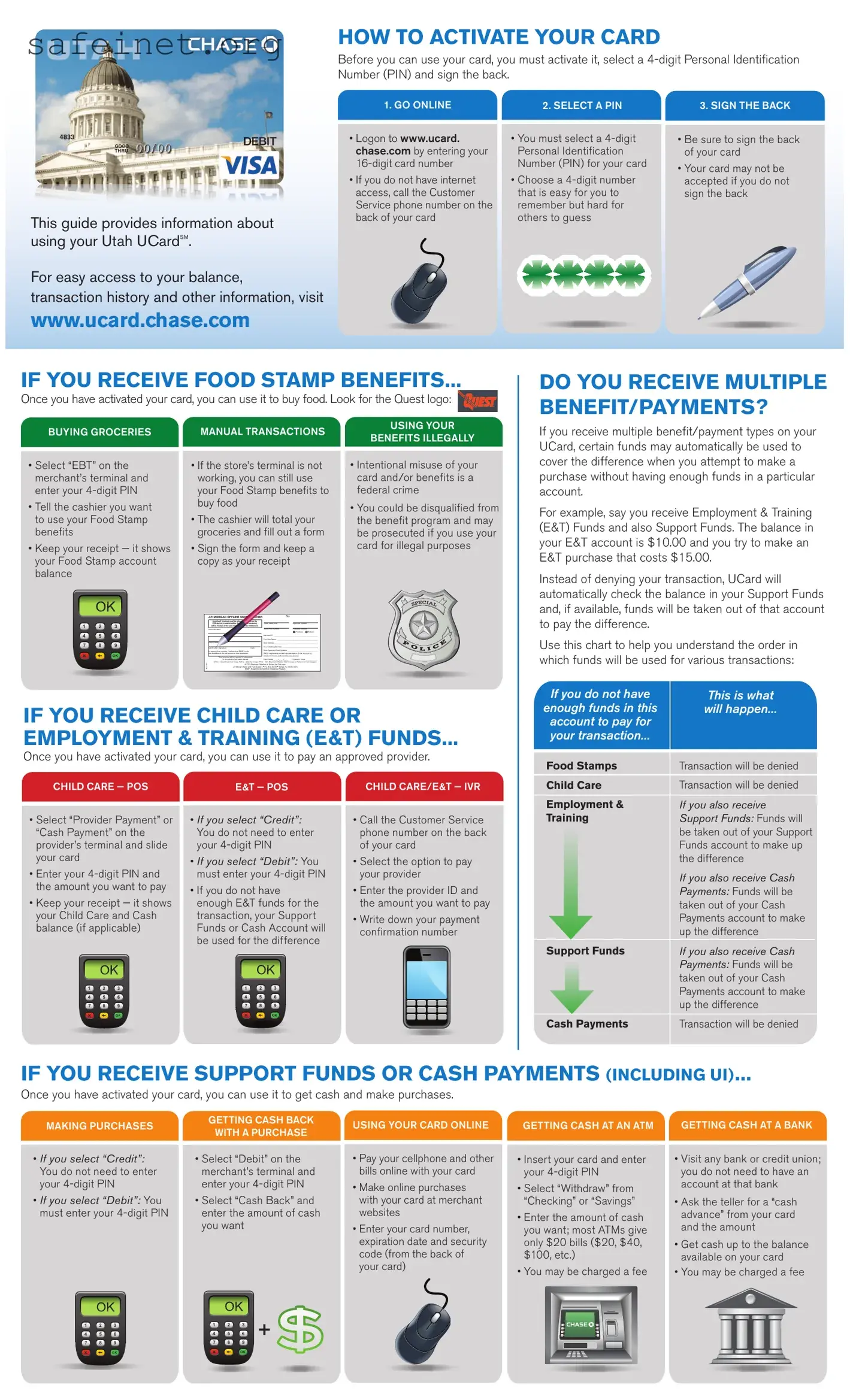

How do I activate my Chase UCard?

To activate your Chase UCard, go online by visiting www.ucard.chase.com. Enter your 16-digit card number, and follow the prompts to select a 4-digit PIN. Don’t forget to sign the back of your card as well. If you do not have internet access, you can activate your card by calling the Customer Service number found on the back of your card.

Can I use my card for grocery purchases?

Yes, once your card is activated, you can use it to purchase groceries. Look for the Quest logo at participating stores that accept food stamp benefits. When ready to pay, simply select “EBT” on the merchant’s terminal and enter your 4-digit PIN. Make sure to keep your receipt, as it will show your account balance and transaction details.

What should I do if there is an incorrect transaction on my food stamp account?

If you notice an incorrect transaction due to an error at a retailer, it may affect your balance. You will receive a notice if there is a correction that reduces your balance. For any discrepancies or concerns, it’s best to call Customer Service for further assistance.

How can I check my balance?

You can check your balance by visiting www.ucard.chase.com. Additionally, you can call Customer Service for up-to-date information regarding your balance. Consider signing up for Deposit Notification Alerts, which provide automatic updates when funds are added to your account.

What steps should I take if I lose my card?

If your card is lost, stolen, or damaged, it’s crucial to act quickly. Go online to www.ucard.chase.com or call Customer Service immediately to report the issue. This will help protect your funds and allow you to request a replacement card.

Are there fees associated with using the UCard?

Yes, there may be fees for certain transactions, which vary based on how you use your card. However, there are no fees for using your card for food stamp or child care benefits. For a detailed list of fees, refer to the Card Fees document that comes with your card.

+

+