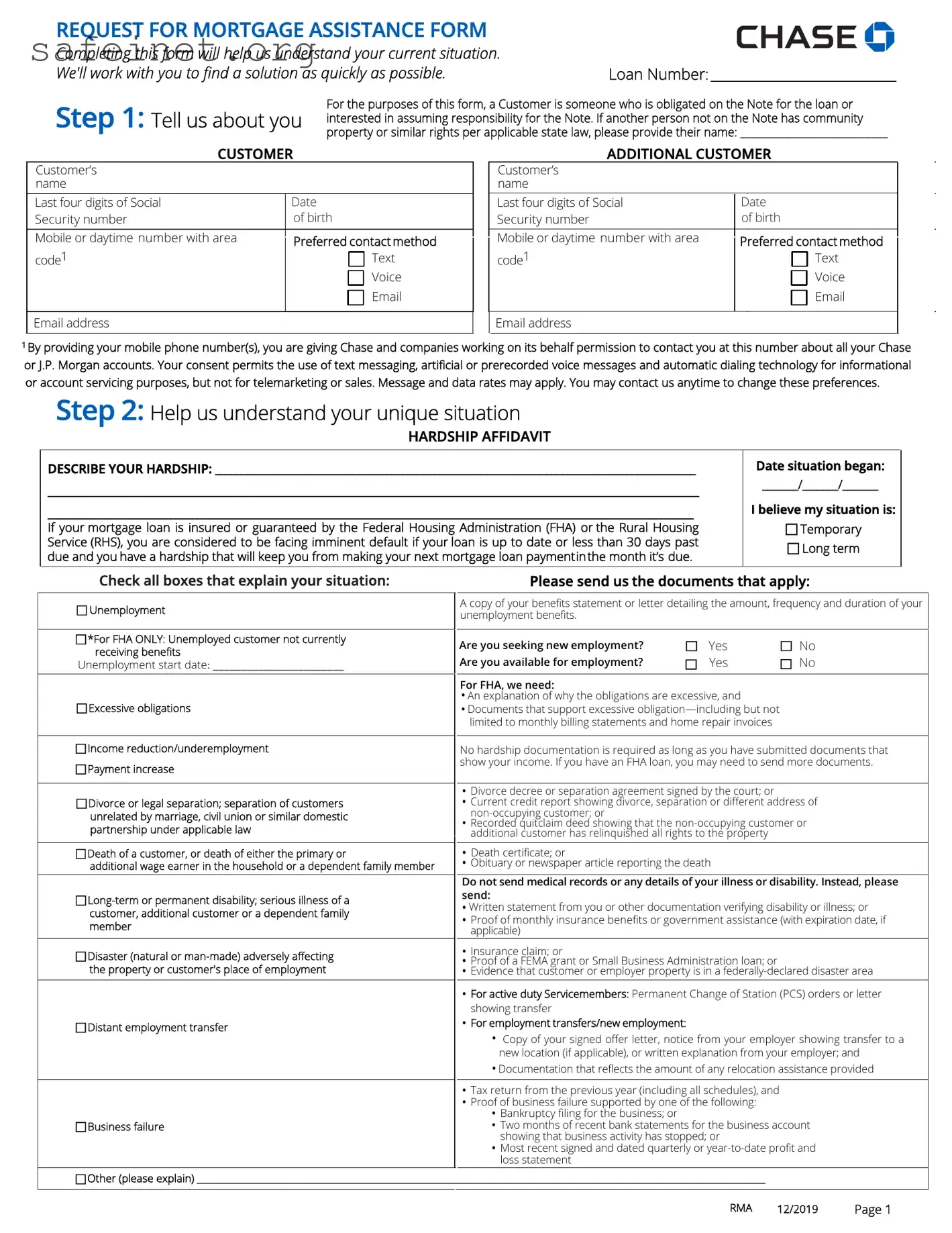

If any customer or occupant of the property is a military Servicemember who is currently on Active Duty or has been on Active Duty within the last 12 months, or is a dependent of a Servicemember, please call Chase Military Services at 1-877-469-0110.

LIENS, MORTGAGES OR JUDGMENTS (if applicable)

Please list any other mortgages or liens associated with this property. If you have more than one loan with us, we'll need you to complete a Request for Mortgage Assistance form for each account you’d like us to review for assistance.

|

|

|

|

|

Servicer: ___________________________________________________________________________________ |

Account #: __________________________________________________ |

Servicer: ___________________________________________________________________________________ |

Account #: __________________________________________________ |

Servicer: ____________________________________________________________________________________ |

Account #: __________________________________________________ |

|

|

|

|

Condominium or HOA fees? n Yes n No |

If yes, how much each month? $_____________ |

Are payments up to date? n Yes n No |

|

If you own other properties, please fill out the following section.

OTHER PROPERTIES OWNED

Customers with more than two additional properties, please download the Schedule of Real Estate Owned form from the Forms

Center at chase.com/MortgageAssistance. Please include the completed form with this application.

Property address: ______________________________________________________________________________________ Monthly rents received: $ ______________________

1st mortgage servicer name: ______________________________________________________________________________________________________________________________

Loan #: ________________________________________________________________________ Monthly principal and interest payment: $ ______________________________

2nd mortgage servicername: ____________________________________________________________________________________________________________________________

Loan #: _______________________________________________________________________ Monthly principal and interest payment: $ ________________________________

Escrow payment (taxes, insurance, PMI): $_______________ Property is: n Vacant n Second/seasonal home n Owner-occupied n Rented

Monthly condominium or HOA fees: $_____________________ Comments: __________________________________________________________________________________

________________________________________________________________________________________________________________________________________________________________

Property address: ___________________________________________________________________________________ Monthly rents received: $ ______________________

1st mortgage servicer name: ___________________________________________________________________________________________________________________________

Loan #: ________________________________________________________________________ Monthly principal and interest payment: $ _______________________________

2nd mortgage servicer name: ___________________________________________________________________________________________________________________________

|

|

|

|

Loan #: |

_____________________________________________________________________ Monthly principal and interest payment: $ ______________________________ |

Escrow payment (taxes, insurance, PMI): $______________ Property is: n Vacant |

n Second/seasonal home n Owner-occupied |

n Rented |

Monthly |

condominium or HOA fees: $_____________________ Comments: ___________________________________________________________________________ |

________________________________________________________________________________________________________________________________________________________________

Third-Party Authorization:

If you want, you can authorize someone to work with us on your behalf. This is optional.

I/We hereby authorize JPMorgan Chase Bank, N.A., to release, furnish and provide information related to my/our account to:

Name of third party _______________________________________________________________________ Phone number (________)_____________________________________

Address of third party_______________________________________________________________________________________________________________________________________