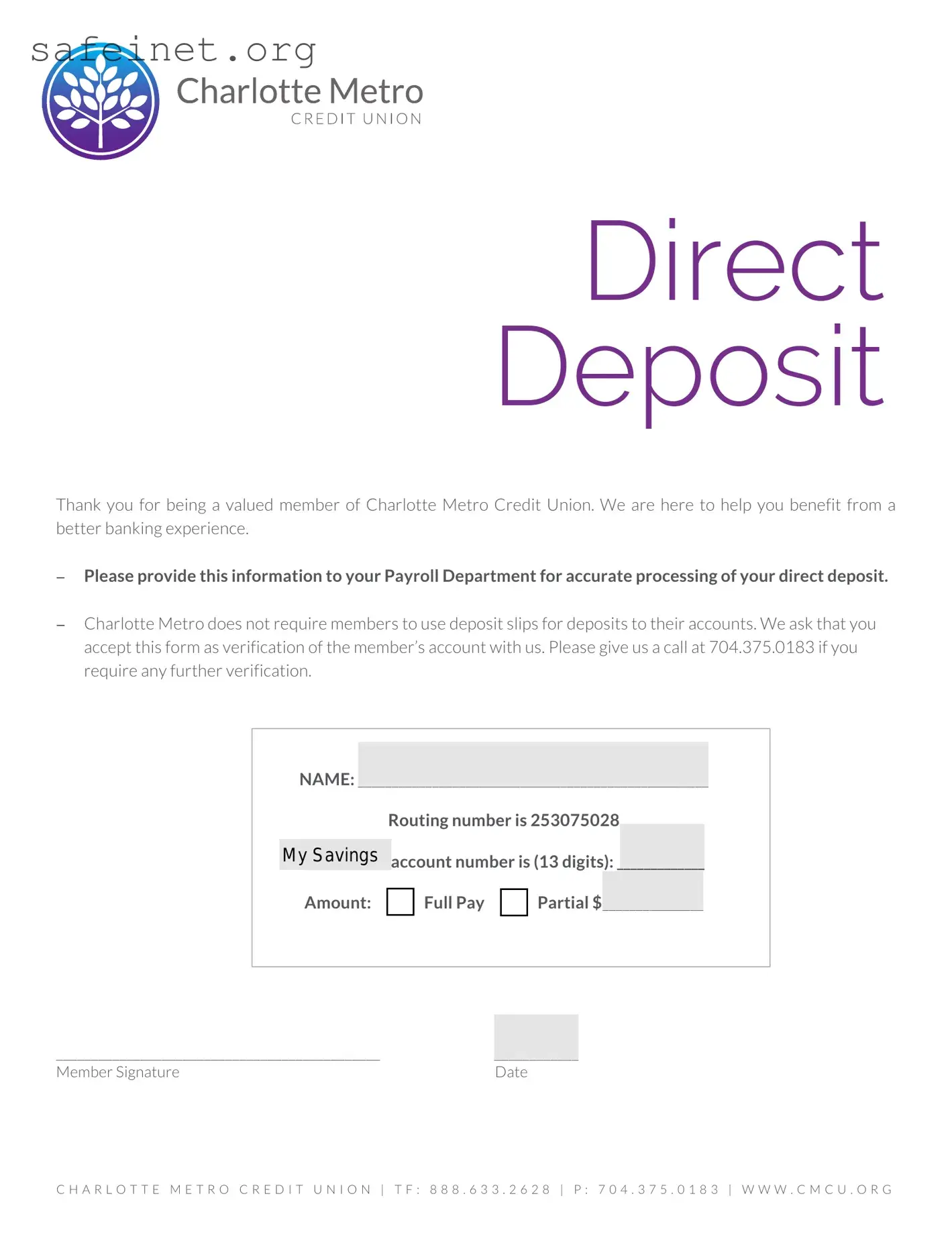

What information is required to complete the Charlotte Metro Credit Union Direct Deposit form?

To fill out the direct deposit form, you need to provide your name, the routing number (253075028), your savings account number (which is 13 digits), and the amount you wish to deposit. You can choose to deposit your full paycheck or a partial amount. Lastly, don’t forget to sign and date the form.

Is it necessary to use deposit slips for my direct deposits?

No, Charlotte Metro Credit Union does not require members to use deposit slips for depositing funds into their accounts. Instead, this direct deposit form serves as the necessary verification for your account. Simply provide it to your payroll department for seamless processing.

How can I submit the Direct Deposit form to my employer?

You should provide the completed direct deposit form to your Payroll Department. Ensure that all required information is filled out correctly to avoid any issues with processing your deposits. You may choose to hand it in personally or send it via email, depending on your employer’s preferred method.

What if I need further verification of my account?

If you need additional verification of your account, you can contact Charlotte Metro Credit Union at 704.375.0183. Their team is ready to assist you with any questions or concerns you may have regarding your account or direct deposits.

What should I do if I want to change the amount or account for my direct deposit?

To change the amount or the account for your direct deposit, you must complete a new Direct Deposit form. Fill in the updated information and submit it to your Payroll Department. Make sure to check for accuracy to ensure the new details are processed without any issues.