What is a Change Trustee form?

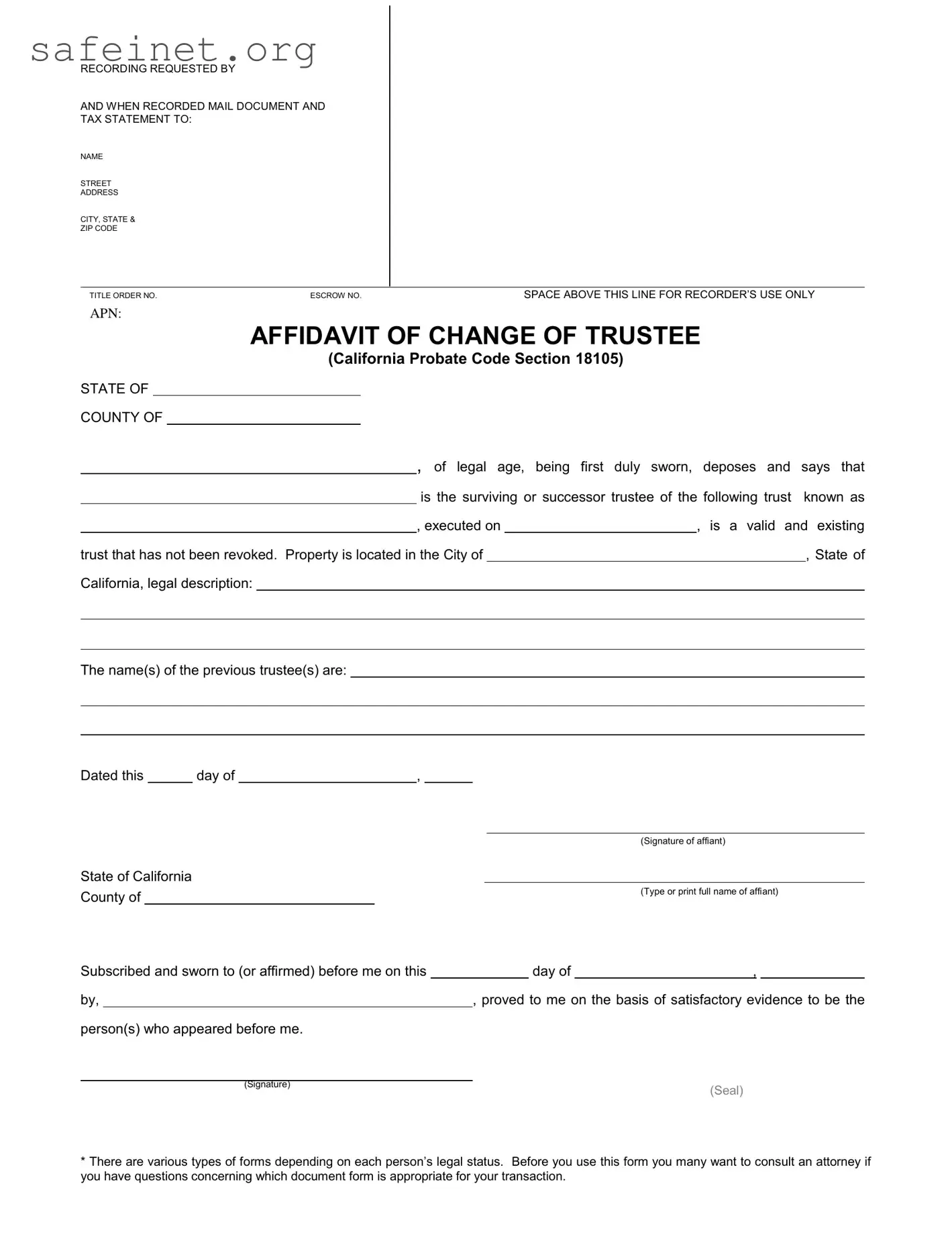

A Change Trustee form is a legal document used to update the trustee of a trust. This form is necessary when a trustee has resigned, passed away, or is otherwise unable to fulfill their duties. By properly filing this form, you ensure that the trust is managed by the appropriate person moving forward.

Who can complete the Change Trustee form?

The Change Trustee form can be completed by the current trustee or the person designated as the successor trustee. It is essential that the individual filling out this form is legally recognized as the new trustee to avoid any complications.

What information is required on the form?

You will need to provide specific information such as the name and address of the new trustee, the name of the trust, and details regarding the previously appointed trustee. This helps ensure that all records are updated accurately.

Is there a need for notarization?

Yes, the Change Trustee form typically requires notarization. This means that the new trustee must sign the document in the presence of a notary public, who will verify their identity. This step adds an important layer of authenticity to the form.

Where should I file the Change Trustee form?

The form should be recorded with the county recorder's office where the trust property is located. This ensures that the change is officially recognized in public records, protecting the rights of the new trustee.

Is there a fee for filing the Change Trustee form?

Yes, there is usually a filing fee associated with submitting the Change Trustee form. The exact amount can vary by county, so it is a good idea to check with your local county recorder's office for the current fee schedule.

What happens if I don't file this form?

If you fail to file the Change Trustee form, the legal authority to manage the trust may remain with the previous trustee. This can lead to complications and potential disputes over the management of the trust and its assets.

Should I consult an attorney before completing this form?

While it is possible to complete the Change Trustee form without legal assistance, consulting an attorney is advisable, particularly if you have concerns about the trust or your legal status. An attorney can provide guidance tailored to your specific situation, ensuring that the transition is smooth and compliant with legal requirements.