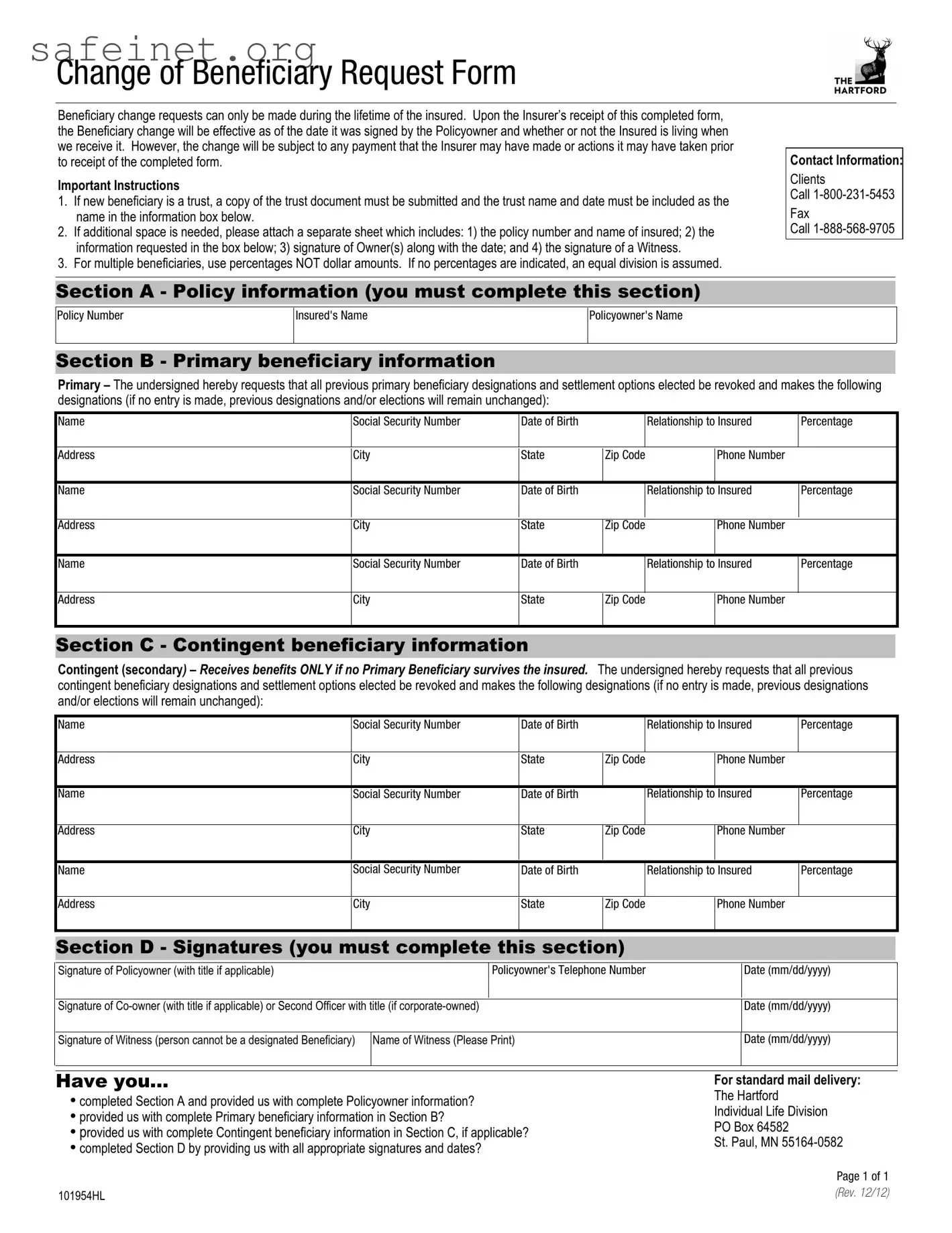

The Change of Beneficiary Request Form shares similarities with the Last Will and Testament. Both documents are essential for expressing personal wishes regarding the distribution of assets. In a Last Will and Testament, an individual can name beneficiaries who will inherit their property upon their death. Similarly, the Change of Beneficiary Request Form allows a policyowner to designate primary and contingent beneficiaries for a life insurance policy, ensuring that their intentions are honored. While one document operates after death, the other pertains to current insurance arrangements, reflecting the importance of clear beneficiary designations in estate planning.

Another document similar to the Change of Beneficiary Request Form is the Power of Attorney. This legal instrument allows an individual to appoint someone to act on their behalf in legal or financial matters. Like the beneficiary change process, it requires clear identification of parties involved and follows specific formalities. Both documents are critical in managing personal affairs, ensuring that the individual's choices are respected and carried out, whether during their lifetime in the case of the Power of Attorney or after their death when dealing with insurance beneficiaries.

The Revocation of Beneficiary Designation is also akin to the Change of Beneficiary Request Form; both serve to update or clarify beneficiary information. This document is specifically used to cancel previous beneficiary designations to ensure that the individual’s current intentions are explicitly recorded. This parallels the process of changing beneficiary information in the Change of Beneficiary Request Form, where previous designations are revoked upon submitting the new request. Both documents require careful attention to detail to ensure the intended beneficiaries receive what is desired.

Similar to these forms is the Trust Agreement. A Trust Agreement outlines how assets will be managed and distributed, much like a beneficiary designation specifies who receives benefits from a life insurance policy. When a trust is named as a beneficiary, the Change of Beneficiary Request Form should include trust details, reflecting the need for precise language and clear instructions in both cases. Trust Agreements provide additional layers of protection and management for assets, paralleling the need for careful planning in beneficiary designations.

Finally, the Beneficiary Designation Form for retirement accounts mirrors the Change of Beneficiary Request Form. Both documents allow individuals to specify who will receive benefits from financial instruments after their death. While they may pertain to different types of accounts, including retirement plans or life insurance, the purpose is the same: to help ensure that the individual’s wishes are followed. In both instances, careful completion and timely updates are essential to prevent any disputes or unintended distributions of funds.