STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY |

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES |

|

CALIFORNIA DEPARTMENT OF HEALTH CARE SERVICES |

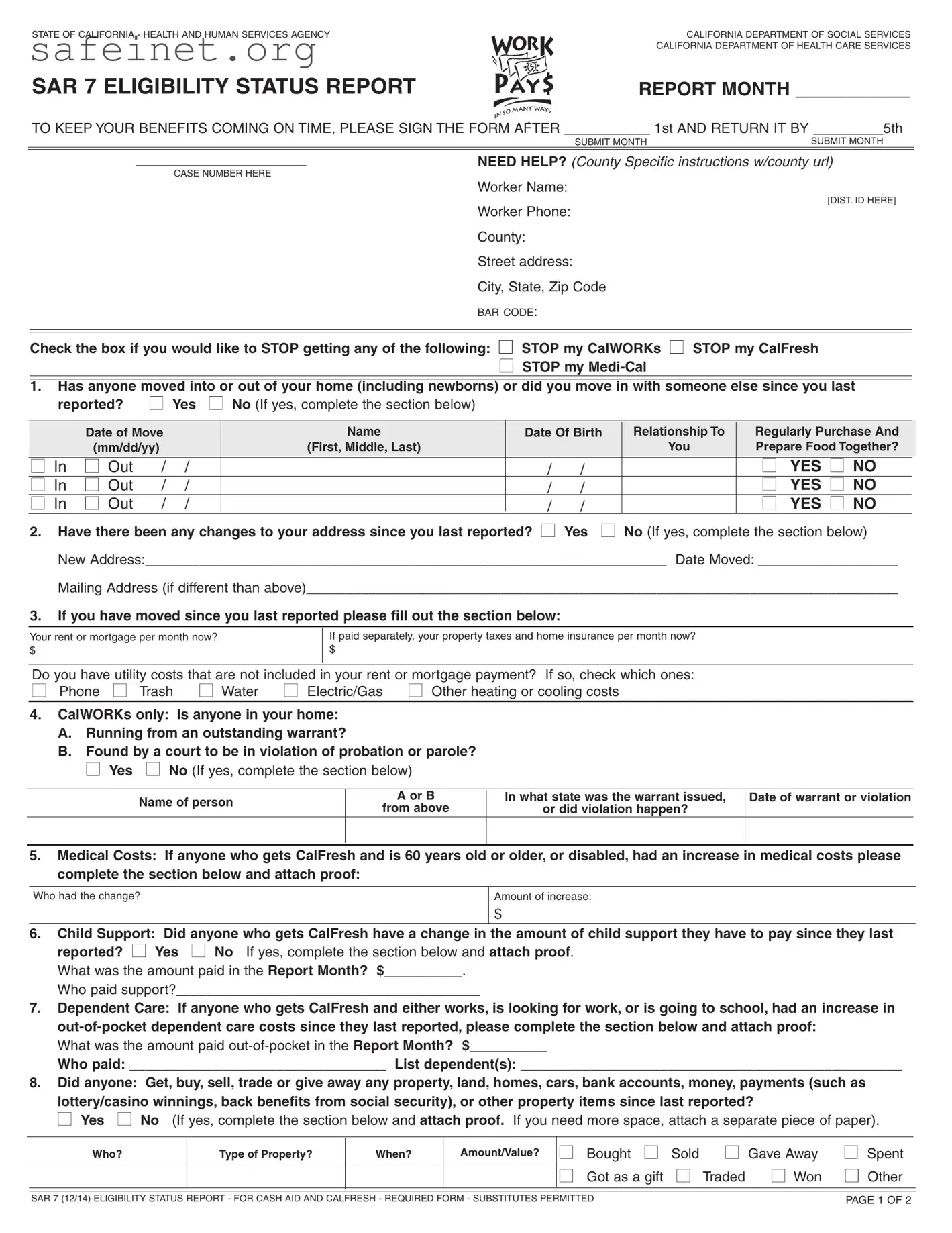

SAR 7 ELIGIBILITY STATUS REPORT

TO KEEP YOUR BENEFITS COMING ON TIME, PLEASE SIGN THE FORM AFTER ___________ 1st AND RETURN IT BY _________5th

SUBMIT MONTHSUBMIT MONTH

NEED HELP? (County Specific instructions w/county url)

CASE NUMBER HERE

Worker Name:

[DIST. ID HERE]

Worker Phone:

County:

Street address:

City, State, Zip Code

BAR CODE:

Check the box if you would like to STOP getting any of the following: ■

■

STOP my CalWORKs ■ STOP my CalFresh STOP my Medi-Cal

1.Has anyone moved into or out of your home (including newborns) or did you move in with someone else since you last

reported? |

■ Yes |

■ No (If yes, complete the section below) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Move |

|

|

Name |

Date Of Birth |

Relationship To |

Regularly Purchase And |

|

(mm/dd/yy) |

|

|

(First, Middle, Last) |

|

|

You |

Prepare Food Together? |

■ In |

■ Out |

/ |

/ |

|

|

/ |

/ |

|

■ YES ■ NO |

|

■ In |

■ Out |

/ |

/ |

|

|

/ |

/ |

|

■ YES ■ NO |

|

■ In |

■ Out |

/ |

/ |

|

|

/ |

/ |

|

■ YES ■ NO |

|

2. Have there been any changes to your address since you last reported? ■ Yes ■ No (If yes, complete the section below) New Address:___________________________________________________________________ Date Moved: __________________

Mailing Address (if different than above)____________________________________________________________________________

3.If you have moved since you last reported please fill out the section below:

Your rent or mortgage per month now?

$

If paid separately, your property taxes and home insurance per month now?

$

Do you have utility costs that are not included in your rent or mortgage payment? If so, check which ones:

■ Phone ■ Trash |

■ Water |

■ Electric/Gas |

■ Other heating or cooling costs |

4.CalWORKs only: Is anyone in your home:

A.Running from an outstanding warrant?

B.Found by a court to be in violation of probation or parole?

■ Yes ■ No (If yes, complete the section below)

In what state was the warrant issued,

or did violation happen?

Date of warrant or violation

5.Medical Costs: If anyone who gets CalFresh and is 60 years old or older, or disabled, had an increase in medical costs please complete the section below and attach proof:

6.Child Support: Did anyone who gets CalFresh have a change in the amount of child support they have to pay since they last reported? ■ Yes ■ No If yes, complete the section below and attach proof.

What was the amount paid in the Report Month? $__________. Who paid support?_______________________________________

7.Dependent Care: If anyone who gets CalFresh and either works, is looking for work, or is going to school, had an increase in out-of-pocket dependent care costs since they last reported, please complete the section below and attach proof:

What was the amount paid out-of-pocket in the Report Month? $__________

Who paid: _________________________________ List dependent(s): _________________________________________________

8.Did anyone: Get, buy, sell, trade or give away any property, land, homes, cars, bank accounts, money, payments (such as lottery/casino winnings, back benefits from social security), or other property items since last reported?

■ Yes ■ No (If yes, complete the section below and attach proof. If you need more space, attach a separate piece of paper).

■ |

Bought ■ Sold ■ Gave Away |

■ |

■ |

Got as a gift ■ Traded ■ Won |

■ |

SAR 7 (12/14) ELIGIBILITY STATUS REPORT - FOR CASH AID AND CALFRESH - REQUIRED FORM - SUBSTITUTES PERMITTED |

PAGE 1 OF 2 |

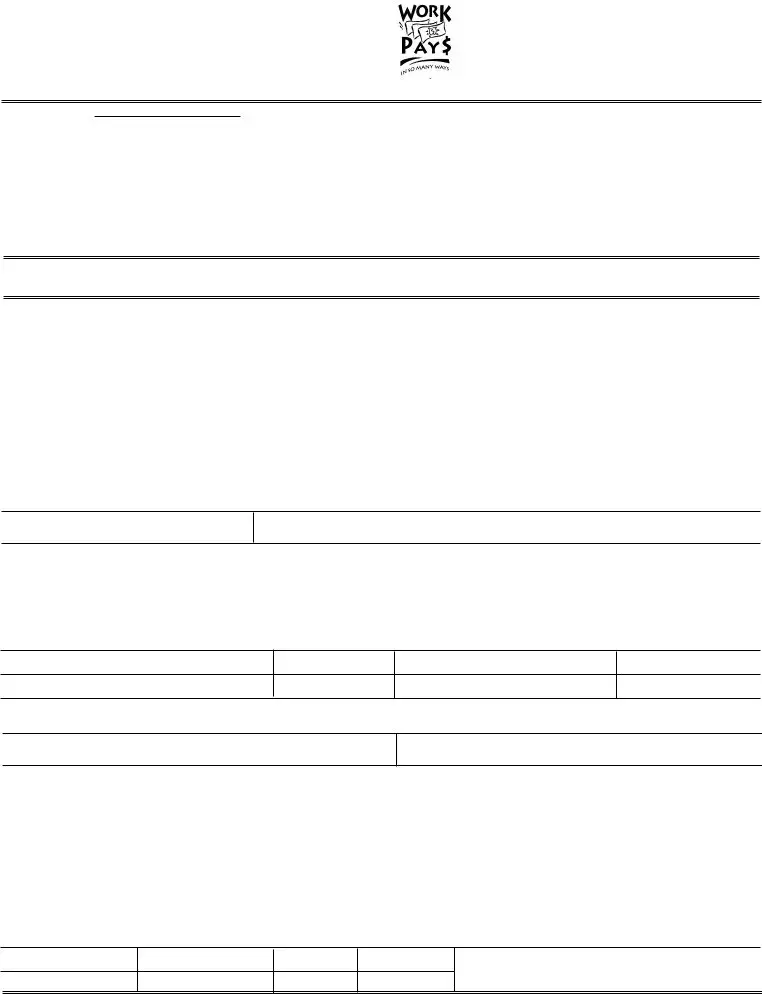

■ Yes

9. Did anyone get income from employment in the Report Month? ■ Yes ■ No (If yes, complete the section below and attach proof). The Report Month is listed at the top of the first page. List each job for each person who works. If you need more space attach a separate piece of paper. Examples include babysitting, salary, self-employment, sick pay, tips. etc. If you lost your job, attach proof.

|

|

|

Job #1 |

|

Job #2 |

|

Job #3 |

|

Name of person who got income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source of income/Employer name: |

|

|

|

|

Self-employed, check here ■ |

|

|

Self-employed, check here ■ |

Self-employed, check here ■ |

|

How often paid: |

■ Weekly |

■ Biweekly ■ Other |

■ Weekly |

■ Biweekly ■ Other |

■ Weekly |

■ Biweekly ■ Other |

|

■ Monthly |

■ Twice monthly |

■ Monthly |

■ Twice monthly |

■ Monthly |

■ Twice monthly |

|

|

|

|

|

|

|

|

|

|

|

Gross amount of income they got in the |

$ |

|

$ |

|

$ |

|

|

report month: |

|

|

|

|

DATE(S) RECEIVED: |

DATE(S) RECEIVED: |

DATE(S) RECEIVED: |

|

|

|

|

|

|

|

|

|

Hours worked per month: |

|

|

|

|

|

|

10. Will there be any changes to your income from employment in the next six months (including income listed in #9)?

■ Yes ■ No (If yes, explain here and attach proof). Examples: Stopping or starting a job; increase or decrease of income; changes in hours; quitting a job or going on strike; change in how often you are paid.

|

|

11. Did anyone get money from any other source in the Report Month: ■ Yes |

■ No (If yes, complete the section below and attach |

|

|

|

proof.) The Report Month is listed at the top of the first page. Examples include: Social Security, Unemployment Compensation, |

|

|

Veteran’s Benefits, State Disability Insurance (SDI), Child/Spousal Support, Worker’s Compensation, Loans/Gifts, Earned/Unearned |

|

|

Housing, Utilities, Food, etc. If you no longer get money from a source you previously reported, attach proof. |

|

|

|

|

Name |

Source of income |

|

One time payment or monthly |

How much |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

12. Will there be any changes to money received from any other source in the next six months (including money listed in #11)? ■ No (If yes, explain here and attach proof). Examples of changes: An increase or decrease in income or benefits, or if

you will start or stop getting income or benefits.

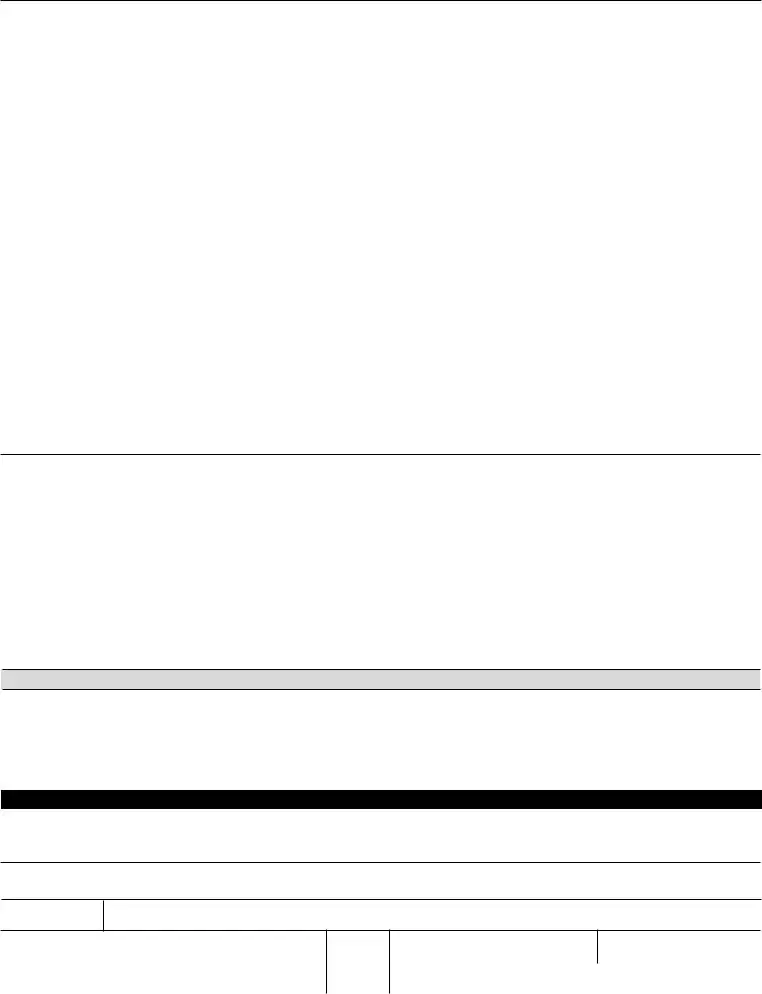

13. CalWORKs only: Have any of the following happened to anyone in your home since you last reported? ■ Yes ■ No (If yes, check below and attach proof):

■Family Change (Married, divorced, separated, entered into a California Registered Domestic Partnership (RDP), have a non-California Domestic Partnership (DP), ended a DP or RDP, became pregnant, or is no longer pregnant?)

Job/Employment (Start, stop, quit a job, started a business or went on strike?) Disability (Became disabled or recovered from a disability or major illness?)

Immigration (Citizenship or immigration status change, or got a new card, form, or letter from USCIS (INS)?) Insurance (Started, stopped, or changed health, dental, or life insurance benefits, including MEDICARE?) Custody (Any change in the amount of time you care for/have custody of your children?)

In-Home Support Services (Started or stopped getting services?)

School Attendance

For Age 18 or older student - started or stopped school/college? (You may be able to claim costs for books, school transportation, etc.)

■Someone paid for all of my housing, food, clothing or utility costs. (please explain) _______________________________

■Other_________________________________________

Please read carefully, sign, and date.

By signing this form:

•I understand and certify, under penalty of perjury, that all my answers on this report are correct and complete to the best of my knowledge.

•I understand the penalties for fraud are as follows: I may be sent to prison for up to 20 years and fined up to $250,000. I may have to pay back benefits if I was not eligible to them. The first time I break the rules on purpose I will not be able to get CalFresh for one year; the second time two years; and after the third time I will not be able to get CalFresh again.

•I understand and agree to give copies of all documents needed to complete my semi-annual report.

•I understand that in some instances, I may be asked to give consent to the County to make whatever contacts are necessary to determine eligibility.

CERTIFICATION - FRAUD WARNING

I UNDERSTAND THAT: If on purpose I do not report all facts or give wrong facts about my income, property, or family status to get or keep getting aid or benefits, I can be legally prosecuted. I may also be charged with committing a felony if more than $950 in Cash Aid, and/or CalFresh is wrongly paid out as a result of such an action. I have received a copy of the Instructions and Penalties for the SAR 7 Eligibility Status Report for Cash Aid and CalFresh.

YOU MUST SIGN AND DATE THIS REPORT AFTER THE LAST DAY OF THE REPORT MONTH OR IT WILL BE CONSIDERED INCOMPLETE.

I declare under penalty of perjury under the laws of the United States and the State of California that the facts contained in this report are true and correct and complete.

WHO MUST For Cash Aid: You and your aided spouse, registered domestic partner, or the other parent (of cash-aided children) if living in the home.

SIGN BELOW: For CalFresh: The head of household, a responsible household member, or the household's authorized representative.

SIGNATURE OR MARK |

DATE SIGNED HOME PHONE |

CONTACT/CELL PHONE |

☛ |

( |

) |

( |

) |

|

|

|

|

|

|

SIGNATURE OF SPOUSE, REGISTERED DOMESTIC PARTNER, OR OTHER |

DATE SIGNED SIGNATURE OF WITNESS TO MARK, INTERPRETER, OR OTHER PERSON |

DATE SIGNED |

PARENT OF CASH AIDED CHILD(REN) |

COMPLETING FORM |

|

|

|

☛ |

☛ |

|

|

|

|

|

|

|

|

|

|

SAR 7 (12/14) ELIGIBILITY STATUS REPORT - FOR CASH AID AND CALFRESH - REQUIRED FORM - SUBSTITUTES PERMITTED |

PAGE 2 OF 2 |

|