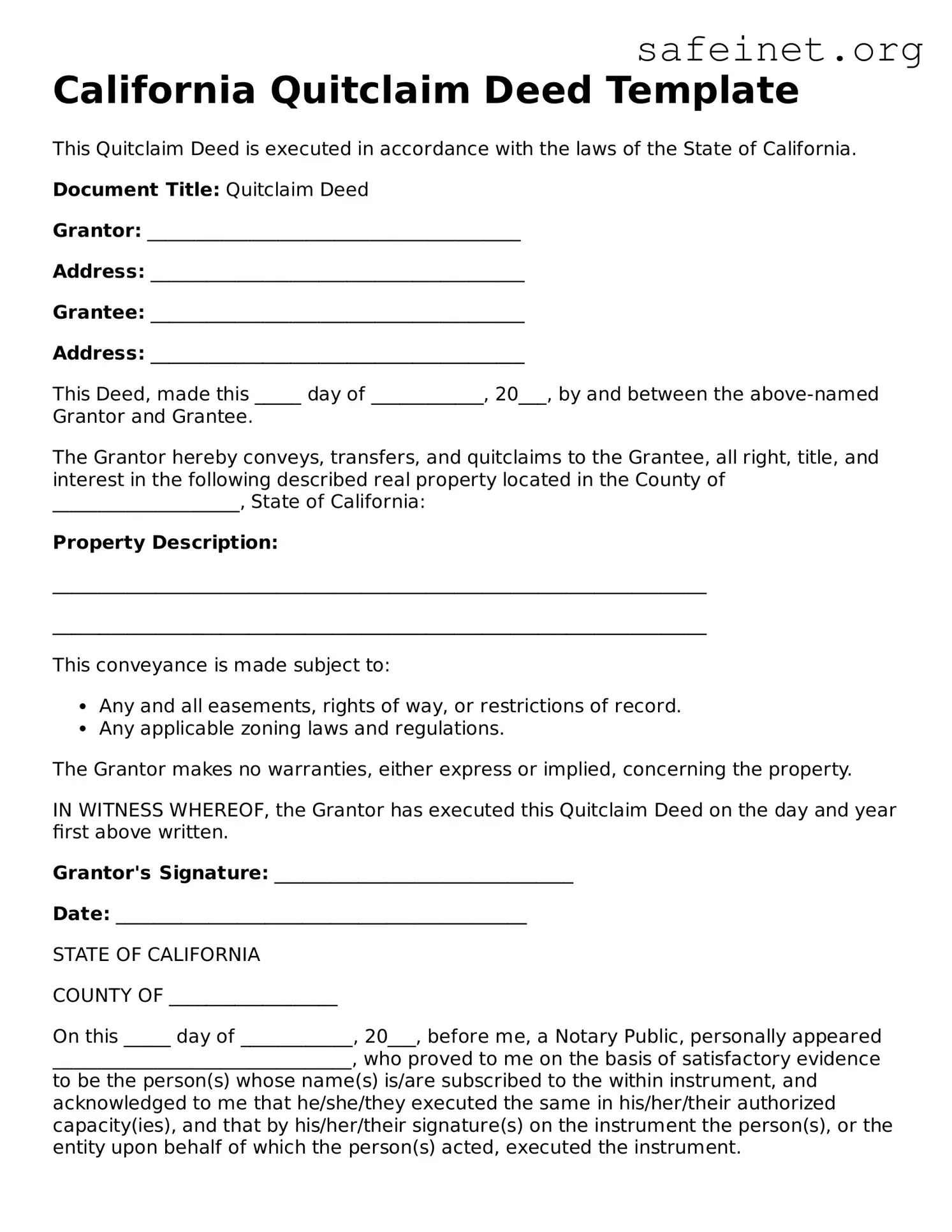

California Quitclaim Deed Template

This Quitclaim Deed is executed in accordance with the laws of the State of California.

Document Title: Quitclaim Deed

Grantor: ________________________________________

Address: ________________________________________

Grantee: ________________________________________

Address: ________________________________________

This Deed, made this _____ day of ____________, 20___, by and between the above-named Grantor and Grantee.

The Grantor hereby conveys, transfers, and quitclaims to the Grantee, all right, title, and interest in the following described real property located in the County of ____________________, State of California:

Property Description:

______________________________________________________________________

______________________________________________________________________

This conveyance is made subject to:

- Any and all easements, rights of way, or restrictions of record.

- Any applicable zoning laws and regulations.

The Grantor makes no warranties, either express or implied, concerning the property.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on the day and year first above written.

Grantor's Signature: ________________________________

Date: ____________________________________________

STATE OF CALIFORNIA

COUNTY OF __________________

On this _____ day of ____________, 20___, before me, a Notary Public, personally appeared ________________________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

Notary Public Signature: _________________________

My Commission Expires: _______________________