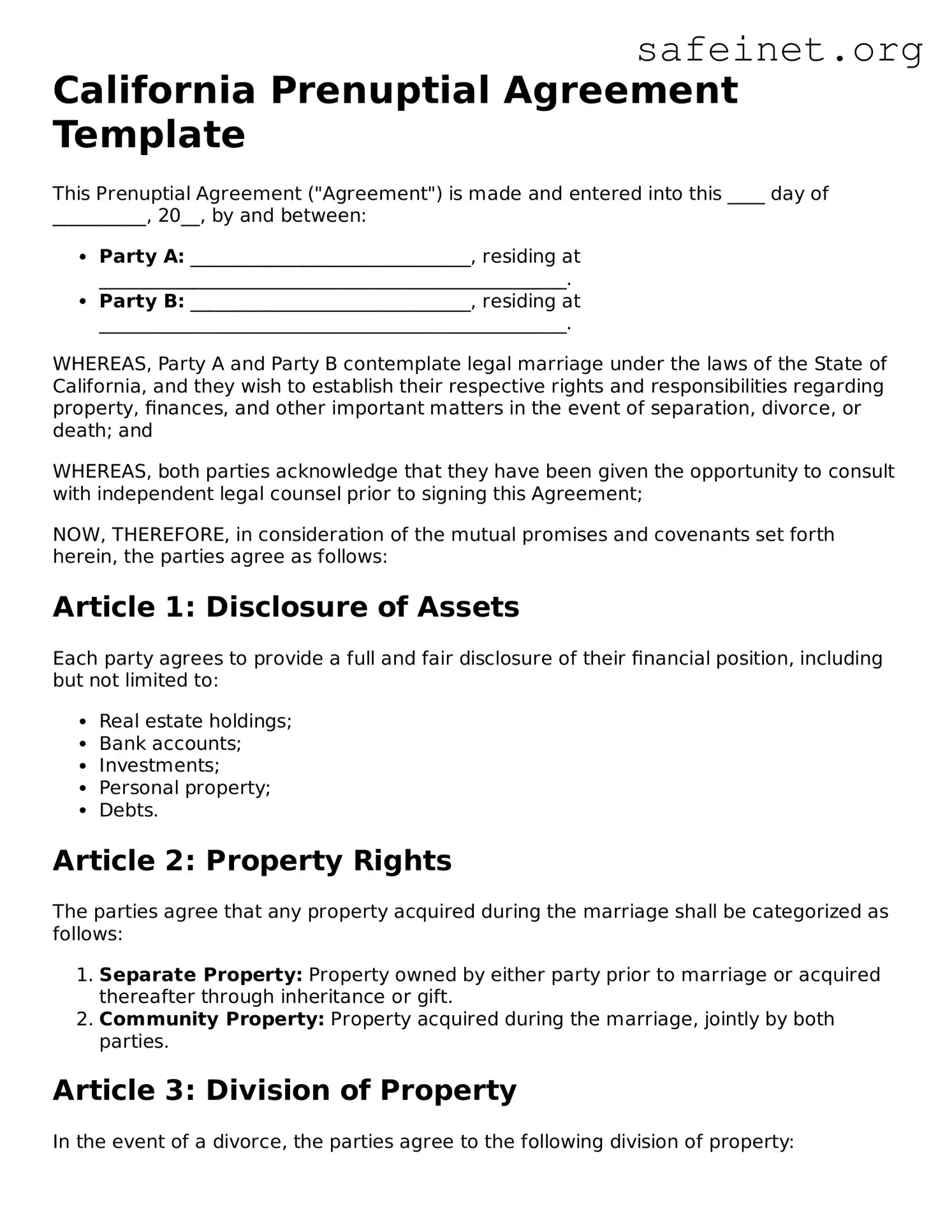

California Prenuptial Agreement Template

This Prenuptial Agreement ("Agreement") is made and entered into this ____ day of __________, 20__, by and between:

- Party A: ______________________________, residing at __________________________________________________.

- Party B: ______________________________, residing at __________________________________________________.

WHEREAS, Party A and Party B contemplate legal marriage under the laws of the State of California, and they wish to establish their respective rights and responsibilities regarding property, finances, and other important matters in the event of separation, divorce, or death; and

WHEREAS, both parties acknowledge that they have been given the opportunity to consult with independent legal counsel prior to signing this Agreement;

NOW, THEREFORE, in consideration of the mutual promises and covenants set forth herein, the parties agree as follows:

Article 1: Disclosure of Assets

Each party agrees to provide a full and fair disclosure of their financial position, including but not limited to:

- Real estate holdings;

- Bank accounts;

- Investments;

- Personal property;

- Debts.

Article 2: Property Rights

The parties agree that any property acquired during the marriage shall be categorized as follows:

- Separate Property: Property owned by either party prior to marriage or acquired thereafter through inheritance or gift.

- Community Property: Property acquired during the marriage, jointly by both parties.

Article 3: Division of Property

In the event of a divorce, the parties agree to the following division of property:

- Party A will retain __________________________________________________.

- Party B will retain __________________________________________________.

Article 4: Alimony or Spousal Support

The parties agree that:

- Party A: __________________________________________________.

- Party B: __________________________________________________.

Article 5: Other Provisions

Additional agreements include:

- ______________________________________________________________________;

- ______________________________________________________________________;

Article 6: Amendments

This Agreement may be amended only in writing, signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Prenuptial Agreement as of the date first above written.

______________________________ (Party A Signature)

______________________________ (Date)

______________________________ (Party B Signature)

______________________________ (Date)