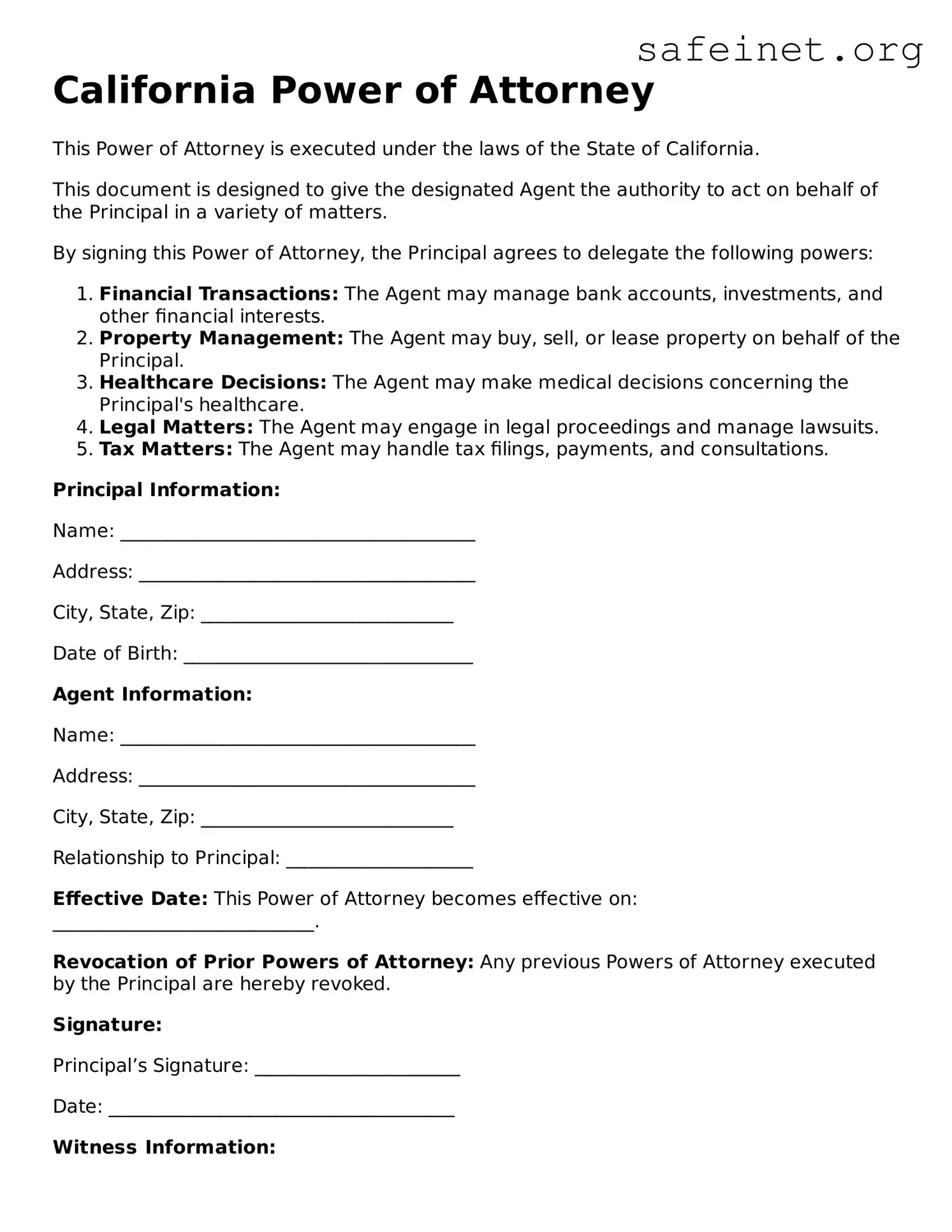

California Power of Attorney

This Power of Attorney is executed under the laws of the State of California.

This document is designed to give the designated Agent the authority to act on behalf of the Principal in a variety of matters.

By signing this Power of Attorney, the Principal agrees to delegate the following powers:

- Financial Transactions: The Agent may manage bank accounts, investments, and other financial interests.

- Property Management: The Agent may buy, sell, or lease property on behalf of the Principal.

- Healthcare Decisions: The Agent may make medical decisions concerning the Principal's healthcare.

- Legal Matters: The Agent may engage in legal proceedings and manage lawsuits.

- Tax Matters: The Agent may handle tax filings, payments, and consultations.

Principal Information:

Name: ______________________________________

Address: ____________________________________

City, State, Zip: ___________________________

Date of Birth: _______________________________

Agent Information:

Name: ______________________________________

Address: ____________________________________

City, State, Zip: ___________________________

Relationship to Principal: ____________________

Effective Date: This Power of Attorney becomes effective on: ____________________________.

Revocation of Prior Powers of Attorney: Any previous Powers of Attorney executed by the Principal are hereby revoked.

Signature:

Principal’s Signature: ______________________

Date: _____________________________________

Witness Information:

Two witnesses are required for this Power of Attorney:

Witness 1:

Name: ______________________________________

Signature: _________________________________

Date: _____________________________________

Witness 2:

Name: ______________________________________

Signature: _________________________________

Date: _____________________________________

Notary Public:

State of California, County of ________________

Subscribed and sworn to before me this ___ day of __________, 20__.

Signature of Notary: ________________________

Notary Stamp: ____________________________________